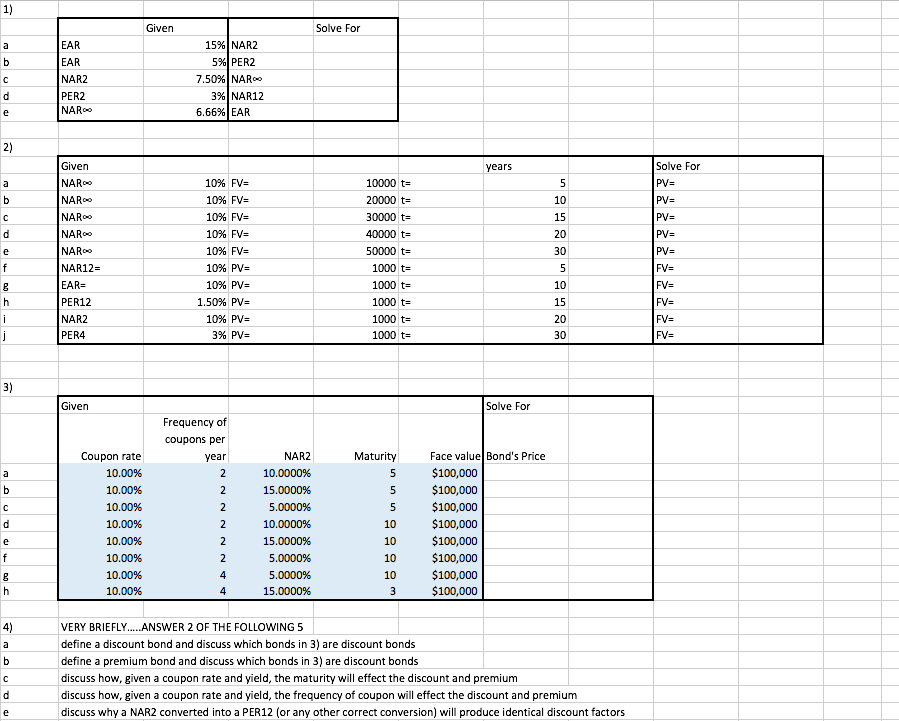

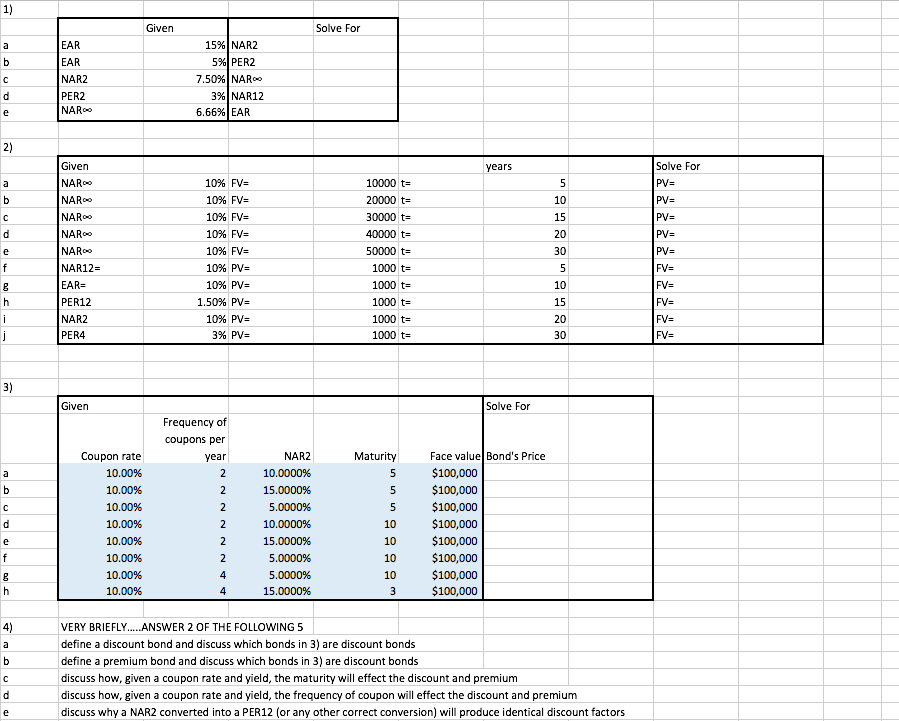

Given Solve For EAR EAR NAR2 PER2 NARoo 15%) NAR2 5%) PER2 7.509 NARCO 3%) NARI2 6.66%) EAR Given NARoo NARoo NARoo NARoo NARoo NAR12- EAR- PER12 NAR2 PER4 years Solve For 10% FV- 1096 FV 1096 FV- 1096 FV- 1096 FV 1096 PV 1096 PV 10000 t- 20000 t- 30000 t- 40000 t- 50000 t- 1000 t 1000 t 1000 t= 1000 t 1000 t 10 15 20 30 PV= 10 15 20 30 1.50% PV 1096 PV- 396 PV Given Solve For Frequency of coupons per year NAR2 10.0000% 15.000096 5.0000% 10.0000% 15.0000% 5.0000% 5.0000% 15.0000% Maturity Coupon rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Face value Bond's Price $100,000 $100,000 $100,000 $100,000 $100,000 $100,000 $100,000 $100,000 10 4) VERY BRIEFLY.... ANSWER 2 OF THE FOLLOWING 5 define a discount bond and discuss which bonds in 3) are discount bonds define a premium bond and discuss which bonds in 3) are discount bonds discuss how, given a coupon rate and yield, the maturity will effect the discount and premium discuss how, given a coupon rate and yield, the frequency of coupon will effect the discount and premium discuss why a NAR2 converted into a PER12 (or any other correct conversion) will produce identical discount factors Given Solve For EAR EAR NAR2 PER2 NARoo 15%) NAR2 5%) PER2 7.509 NARCO 3%) NARI2 6.66%) EAR Given NARoo NARoo NARoo NARoo NARoo NAR12- EAR- PER12 NAR2 PER4 years Solve For 10% FV- 1096 FV 1096 FV- 1096 FV- 1096 FV 1096 PV 1096 PV 10000 t- 20000 t- 30000 t- 40000 t- 50000 t- 1000 t 1000 t 1000 t= 1000 t 1000 t 10 15 20 30 PV= 10 15 20 30 1.50% PV 1096 PV- 396 PV Given Solve For Frequency of coupons per year NAR2 10.0000% 15.000096 5.0000% 10.0000% 15.0000% 5.0000% 5.0000% 15.0000% Maturity Coupon rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Face value Bond's Price $100,000 $100,000 $100,000 $100,000 $100,000 $100,000 $100,000 $100,000 10 4) VERY BRIEFLY.... ANSWER 2 OF THE FOLLOWING 5 define a discount bond and discuss which bonds in 3) are discount bonds define a premium bond and discuss which bonds in 3) are discount bonds discuss how, given a coupon rate and yield, the maturity will effect the discount and premium discuss how, given a coupon rate and yield, the frequency of coupon will effect the discount and premium discuss why a NAR2 converted into a PER12 (or any other correct conversion) will produce identical discount factors