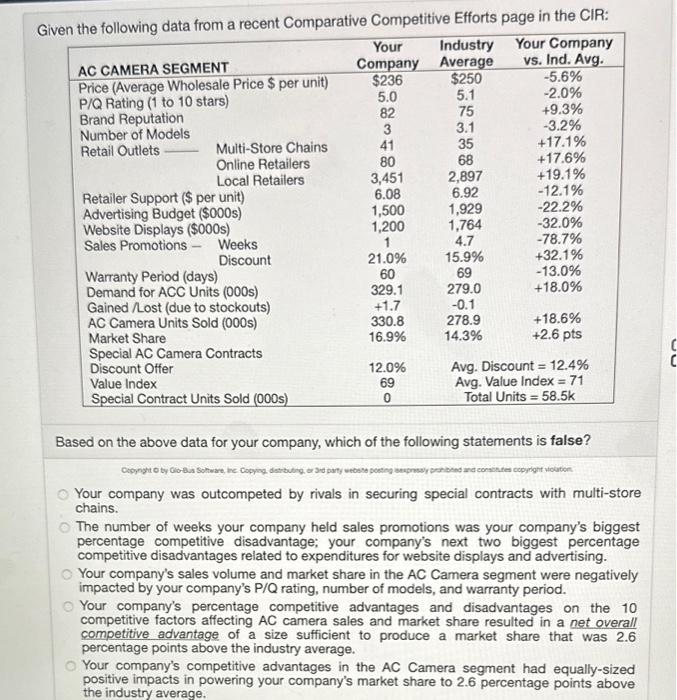

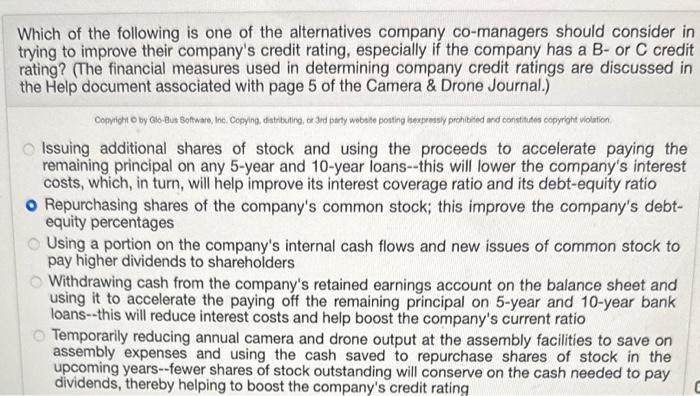

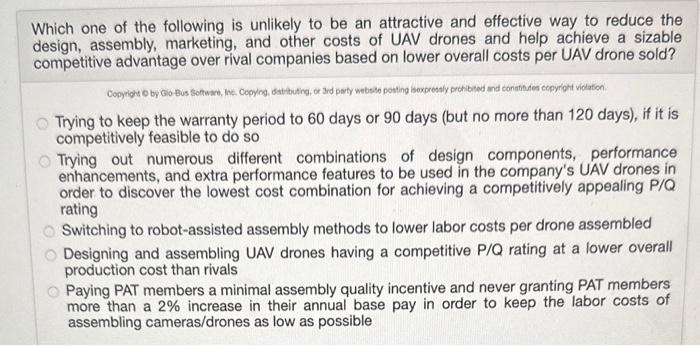

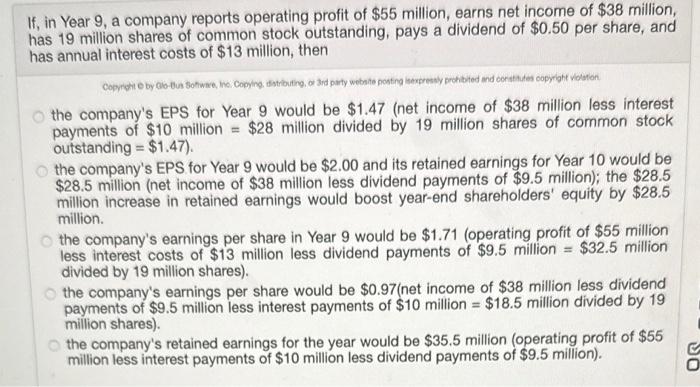

Given tha fallnwinn data from a recent Comparative Competitive Efforts page in the CIR: Based on the above data for your company, which of the following statements is false? Your company was outcompeted by rivals in securing special contracts with multi-store chains. The number of weeks your company held sales promotions was your company's biggest percentage competitive disadvantage; your company's next two biggest percentage competitive disadvantages related to expenditures for website displays and advertising. Your company's sales volume and market share in the AC Camera segment were negatively impacted by your company's P/Q rating, number of models, and warranty period. Your company's percentage competitive advantages and disadvantages on the 10 competitive factors affecting AC camera sales and market share resulted in a net overall competitive advantage of a size sufficient to produce a market share that was 2.6 percentage points above the industry average. Your company's competitive advantages in the AC Camera segment had equally-sized positive impacts in powering your company's market share to 2.6 percentage points above the industry average. Which of the following is one of the alternatives company co-managers should consider in trying to improve their company's credit rating, especially if the company has a B-or C credit rating? (The financial measures used in determining company credit ratings are discussed in the Help document associated with page 5 of the Camera \& Drone Journal.) Issuing additional shares of stock and using the proceeds to accelerate paying the remaining principal on any 5 -year and 10 -year loans--this will lower the company's interest costs, which, in turn, will help improve its interest coverage ratio and its debt-equity ratio Repurchasing shares of the company's common stock; this improve the company's debtequity percentages Using a portion on the company's internal cash flows and new issues of common stock to pay higher dividends to shareholders Withdrawing cash from the company's retained earnings account on the balance sheet and using it to accelerate the paying off the remaining principal on 5-year and 10-year bank loans--this will reduce interest costs and help boost the company's current ratio Temporarily reducing annual camera and drone output at the assembly facilities to save on assembly expenses and using the cash saved to repurchase shares of stock in the upcoming years--fewer shares of stock outstanding will conserve on the cash needed to pay Which one of the following is unlikely to be an attractive and effective way to reduce the design, assembly, marketing, and other costs of UAV drones and help achieve a sizable competitive advantage over rival companies based on lower overall costs per UAV drone sold? Trying to keep the warranty period to 60 days or 90 days (but no more than 120 days), if it is competitively feasible to do so Trying out numerous different combinations of design components, performance enhancements, and extra