Answered step by step

Verified Expert Solution

Question

1 Approved Answer

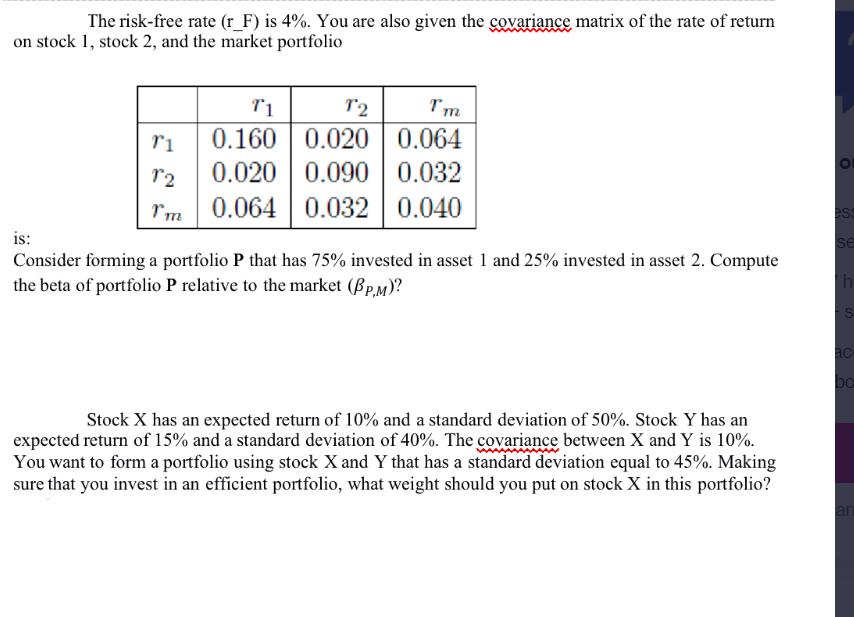

The risk-free rate (r_F) is 4%. You are also given the covariance matrix of the rate of return on stock 1, stock 2, and

The risk-free rate (r_F) is 4%. You are also given the covariance matrix of the rate of return on stock 1, stock 2, and the market portfolio T1 72 Tm 0.160 0.020 0.064 12 0.020 0.090 0.032 I'm 0.064 0.032 0.040 T1 is: Consider forming a portfolio P that has 75% invested in asset 1 and 25% invested in asset 2. Compute the beta of portfolio P relative to the market (BP,M)? Stock X has an expected return of 10% and a standard deviation of 50%. Stock Y has an expected return of 15% and a standard deviation of 40%. The covariance between X and Y is 10%. You want to form a portfolio using stock X and Y that has a standard deviation equal to 45%. Making sure that you invest in an efficient portfolio, what weight should you put on stock X in this portfolio? OF ess se 'h S ac ba an

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the beta of portfolio P relative to the market PM we need to calculate the weighted average beta of the individual assets in the portfolio ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started