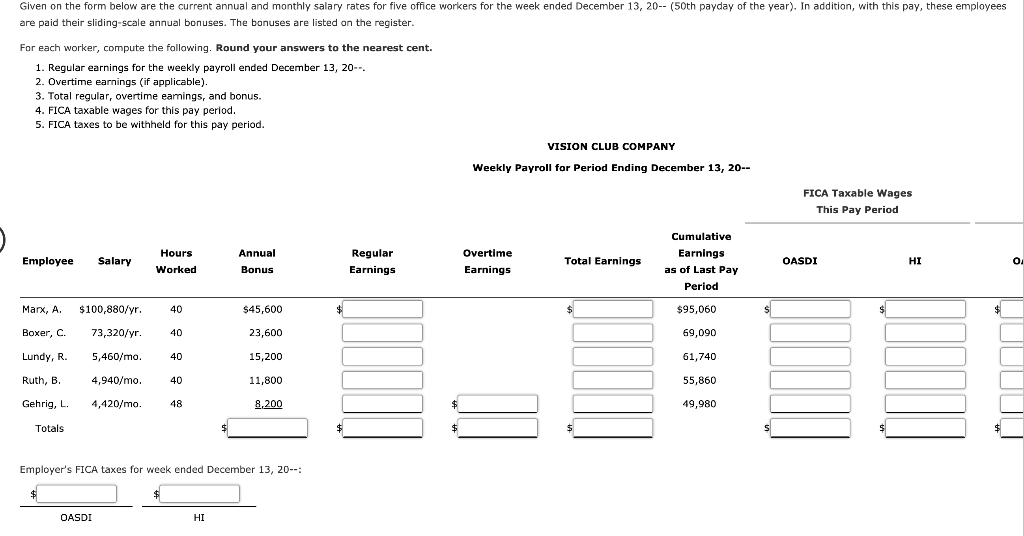

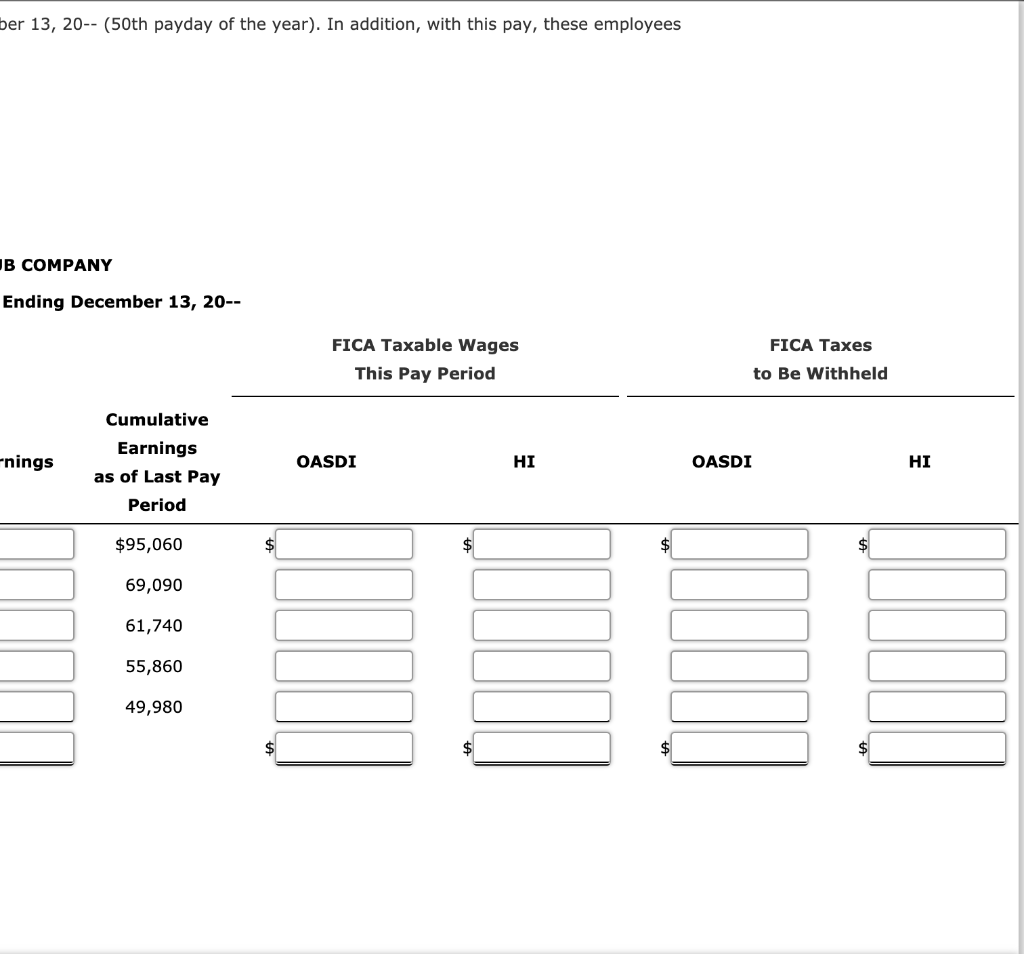

Given on the form below are the current annual and monthly salary rates for five office workers for the week ended December 13, 20-- (50th payday of the year). In addition, with this pay, these employees are paid their sliding-scale annual bonuses. The bonuses are listed on the register. For each worker, compute the following. Round your answers to the nearest cent. 1. Regular earnings for the weekly payroll ended December 13, 20--- 2. Overtime earnings (if applicable) 3. Total regular, overtime eamings, and bonus. 4. FICA taxable wages for this pay period. 5. FICA taxes to be withheld for this pay period. VISION CLUB COMPANY Weekly Payroll for Period Ending December 13, 20-- FICA Taxable Wages This Pay Period Overtime Employee Salary Hours Worked Annual Bonus Regular Earnings Total Earnings Cumulative Earnings as of Last Pay Period OASDI HI 0. Earnings Marx, A. $100,880/yr. 40 $45,600 $ $ $95,060 $ $ $ Boxer, C. 73,320/yr. 40 23,600 69,090 Lundy, R. 5,460/mo. 40 15,200 61,740 Ruth, B. 4,940/mo. 40 11,800 55,860 Gehrig, L. 4,420/mo. 48 8,200 49,980 Totals $ $ S Employer's FICA taxes for week ended December 13, 20--: $ OASDI HI ber 13, 20-- (50th payday of the year). In addition, with this pay, these employees B COMPANY Ending December 13, 20-- FICA Taxable Wages This Pay Period FICA Taxes to Be Withheld -nings Cumulative Earnings as of Last Pay Period OASDI HI OASDI