Question

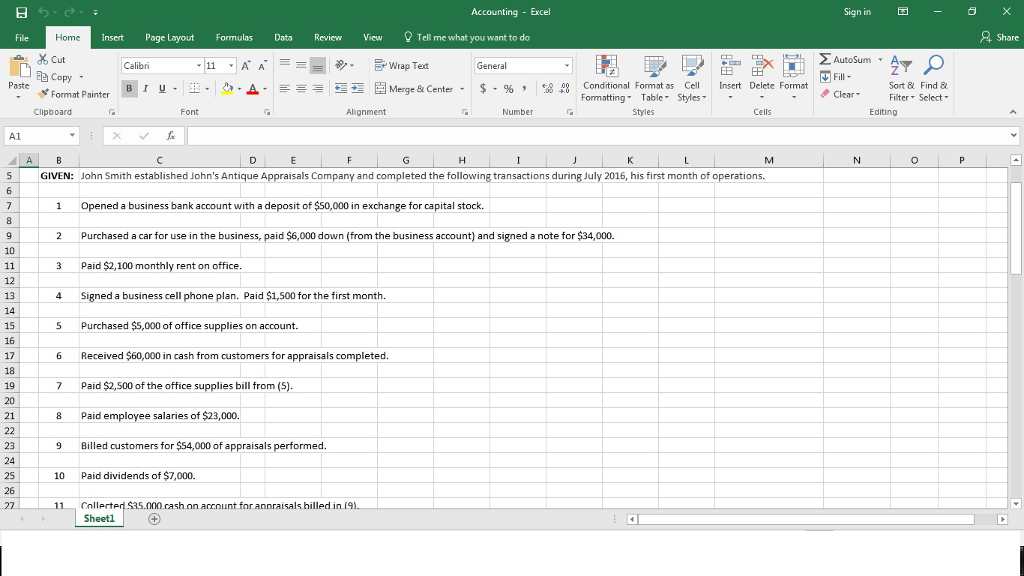

GIVEN: John Smith established John's Antique Appraisals Company and completed the following transactions during July 2016, his first month of operations. 1. Opened a business

GIVEN: John Smith established John's Antique Appraisals Company and completed the following transactions during July 2016, his first month of operations.

1. Opened a business bank account with a deposit of $50,000 in exchange for capital stock

2. Purchased a car for use in the business, paid $6,000 down (from the business account) and signed a note for $34,000.

3. Paid $2,100 monthly rent on office.

4. Signed a business cell phone plan. Paid $1,500 for the first month.

5. Purchased $5,000 of office supplies on account.

6. Received $60,000 in cash from customers for appraisals completed.

7. Paid $2,500 of the office supplies bill from (5).

8. Paid employee salaries of $23,000.

9. Billed customers for $54,000 of appraisals performed.

10. Paid dividends of $7,000.

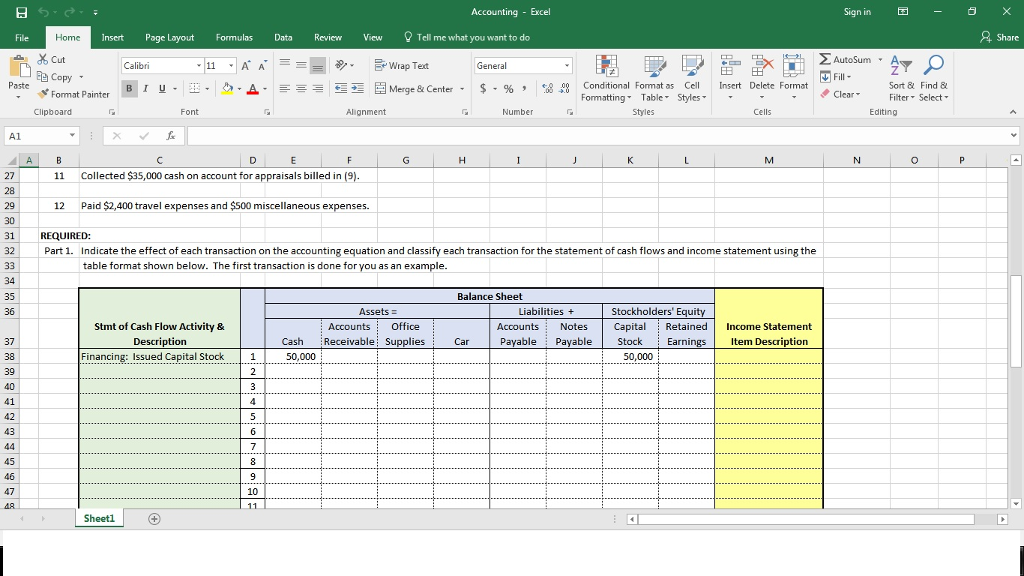

11. Collected $35,000 cash on account for appraisals billed in (9).

12. Paid $2,400 travel expenses and $500 miscellaneous expenses.

REQUIRED:

Part 1. Indicate the effect of each transaction on the accounting equation and classify each transaction for the statement of cash flows and income statement using the table format shown below. The first transaction is done for you as an example.

