Given that answers, what are the solutions how it get?

provide the solution

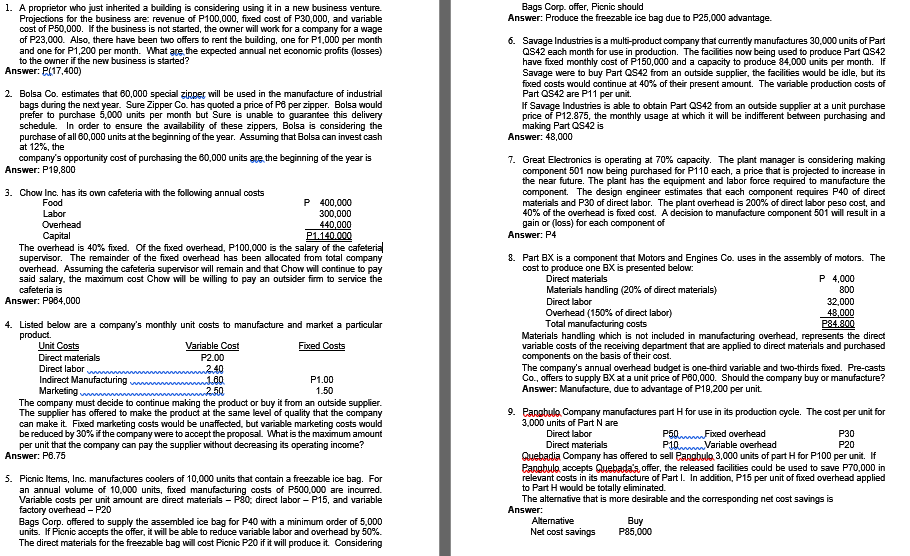

1. A proprietor who just inherited a building is considering using it in a new business venture. Bags Corp. offer, Picnic should Projections for the business are: revenue of P100,000, fixed cost of P30,000, and variable Answer: Produce the freezable ice bag due to P25,000 advantage. cost of P50,000. If the business is not started, the owner will work for a company for a wage of P23,000. Also. there have been two offers to rent the building, one for P1,000 per month 6. Savage Industries is a multi-product company that currently manufactures 30,000 units of Part and one for P1,200 per month. What are the expected annual net economic profits (losses) QS42 each month for use in production. The facilities now being used to produce Part QS42 to the owner if the new business is started? have fixed monthly cost of P150,000 and a capacity to produce 84,000 units per month. If Answer: P(17,400) Savage were to buy Part Q542 from an outside supplier, the facilities would be idle, but its fixed costs would continue at 40%% of their present amount. The variable production costs of 2. Bolsa Co. estimates that 60,000 special zipper will be used in the manufacture of industrial Part Q542 are P11 per unit. bags during the next year. Sure Zipper Co. has quoted a price of PO per zipper. Bolsa would If Savage Industries is able to obtain Part Q542 from an outside supplier at a unit purchase prefer to purchase 5,000 units per month but Sure is unable to guarantee this delivery price of P12.875, the monthly usage at which it will be indifferent between purchasing and schedule. In order to ensure the availability of these zippers, Bolsa is considering the making Part Q542 is purchase of all 60,000 units at the beginning of the year. Assuming that Bolsa can invest cash Answer: 48,000 at 12%, the company's opportunity cost of purchasing the 80,000 units are the beginning of the year is 7. Great Electronics is operating at 70% capacity. The plant manager is considering making Answer: P18,800 component 501 now being purchased for P110 each, a price that is projected to increase in the near future. The plant has the equipment and labor force required to manufacture the 3. Chow Inc. has its own cafeteria with the following annual costs component. The design engineer estimates that each component requires P40 of direct Food P 400,000 materials and P30 of direct labor. The plant overhead is 200% of direct labor peso cost, and Labor 300,000 40% of the overhead is fixed cost. A decision to manufacture component 501 will result in a Overhead 440,000 gain or (loss) for each component of Capital P1.140.000 Answer: P4 The overhead is 40% fixed. Of the fixed overhead, P100,000 is the salary of the cafeterial supervisor. The remainder of the fixed overhead has been allocated from total company 8. Part BX is a component that Motors and Engines Co. uses in the assembly of motors. The overhead. Assuming the cafeteria supervisor will remain and that Chow will continue to pay cost to produce one BX is presented below: said salary. the maximum cost Chow will be willing to pay an outsider firm to service the Direct materials P 4,000 cafeteria is Materials handling (20% of direct materials) 800 Answer: P964,000 Direct labor 32,000 Overhead (150% of direct labor) 48,000 4. Listed below are a company's monthly unit costs to manufacture and market a particular Total manufacturing costs 284.800 product. Materials handling which is not included in manufacturing overhead, represents the direct Unit Costs Variable Cost Fixed Costs variable costs of the receiving department that are applied to direct materials and purchased Direct materials P2.00 components on the basis of their cost. Direct labor mmmmmmmmmwwwwwwwww The company's annual overhead budget is one-third variable and two-thirds fixed. Pre-casts Indirect Manufacturing wanna 1.80 P1.00 Co., offers to supply BX at a unit price of P60,000. Should the company buy or manufacture? Marketing ummmmmmmmm 1.50 Answer: Manufacture, due to advantage of P19,200 per unit. The company must decide to continue making the product or buy it from an outside supplier. The supplier has offered to make the product at the same level of quality that the company 9. Panobulo Company manufactures part H for use in its production cycle. The cost per unit for can make it. Fixed marketing costs would be unaffected, but variable marketing costs would 3.000 units of Part N are be reduced by 30% if the company were to accept the proposal. What is the maximum amount Direct labor P50.Fixed overhead P30 per unit that the company can pay the supplier without decreasing its operating income? Direct materials P10wwwwwwwVariable overhead P20 Answer: P6.75 Quebadia Company has offered to sell Papobulo 3,000 units of part H for P100 per unit. If Panobulo accepts Quebada's offer, the released facilities could be used to save P70,000 in 5. Picnic Items, Inc. manufactures coolers of 10,000 units that contain a freezable ice bag. For relevant costs in its manufacture of Part I. In addition, P15 per unit of fixed overhead applied an annual volume of 10.000 units, fixed manufacturing costs of P500,000 are incurred. to Part H would be totally eliminated. Variable costs per unit amount are direct materials - P80; direct labor - P15, and variable The alternative that is more desirable and the corresponding net cost savings is factory overhead - P20 Answer: Bags Corp. offered to supply the assembled ice bag for P40 with a minimum order of 5,000 Alternative Buy units. If Picnic accepts the offer, it will be able to reduce variable labor and overhead by 50%. Net cost savings P85,000 The direct materials for the freezable bag will cost Picnic P20 if it will produce it. Considering