Answered step by step

Verified Expert Solution

Question

1 Approved Answer

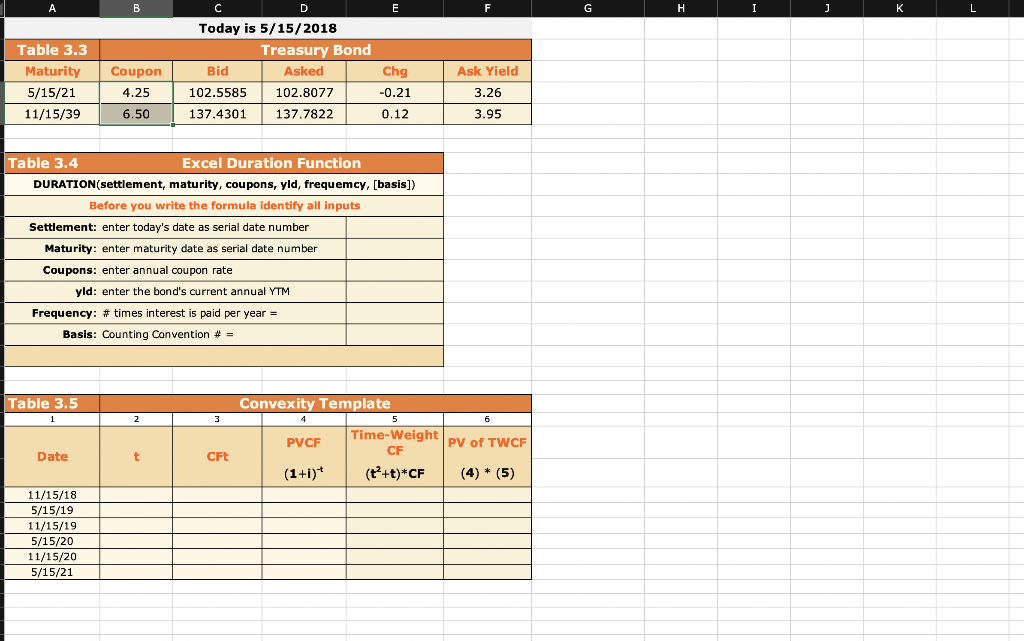

Given the B, for the 11/15/39 T-Bond in response to a 102 bps increase in yields, show: ( 3pt ) a ) How much of

Given the  B, for the 11/15/39 T-Bond in response to a 102 bps increase in yields, show: (3pt)

B, for the 11/15/39 T-Bond in response to a 102 bps increase in yields, show: (3pt)

a) How much of the bond price change is due to duration? . Show the formula with inputs and solution.

b) How much of the bond price change is due to convexity? . Show the formula with inputs and solution.

Given: The convexity of the 11/15/39 T-Bond = 118.9216

Today is 5/15/2018 Table 3.3 Treasury Bond Maturity Coupon 5/15/21 11/15/39 Bid 102.5585 137.4301 Chg -0.21 0.12 Asked Ask Yield 3.26 3.95 4.25 102.8077 6.50 301 137.7822 Table 3.4 Excel Duration Function DURATION (settlement, maturity, coupons, yld, frequemcy, [basis]) Before you write the formula identify all inputs Settlement: enter today's date as serial date number Maturity: enter maturity date as serial date number Coupons: enter annual coupon rate yld: enter the bond's current annual YTM Frequency: # times interest is paid per year- Basis: Counting Convention # Table 3.5 Convexity Template Time-Weight py of TWC PVCF Date CF CFt (t*+t)*CF (4) (5) 11/15/18 5/15/19 11/15/19 5/15/20 11/15/20 5/15/21 Today is 5/15/2018 Table 3.3 Treasury Bond Maturity Coupon 5/15/21 11/15/39 Bid 102.5585 137.4301 Chg -0.21 0.12 Asked Ask Yield 3.26 3.95 4.25 102.8077 6.50 301 137.7822 Table 3.4 Excel Duration Function DURATION (settlement, maturity, coupons, yld, frequemcy, [basis]) Before you write the formula identify all inputs Settlement: enter today's date as serial date number Maturity: enter maturity date as serial date number Coupons: enter annual coupon rate yld: enter the bond's current annual YTM Frequency: # times interest is paid per year- Basis: Counting Convention # Table 3.5 Convexity Template Time-Weight py of TWC PVCF Date CF CFt (t*+t)*CF (4) (5) 11/15/18 5/15/19 11/15/19 5/15/20 11/15/20 5/15/21Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started