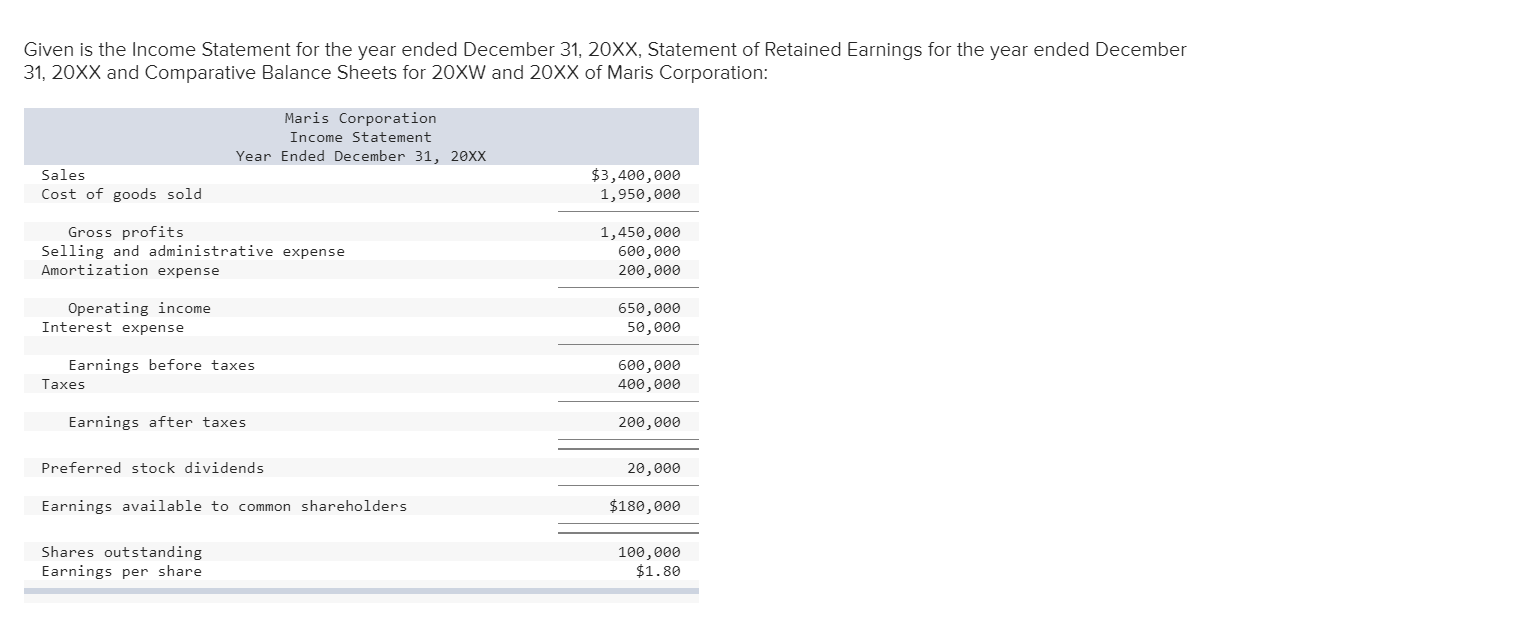

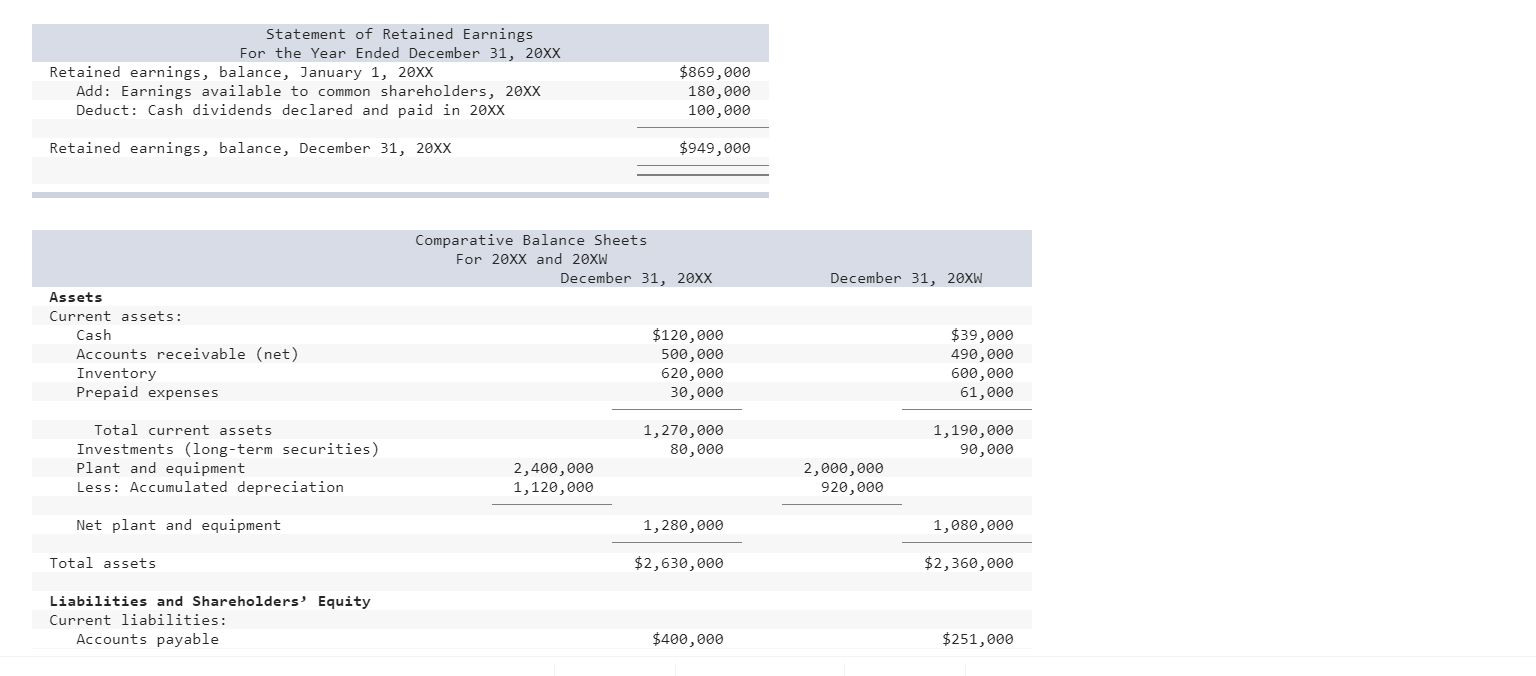

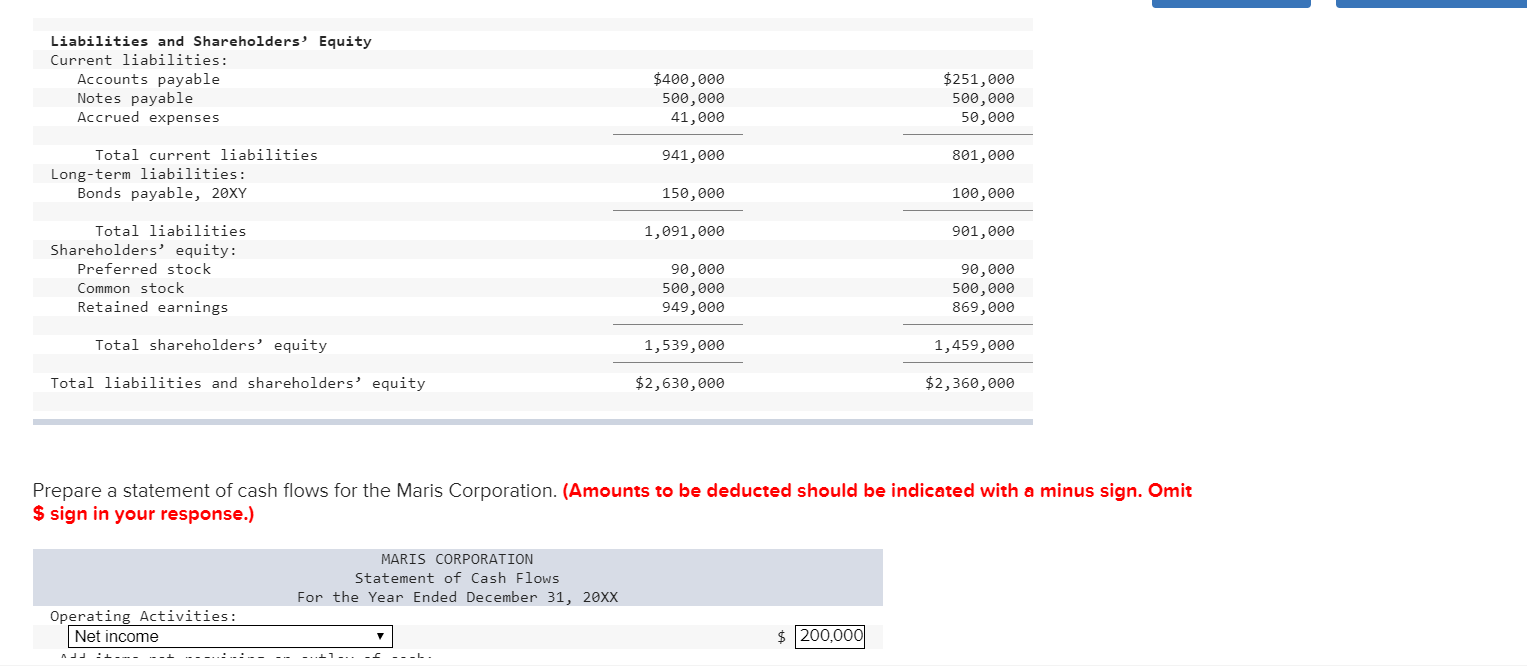

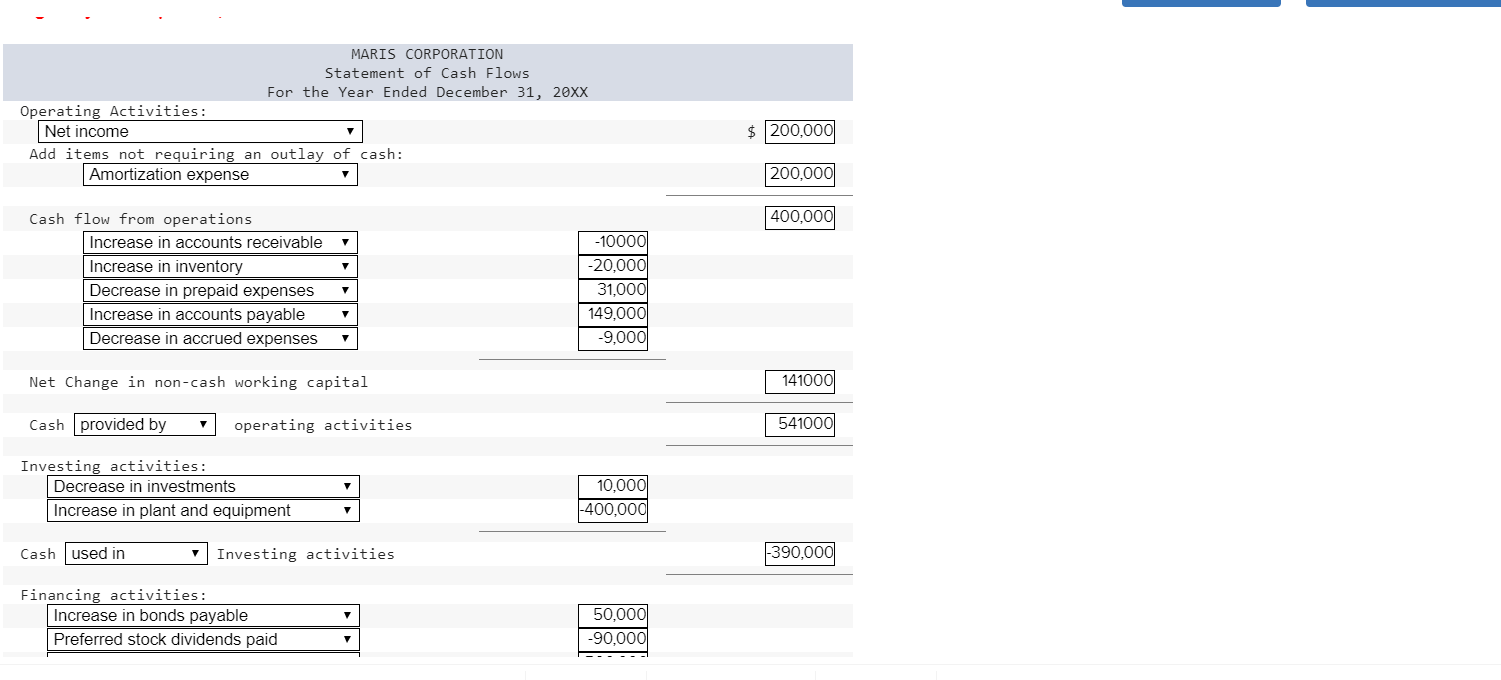

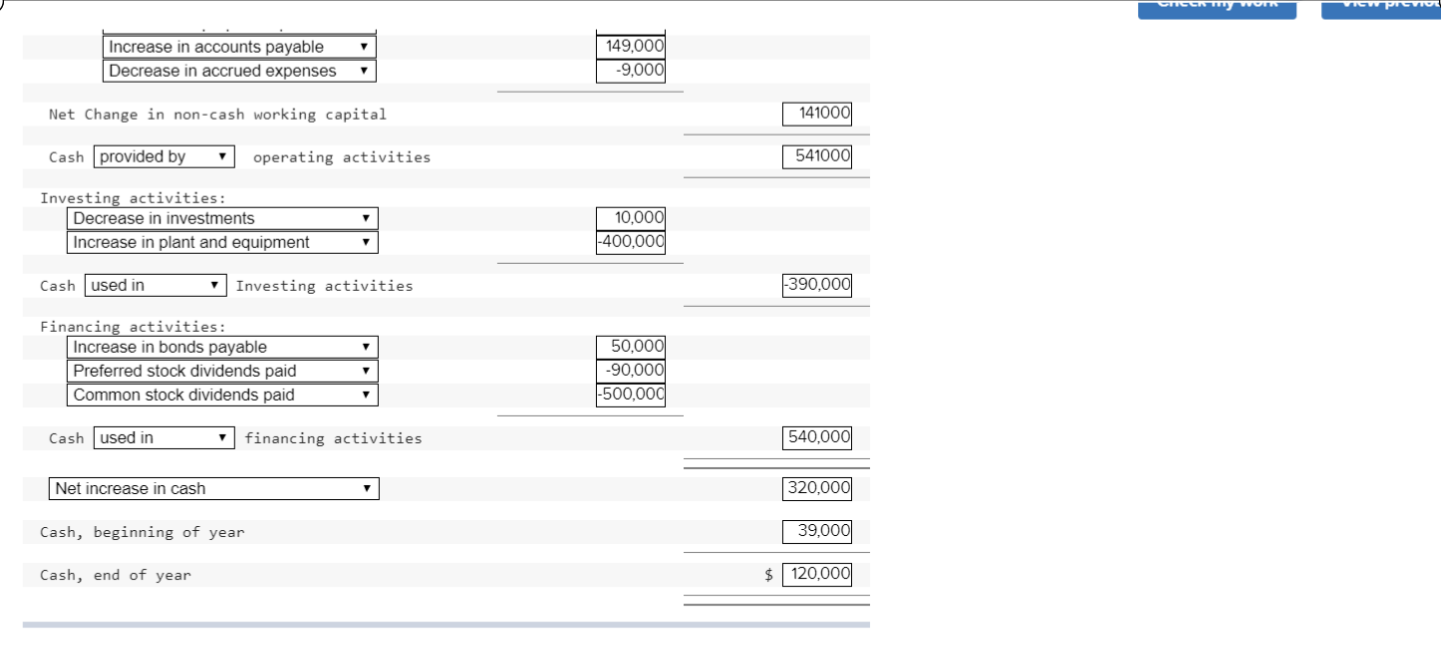

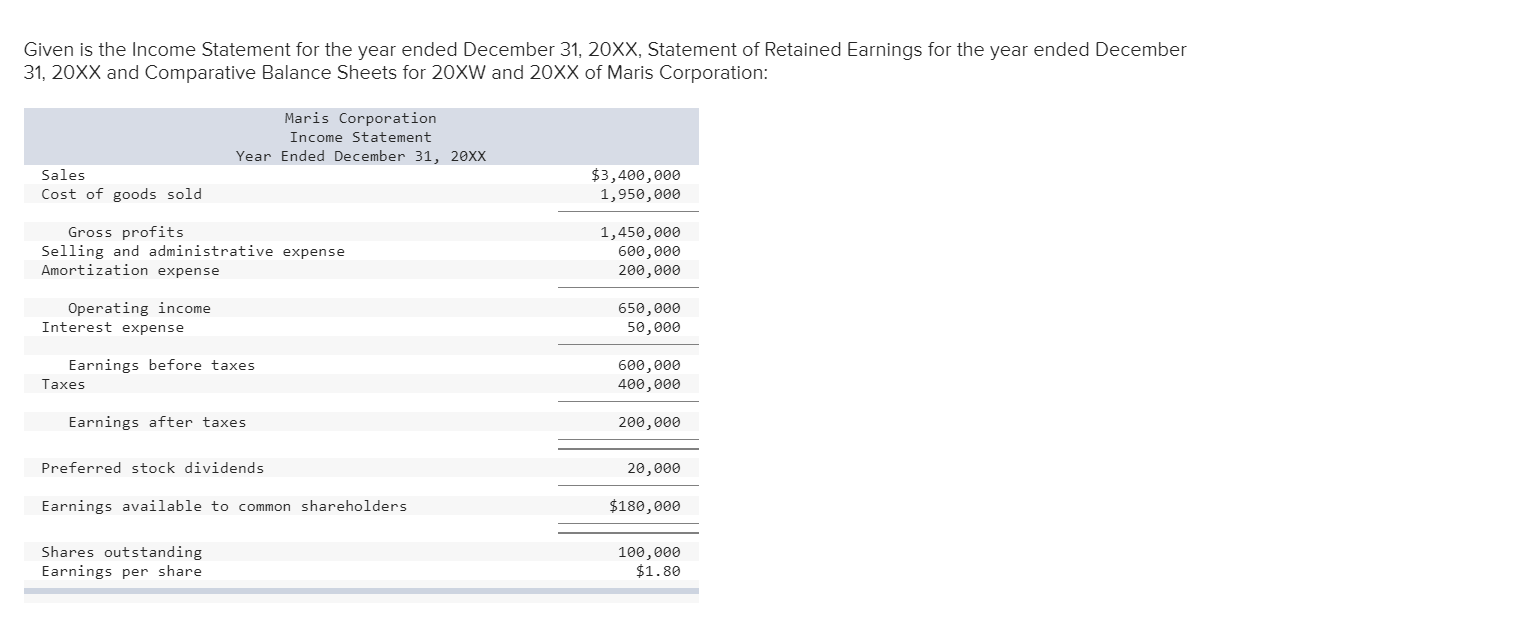

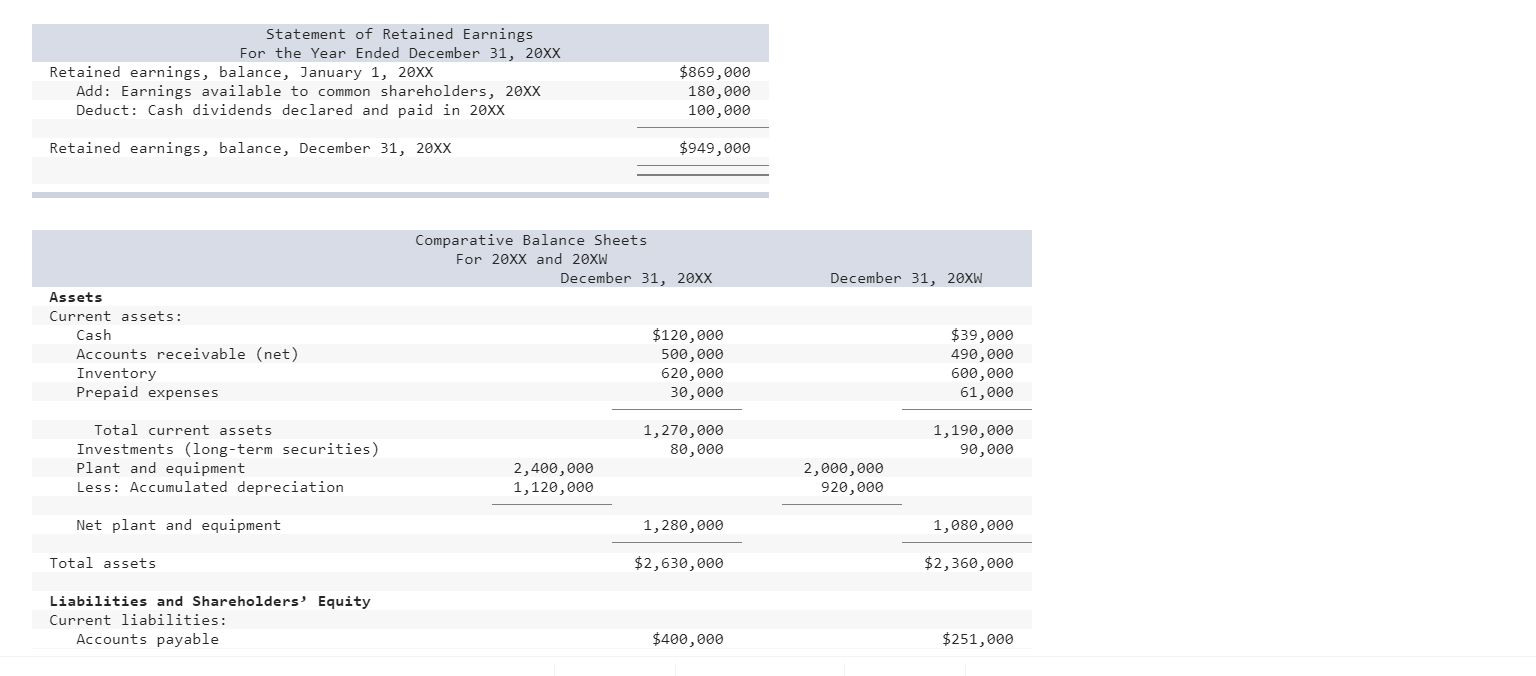

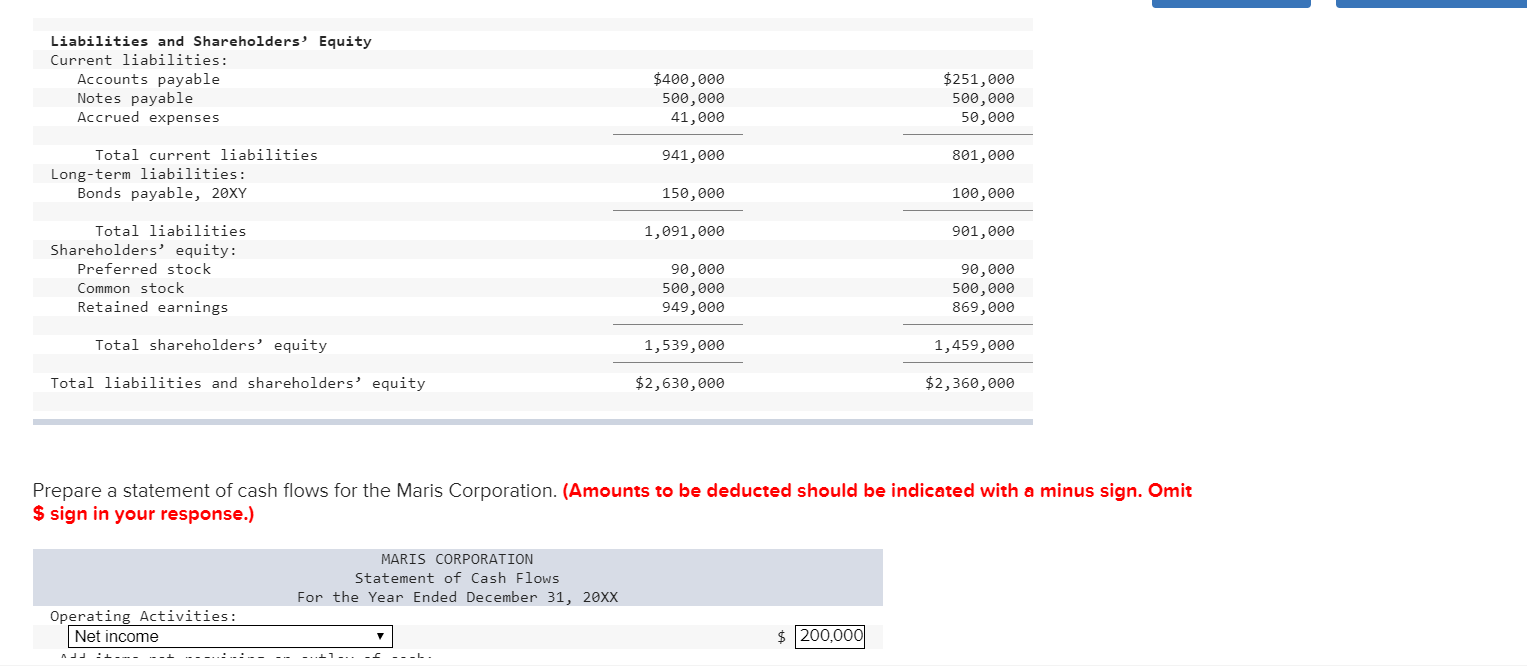

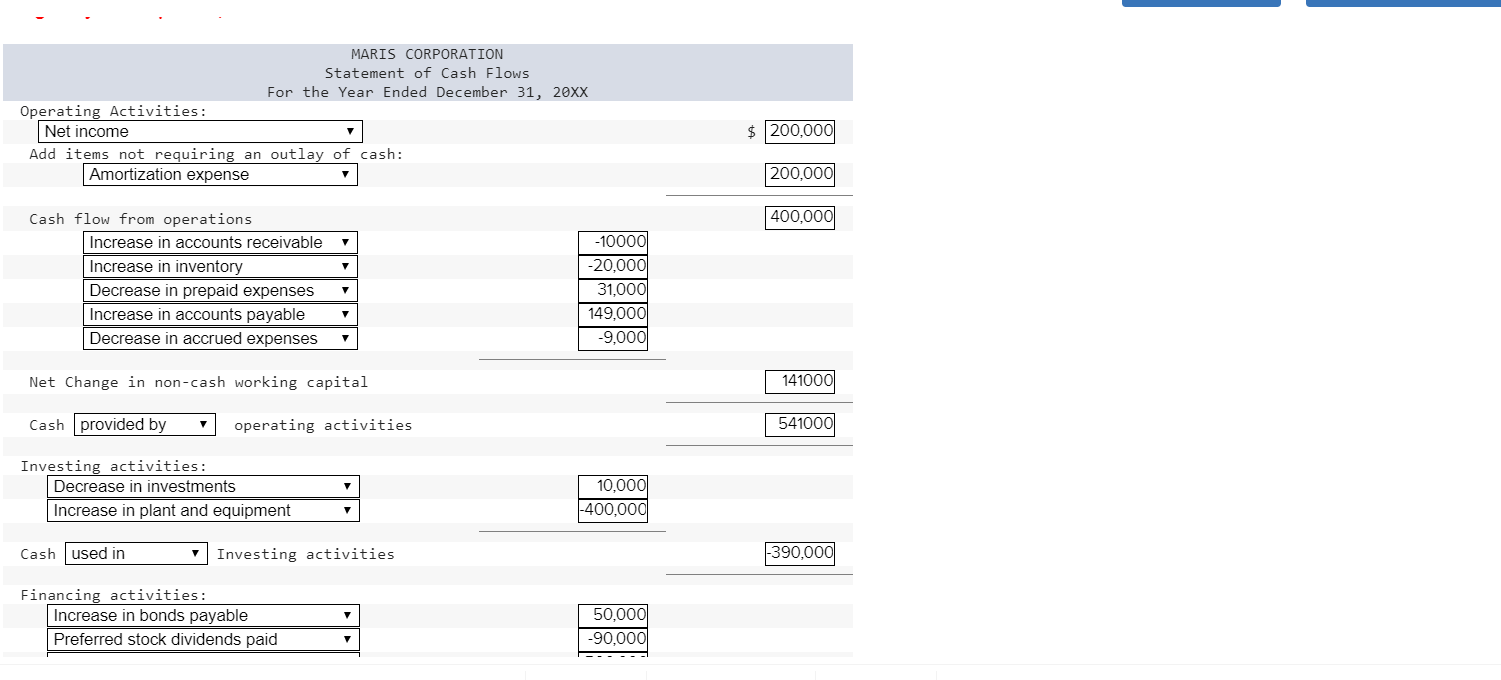

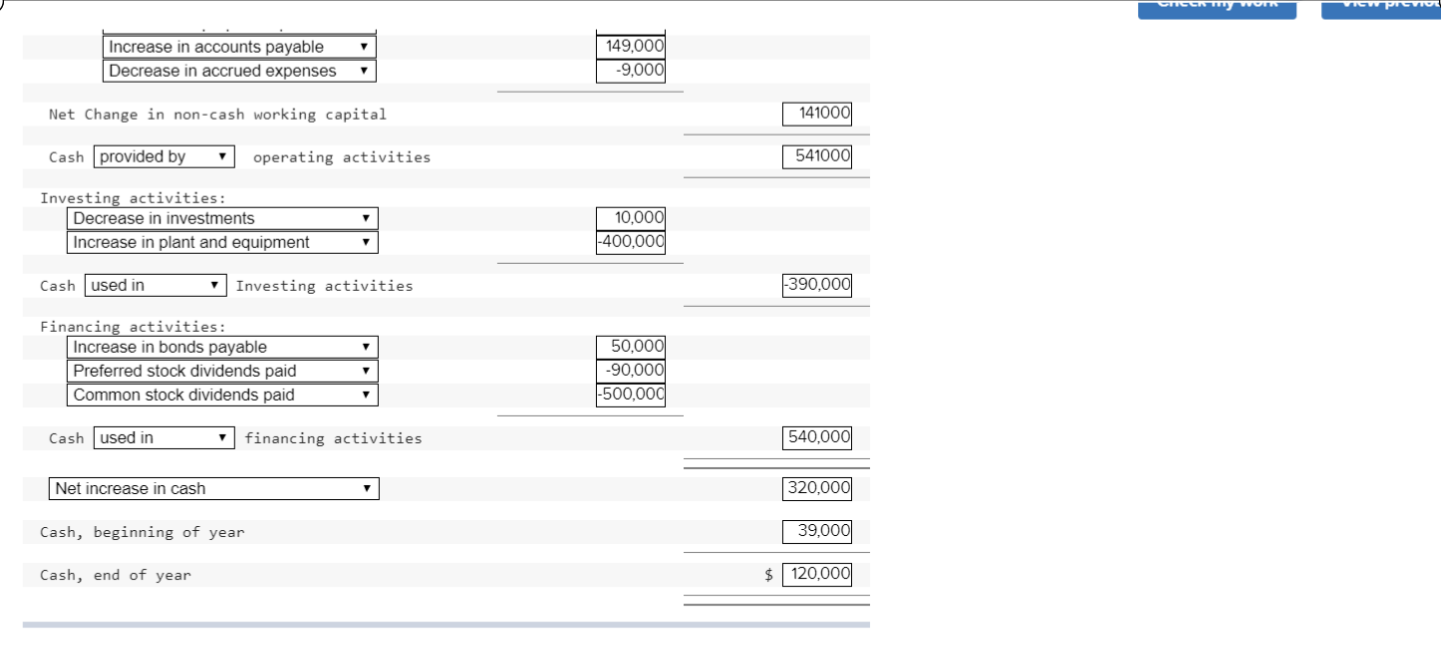

Given is the Income Statement for the year ended December 31, 20XX, Statement of Retained