Given that answers, what are the solutions how it get?

provide the solution

?

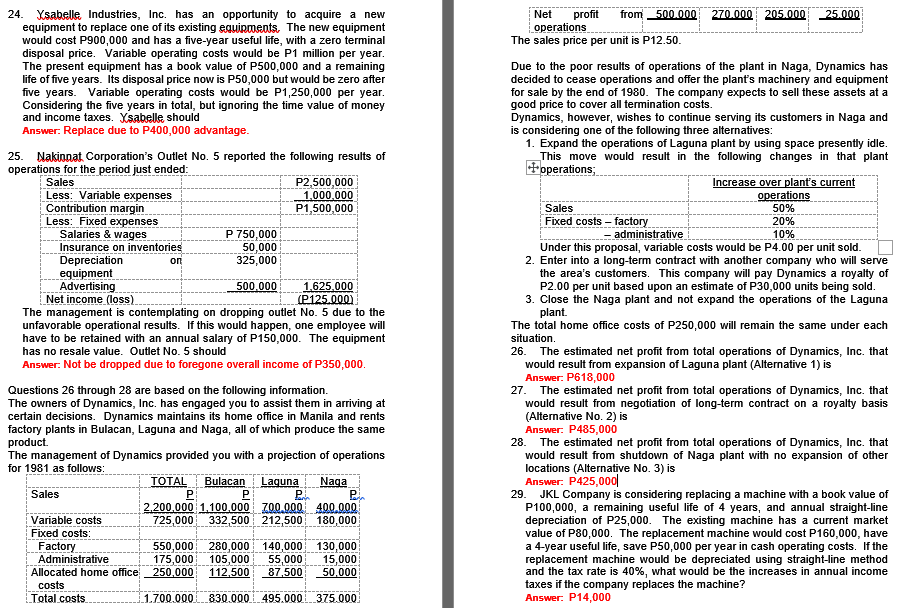

24. Xsabelle Industries, Inc. has an opportunity to acquire a new Net profit from 500.000 270.000 205.000 25.000 equipment to replace one of its existing equipments, The new equipment _operations_ would cost P900,000 and has a five-year useful life, with a zero terminal The sales price per unit is P12.50. disposal price. Variable operating costs would be P1 million per year. The present equipment has a book value of P500,000 and a remaining Due to the poor results of operations of the plant in Naga, Dynamics has life of five years. Its disposal price now is P50,000 but would be zero after decided to cease operations and offer the plant's machinery and equipment five years. Variable operating costs would be P1,250,000 per year. for sale by the end of 1980. The company expects to sell these assets at a Considering the five years in total, but ignoring the time value of money good price to cover all termination costs. and income taxes. Xsabelle should Dynamics, however, wishes to continue serving its customers in Naga and Answer. Replace due to P400,000 advantage. is considering one of the following three alternatives: 1. Expand the operations of Laguna plant by using space presently idle. 25. Nakinnat Corporation's Outlet No. 5 reported the following results of This move would result in the following changes in that plant operations for the period just ended: operations; Sales P2,500,000 Increase over plant's current | Less: Variable expenses 1,000,000 operations Contribution margin P1,500,000 Sales 50% Less: Fixed expenses Fixed costs - factory 20% Salaries & wages P 750,000 = administrative 10% Insurance on inventories 50,000 Under this proposal, variable costs would be P4.00 per unit sold. Depreciation on 325,000 2. Enter into a long-term contract with another company who will serve equipment the area's customers. This company will pay Dynamics a royalty of Advertising 500.000 1.625,000 P2.00 per unit based upon an estimate of P30,000 units being sold. Net income (loss) (P125.000) 3. Close the Naga plant and not expand the operations of the Laguna The management is contemplating on dropping outlet No. 5 due to the plant. unfavorable operational results. If this would happen, one employee will The total home office costs of P250,000 will remain the same under each have to be retained with an annual salary of P150,000. The equipment situation has no resale value. Outlet No. 5 should 26. The estimated net profit from total operations of Dynamics, Inc. that Answer: Not be dropped due to foregone overall income of P350,000. would result from expansion of Laguna plant (Alternative 1) is Answer: P618,000 Questions 26 through 28 are based on the following information. 27. The estimated net profit from total operations of Dynamics, Inc. that The owners of Dynamics, Inc. has engaged you to assist them in arriving at would result from negotiation of long-term contract on a royalty basis certain decisions. Dynamics maintains its home office in Manila and rents (Alternative No. 2) is factory plants in Bulacan, Laguna and Naga, all of which produce the same Answer: P485,000 product 28. The estimated net profit from total operations of Dynamics, Inc. that The management of Dynamics provided you with a projection of operations would result from shutdown of Naga plant with no expansion of other for 1981 as follows: locations (Alternative No. 3) is TOTAL |_Bulacan | Laguna | _Naga Answer. P425,000 Sales Pi 29. JKL Company is considering replacing a machine with a book value of 2,200,000 1.100,000 700 000 400 000 P100,000, a remaining useful life of 4 years, and annual straight-line Variable costs 725,000 332,500 212,500 180,000 depreciation of P25,000. The existing machine has a current market Fixed costs value of P80,000. The replacement machine would cost P160,000, have Factory 550,000 280,000 140,000 130,000 a 4-year useful life, save P50,000 per year in cash operating costs. If the Administrative 175,000 105,000 55,000 15,000 replacement machine would be depreciated using straight-line method Allocated home office! _ 250,000 112,500 87,500 50,000 and the tax rate is 40%, what would be the increases in annual income costs taxes if the company replaces the machine? Total costs 1.700.000 ._830.000 __495.000 375.000) Answer: P14,000