performance features to be used in the company's UAV drones in order to discover the lowest cost combination for achieving a competitively appealing P/Q rating Switching to robot-assisted assembly methods to lower labor costs per drone assembled Designing and assembling UAV drones having a competitive P/Q rating at a lower overall production cost than rivals Paying PAT members a minimal assembly quality incentive and never granting PAT members more than a 2% increase in their annual base pay in order to keep the labor costs of assembling cameras/drones as low as possible If, in Year 9 , a company reports operating profit of $55 million, earns net income of $38 million, has 19 million shares of common stock outstanding, pays a dividend of $0.50 per share, and has annual interest costs of $13 million, then the company's EPS for Year 9 would be $1.47 (net income of $38 million less interest payments of $10 million =$28 million divided by 19 million shares of common stock outstanding =$1.47 ). the company's EPS for Year 9 would be $2.00 and its retained earnings for Year 10 would be $28.5 million (net income of $38 million less dividend payments of $9.5 million); the $28.5 million increase in retained earnings would boost year-end shareholders' equity by $28.5 million. the company's earnings per share in Year 9 would be $1.71 (operating profit of $55 million less interest costs of $13 million less dividend payments of $9.5 million =$32.5 million divided by 19 million shares). the company's earnings per share would be $0.97 (net income of $38 million less dividend payments of $9.5 million less interest payments of $10 million =$18.5 million divided by 19 million shares). the company's retained earnings for the year would be $35.5 million (operating profit of $55 million less interest payments of $10 million less dividend payments of $9.5 million). The makers of action-capture cameras have a strong incentive to sell their camera models to camera retailers in Europe-Africa at higher average wholesale prices than the average wholesale prices charged to camera retailers in the North America region they incur higher marketing costs in selling action cameras to camera retailers in EuropeAfrica than they do in marketing action cameras to retailers in North America. whenever they incur import duties that are significantly higher per action camera sold/shipped to camera retailers in Europe-Africa than they pay on each action camera sold/shipped to camera retailers in North America. the costs of materials and components costs that camera-makers incur in producing action cameras sold to camera retailers in Europe-Africa are on average about \$8 per camera higher than the cost of materials and components incurred in producing action cameras sold to camera retailers in North America. the costs of shipping AC cameras from Taiwan to camera retailers in Europe-Africa are $3 higher than the costs of shipping AC cameras from Taiwan to North America. the corporate profits taxes that the industry's camera-makers have to pay to governments in the Europe-Africa region are 25% higher on average than the corporate profits taxes that they have to pay governments in North America