HI $95,060 $ 69,090 61,740 55,860 49,980 Given on the form below are the current annual and monthly salary rates for five office workers for the week ended December 13, 20-- (50th payday of the year). In addition, with this pay, these employees are paid their sliding-scale annual bonuses. The bonuses are listed on the register. For each worker, compute the following. Round your answers to the nearest cent. 1. Regular earnings for the weekly payroll ended December 13, 20--- 2. Overtime earnings (if applicable) 3. Total regular, overtime eamings, and bonus. 4. FICA taxable wages for this pay period. 5. FICA taxes to be withheld for this pay period. VISION CLUB COMPANY Weekly Payroll for Period Ending December 13, 20-- FICA Taxable Wages This Pay Period Overtime Employee Salary Hours Worked Annual Bonus Regular Earnings Total Earnings Cumulative Earnings as of Last Pay Period OASDI HI 0. Earnings Marx, A. $100,880/yr. 40 $45,600 $ $ $95,060 $ $ $ Boxer, C. 73,320/yr. 40 23,600 69,090 Lundy, R. 5,460/mo. 40 15,200 61,740 Ruth, B. 4,940/mo. 40 11,800 55,860 Gehrig, L. 4,420/mo. 48 8,200 49,980 Totals $ $ S Employer's FICA taxes for week ended December 13, 20--: $ OASDI HI ber 13, 20-- (50th payday of the year). In addition, with this pay, these employees B COMPANY Ending December 13, 20-- FICA Taxable Wages This Pay Period FICA Taxes to Be Withheld -nings Cumulative Earnings as of Last Pay Period OASDI HI OASDI HI $95,060 $ 69,090 61,740 55,860 49,980