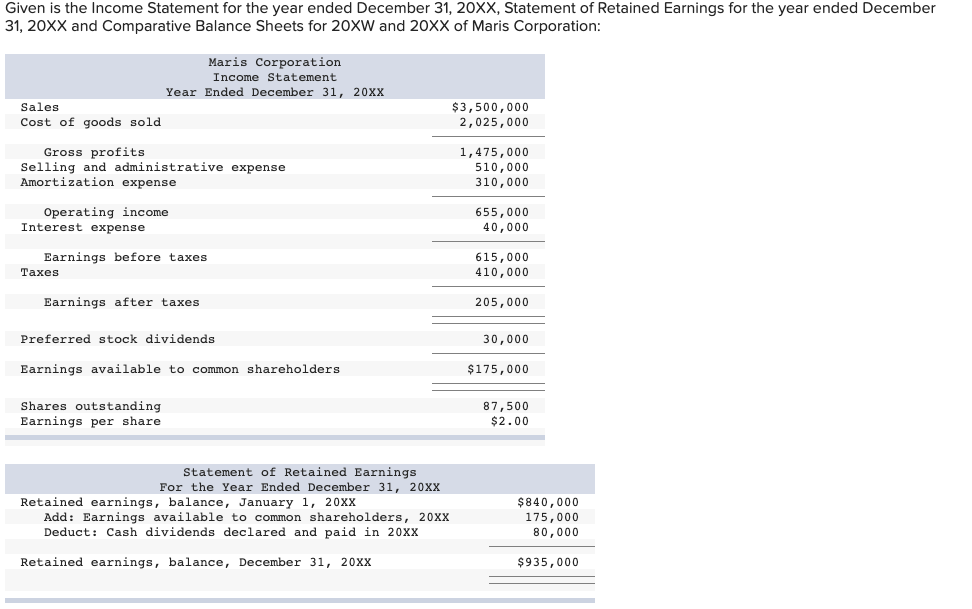

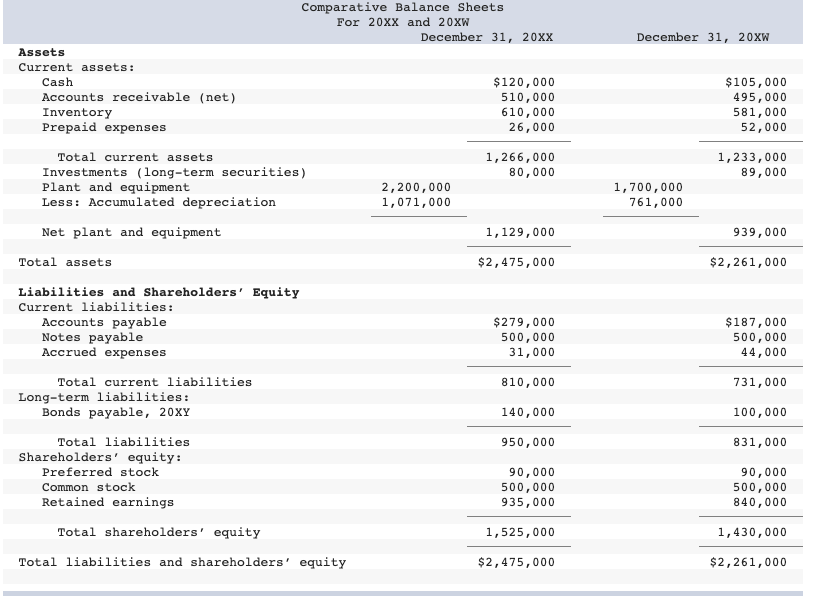

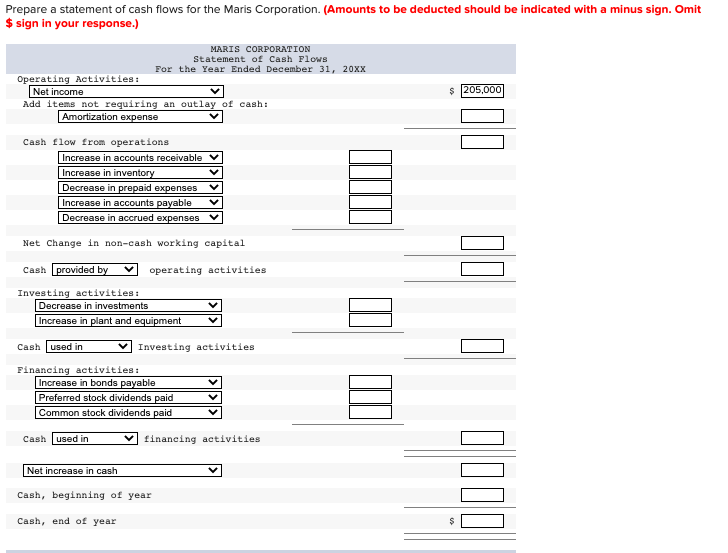

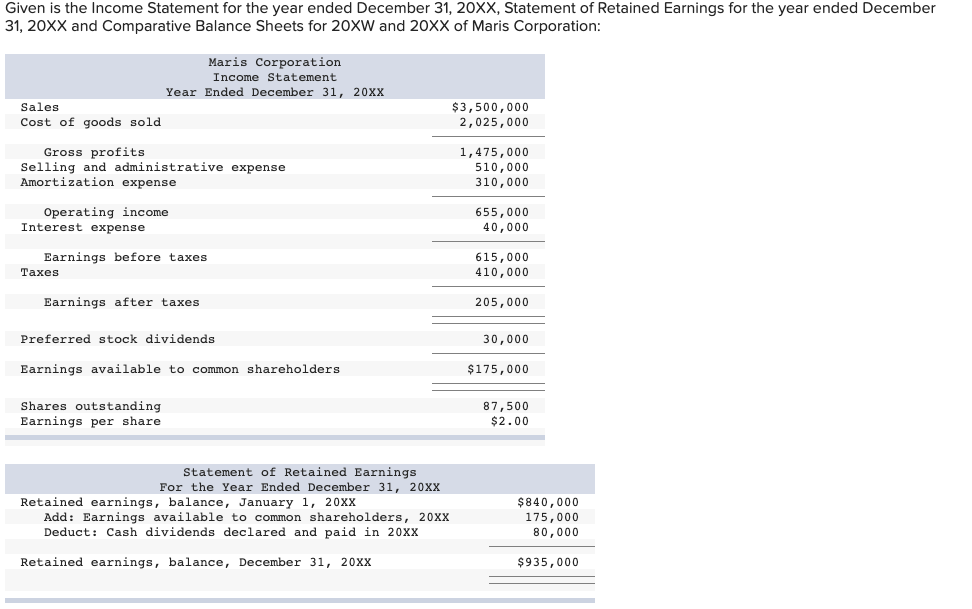

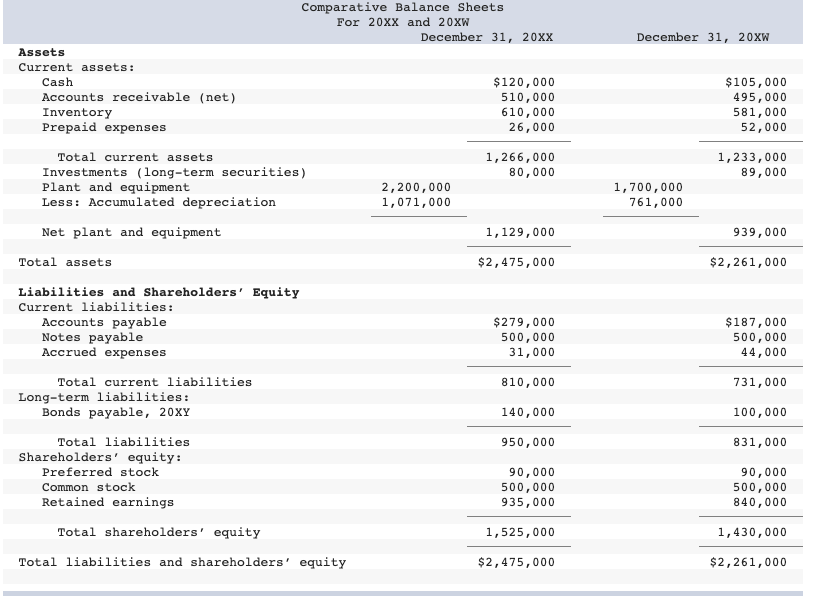

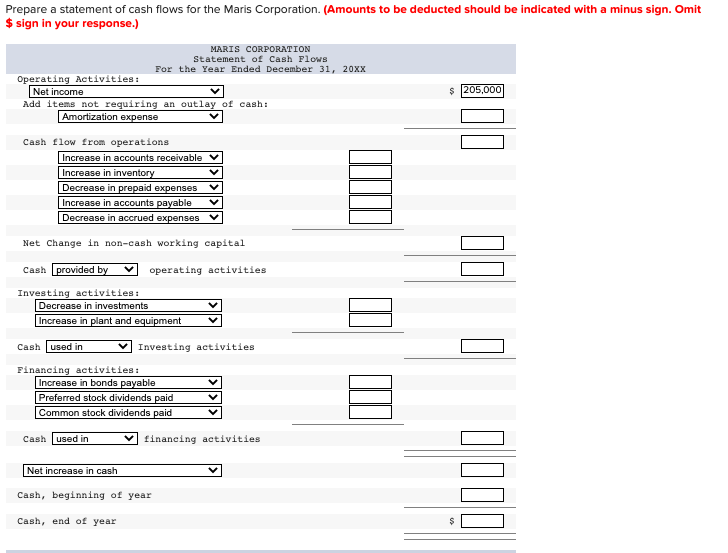

Given is the Income Statement for the year ended December 31, 20XX, Statement of Retained Earnings for the year ended December 31, 20XX and Comparative Balance Sheets for 20XW and 20XX of Maris Corporation: Maris Corporation Income Statement Year Ended December 31, 20xx Sales Cost of goods sold $3,500,000 2,025,000 Gross profits Selling and administrative expense Amortization expense 1,475,000 510,000 310,000 Operating income Interest expense 655,000 40,000 Earnings before taxes Taxes 615,000 410,000 Earnings after taxes 205,000 Preferred stock dividends 30,000 Earnings available to common shareholders $175,000 Shares outstanding Earnings per share 87,500 $2.00 Statement of Retained Earnings For the Year Ended December 31, 20xx Retained earnings, balance, January 1, 20XX Add: Earnings available to common shareholders, 20xx Deduct: Cash dividends declared and paid in 20xx $840,000 175,000 80,000 Retained earnings, balance, December 31, 20xx $935,000 December 31, 20XW Comparative Balance Sheets For 20xx and 20xw December 31, 20XX Assets Current assets: Cash $120,000 Accounts receivable (net) 510,000 Inventory 610,000 Prepaid expenses 26,000 Total current assets 1,266,000 Investments (long-term securities) 80,000 Plant and equipment 2,200,000 Less: Accumulated depreciation 1,071,000 $105,000 495,000 581,000 52,000 1,233,000 89,000 1,700,000 761,000 1,129,000 939,000 Net plant and equipment Total assets $2,475,000 $2,261,000 Liabilities and Shareholders' Equity Current liabilities: Accounts payable Notes payable Accrued expenses $279,000 500,000 31,000 $187,000 500,000 44,000 810,000 731,000 Total current liabilities Long-term liabilities: Bonds payable, 20XY 140,000 100,000 950,000 831,000 Total liabilities Shareholders' equity: Preferred stock Common stock Retained earnings 90,000 500,000 935,000 90,000 500,000 840,000 1,525,000 1,430,000 Total shareholders' equity Total liabilities and shareholders' equity $2,475,000 $2,261,000 Prepare a statement of cash flows for the Maris Corporation. (Amounts to be deducted should be indicated with a minus sign. Omit $ sign in your response.) MARIS CORPORATION Statement of Cash Flows For the Year Ended December 31, 20xx Operating Activities: Net income Add items not requiring an outlay of cash: Amortization expense $ 205,000 Cash flow from operations Increase in accounts receivable v Increase in inventory Decrease in prepaid expenses Increase in accounts payable Decrease in accrued expenses Net Change in non-cash working capital Cash provided by operating activities Investing activities: Decrease in investments Increase in plant and equipment Cash used in Investing activities Financing activities: Increase in bonds payable Preferred stock dividends paid Common stock dividends paid III 000 000 Cash used in financing activities Net increase in cash Cash, beginning of year Cash, end of year