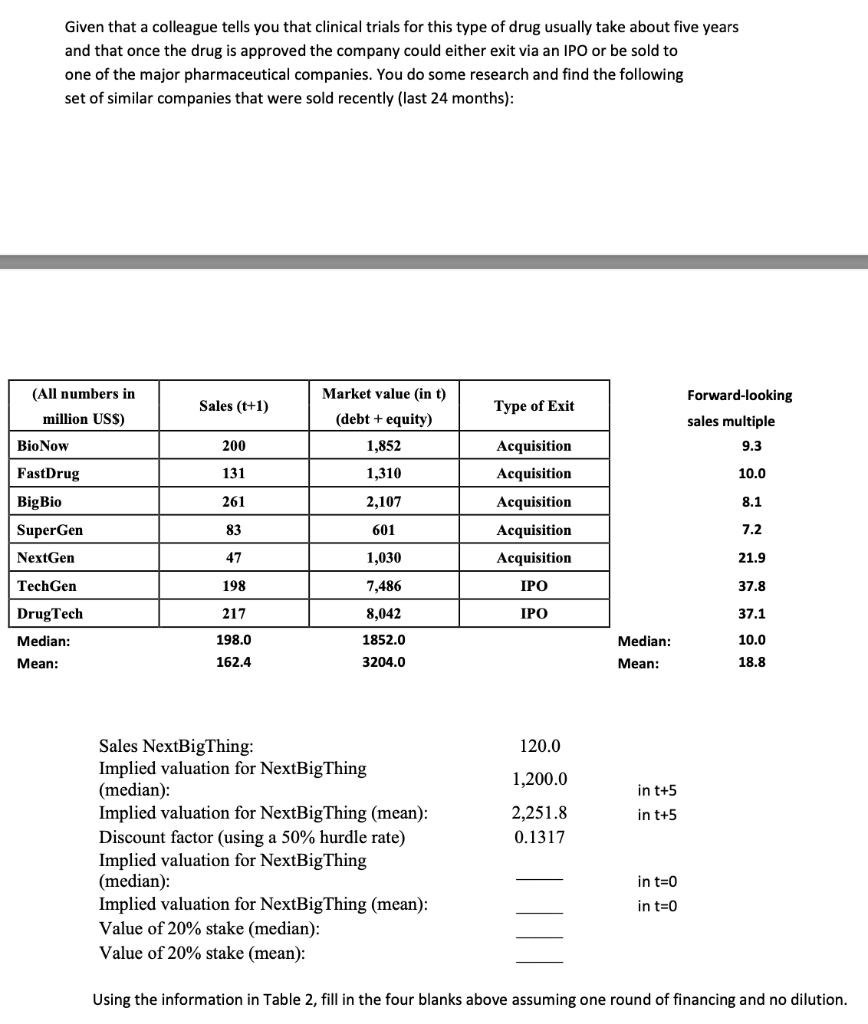

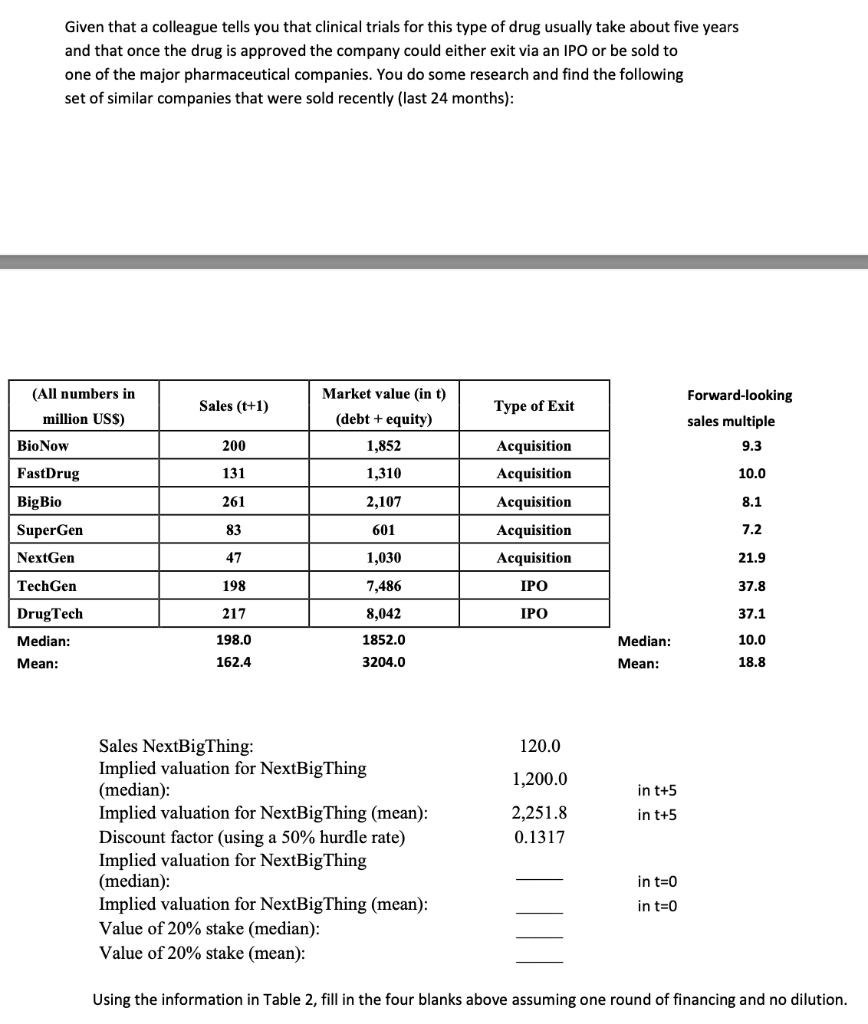

Given that a colleague tells you that clinical trials for this type of drug usually take about five years and that once the drug is approved the company could either exit via an IPO or be sold to one of the major pharmaceutical companies. You do some research and find the following set of similar companies that were sold recently (last 24 months): (All numbers in million USS) Sales (t+1) Type of Exit Market value (int) (debt + equity) 1,852 Forward-looking sales multiple 9.3 Bio Now 200 FastDrug 131 1,310 10.0 261 2,107 Acquisition Acquisition Acquisition Acquisition Acquisition BigBio SuperGen NextGen 8.1 83 601 7.2 47 1,030 21.9 TechGen 198 7,486 IPO 37.8 DrugTech 217 8,042 IPO 37.1 Median: 198.0 162.4 1852.0 3204.0 Median: Mean: 10.0 18.8 Mean: 120.0 1,200.0 in t+5 in t+5 2,251.8 0.1317 Sales NextBig Thing: Implied valuation for NextBig Thing (median): Implied valuation for NextBig Thing (mean): Discount factor (using a 50% hurdle rate) Implied valuation for NextBig Thing (median): Implied valuation for NextBigThing (mean): Value of 20% stake (median): Value of 20% stake (mean): in t=0 in t=0 Using the information in Table 2, fill in the four blanks above assuming