Earnings for the year ended December 31, 20XX and Comparative Balance Sheets for 20XW and 20XX of Maris Corporation: Maris Corporation Income Statement Year Ended December 31, 20XX Sales Cost of goods sold $3,400,000 1,950,000 Gross profits Selling and administrative expense Amortization expense 1,450,000 600,000 200,000 Operating income Interest expense 650,000 50,000 Earnings before taxes Taxes 600,000 400,000 Earnings after taxes 200,000 Preferred stock dividends 20,000 Earnings available to common shareholders $180,000 Shares outstanding Earnings per share 100,000 $1.80 Statement of Retained Earnings For the Year Ended December 31, 20XX Retained earnings, balance, January 1, 20XX Add: Earnings available to common shareholders, 20XX Deduct: Cash dividends declared and paid in 20XX $869,000 180,000 100,000 Retained earnings, balance, December 31, 20XX $949,000 Comparative Balance Sheets For 20XX and 20XW December 31, 20XX December 31, 20XW Assets Current assets: Cash Accounts receivable (net) Inventory Prepaid expenses $120,000 500,000 620,000 30,000 $39,000 490,000 600,000 61,000 1,270,000 80,000 Total current assets Investments (long-term securities) Plant and equipment Less: Accumulated depreciation 1,190,000 90,000 2,400,000 1,120,000 2,000,000 920,000 Net plant and equipment 1,280,000 1,080,000 Total assets $2,630,000 $2,360,000 Liabilities and Shareholders' Equity Current liabilities: Accounts payable $400,000 $251,000 Liabilities and Shareholders' Equity Current liabilities: Accounts payable Notes payable Accrued