Answered step by step

Verified Expert Solution

Question

1 Approved Answer

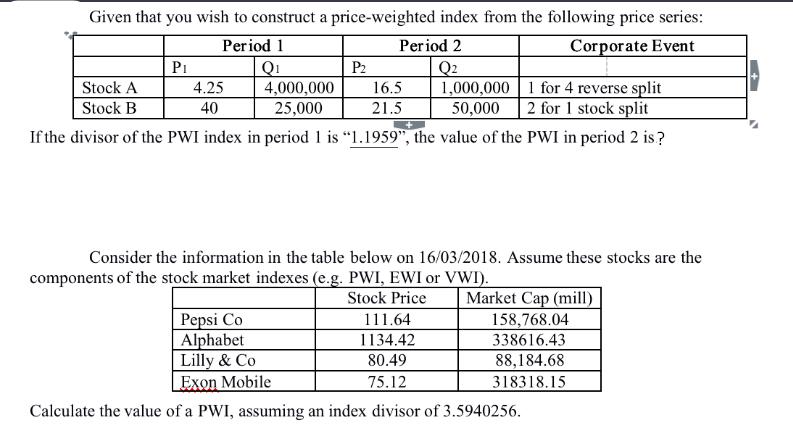

Given that you wish to construct a price-weighted index from the following price series: Period 1 Period 2 Corporate Event Q Q Stock A

Given that you wish to construct a price-weighted index from the following price series: Period 1 Period 2 Corporate Event Q Q Stock A Stock B P 4.25 40 4,000,000 25,000 1,000,000 1 for 4 reverse split 50,000 2 for 1 stock split If the divisor of the PWI index in period 1 is "1.1959", the value of the PWI in period 2 is? P 16.5 21.5 Consider the information in the table below on 16/03/2018. Assume these stocks are the components of the stock market indexes (e.g. PWI, EWI or VWI). Stock Price 111.64 1134.42 80.49 75.12 Market Cap (mill) 158,768.04 338616.43 88,184.68 318318.15 Pepsi Co Alphabet Lilly & Co Exon Mobile Calculate the value of a PWI, assuming an index divisor of 3.5940256. +

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Price Weighted Index PWI for period 2 we need to take into account the changes in stock prices as well as the corporate events such a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started