one round of financing and no dilution. Given that a colleague tells you that clinical trials for this type of drug usually take about five years and that once the drug is approved the company could either exit via an IPO or be sold to one of the major pharmaceutical companies. You do some research and find the following set of similar companies that were sold recently (last 24 months): (All numbers in million USS) Sales (t+1) Type of Exit Market value (int) (debt + equity) 1,852 Forward-looking sales multiple 9.3 Bio Now 200 FastDrug 131 1,310 10.0 261 2,107 Acquisition Acquisition Acquisition Acquisition Acquisition BigBio SuperGen NextGen 8.1 83 601 7.2 47 1,030 21.9 TechGen 198 7,486 IPO 37.8 DrugTech 217 8,042 IPO 37.1 Median: 198.0 162.4 1852.0 3204.0 Median: Mean: 10.0 18.8 Mean: 120.0 1,200.0 in t+5 in t+5 2,251.8 0.1317 Sales NextBig Thing: Implied valuation for NextBig Thing (median): Implied valuation for NextBig Thing (mean): Discount factor (using a 50% hurdle rate) Implied valuation for NextBig Thing (median): Implied valuation for NextBigThing (mean): Value of 20% stake (median): Value of 20% stake (mean): in t=0 in t=0 Using the information in Table 2, fill in the four blanks above assuming one round of financing and no dilution