expenses $400,000 500,000 41,000 $251,000 500,000 50,000 941,000 801,000 Total current liabilities Long-term liabilities: Bonds payable, 20XY 150,000 100,000 1,091,000 901,000 Total liabilities Shareholders' equity: Preferred stock Common stock Retained earnings 90,000 500,000 949,000 90,000 500,000 869,000 Total shareholders' equity 1,539,000 1,459,000 Total liabilities and shareholders' equity $2,630,000 $2,360,000 Prepare a statement of cash flows for the Maris Corporation. (Amounts to be deducted should be indicated with a minus sign. Omit $ sign in your response.) MARIS CORPORATION Statement of Cash Flows For the Year Ended December 31, 20XX Operating Activities: Net income N J --- --- ---- -- $ 200,000 -- -- - .. l-.. -- ---L. MARIS CORPORATION Statement of Cash Flows For the Year Ended December 31, 20XX Operating Activities: Net income Add items not requiring an outlay of cash: Amortization expense $ 200,000 200,000 400,000 Cash flow from operations Increase in accounts receivable Increase in inventory Decrease in prepaid expenses Increase in accounts payable Decrease in accrued expenses -10000 -20,000 31,000 149,000 -9,000 Net Change in non-cash working capital 141000 Cash provided by operating activities 541000 Investing activities: Decrease in investments Increase in plant and equipment ' 10,000 -400,000 Cash used in Investing activities 390,000 Financing activities: Increase in bonds payable Preferred stock dividends paid 50,000 -90,000 CHICC Wom VicwPrevio Increase in accounts payable Decrease in accrued expenses 149.000 -9,000 Net Change in non-cash working capital 141000 Cash provided by operating activities 541000 Investing activities: Decrease in investments Increase in plant and equipment 10,000 -400,000 Cash used in Investing activities 390,000 Financing activities: Increase in bonds payable Preferred stock dividends paid Common stock dividends paid 50.000 -90,000 -500,000 Cash used in financing activities 540,000 Net increase in cash 320,000 Cash, beginning of year 39,000 Cash, end of year $ 120,000