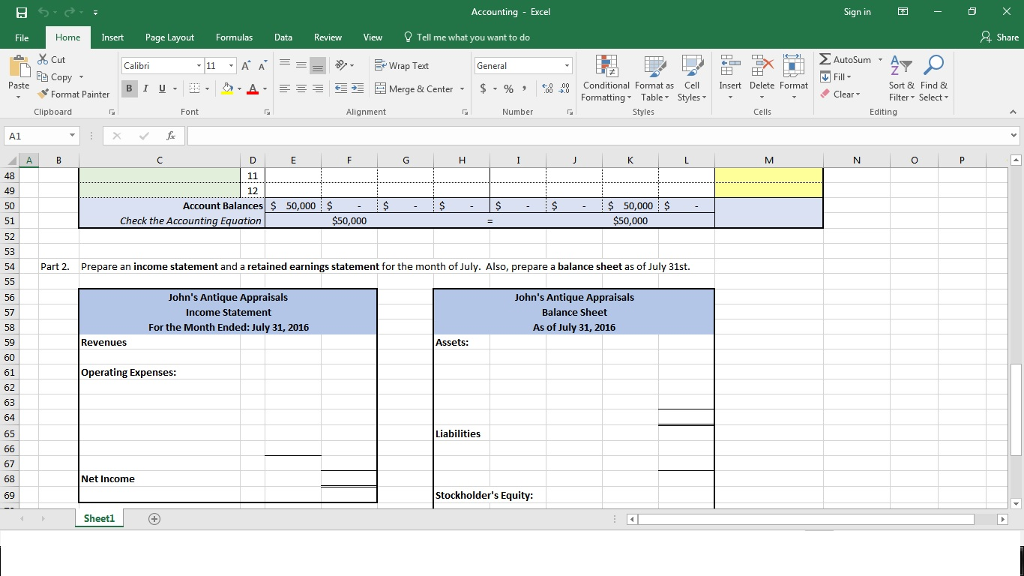

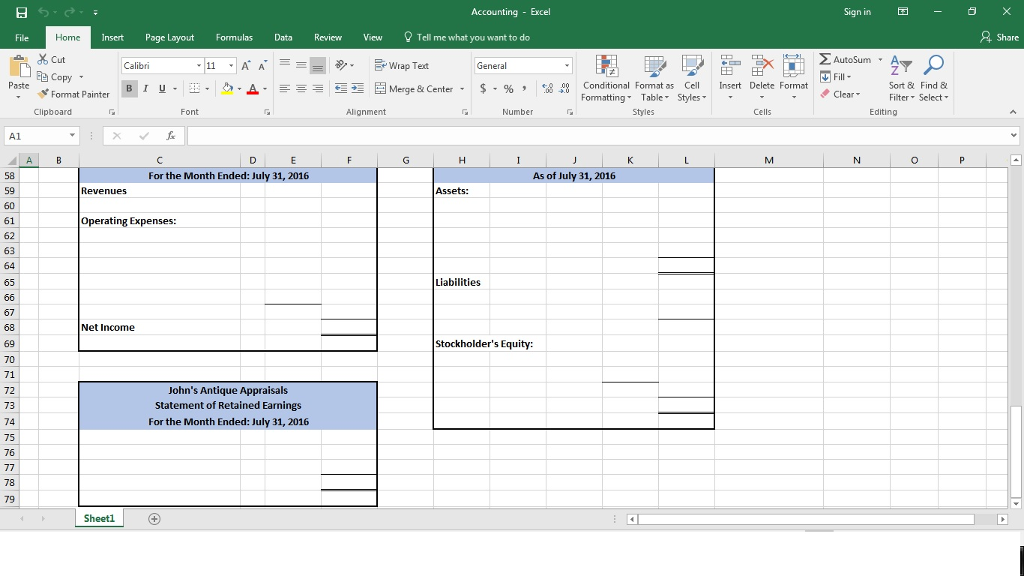

Part 2. Prepare an income statement and a retained earnings statement for the month of July. Also, prepare a balance sheet as of July 31st.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started