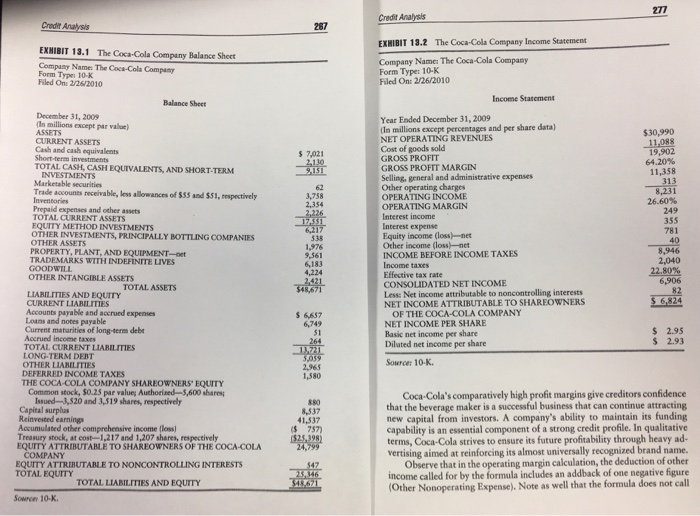

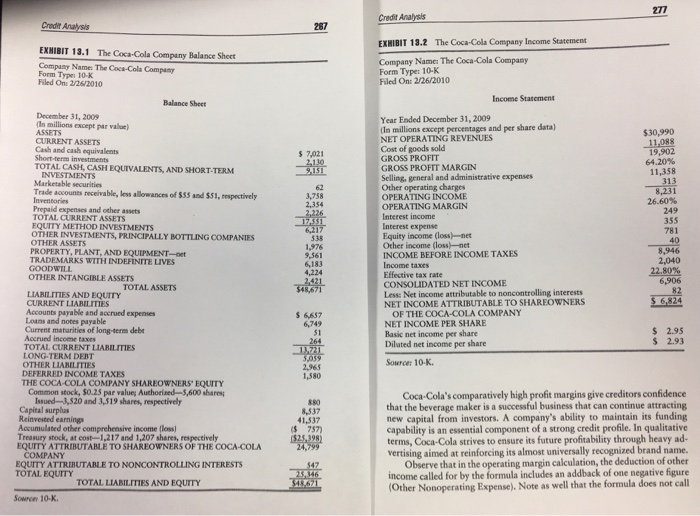

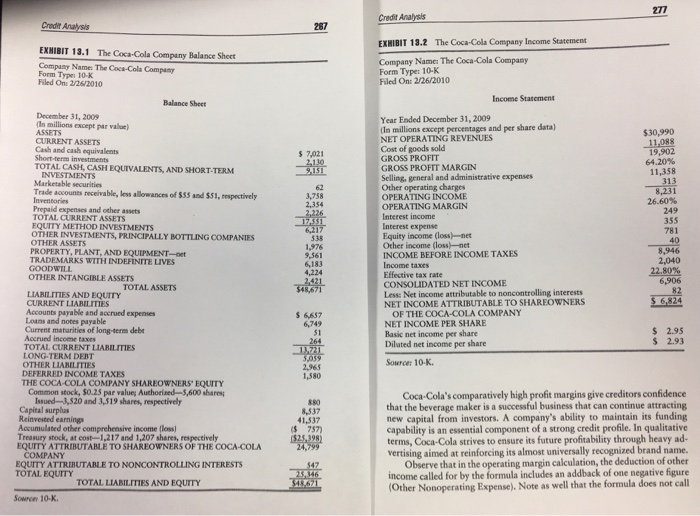

given the balance sheet and income statement of Coca-Cola calculate its net margin, return on equity, receivables turnover, inventory turnover, and total debt to cash flow (assuming Coca-Cola had 30 million cash flow from operations).

Credit Analysis Credit Analysis EXHIBIT 13.1 The Coca-Cola Company Balance Sheet Company Name: The Coca-Cola Company Form Type 10-K Filed On 2/24/2010 EXHIBIT 13.2 The Coca-Cola Company Income Statement Company Name: The Coca-Cola Company Form Type: 10-K Filed On: 2/26/2010 Income Statement $7,021 9,151 $30,990 11.08 19,902 64.20% 11.358 313 8.231 26.60% 249 355 781 3,758 1431 Year Ended December 31, 2009 (In millions except percentages and per share data) NET OPERATING REVENUES Cost of goods sold GROSS PROFIT GROSS PROFIT MARGIN Selling, general and administrative expenses Other operating charges OPERATING INCOME OPERATING MARGIN Interest income Interest expense Equity income (lossnet Other income (lossynet INCOME BEFORE INCOME TAXES Income taxes Effective tax rate CONSOLIDATED NET INCOME Less: Net Income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY NET INCOME PER SHARE Basic net income per share Diluted net income per share 9.561 8.946 2,040 22.80% 6,906 Balance Sheet December 31, 2009 (in millions except par value ASSETS CURRENT ASSETS Cash and cash equivalents Short-term investments TOTAL CASH, CASH EQUIVALENTS, AND SHORT-TERM INVESTMENTS Marketable securities Trade accounts receivable, less allowances of $55 and $51, respectively Inventories Prepaid expenses and other assets TOTAL CURRENT ASSETS EQUITY METHOD INVESTMENTS OTHER INVESTMENTS, PRINCIPALLY BOTTLING COMPANIES OTHER ASSETS PROPERTY, PLANT, AND EQUIPMENT TRADEMARKS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debe Accrued Income taxes TOTAL CURRENT LIABILITIES LONG-TERM DEBT OTHER LIABILITIES DEFERRED INCOME TAXES THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, $0.25 par values Authorised-5,600 shares Issued 2,520 and 3.519 shares, respectively Capital surplus Reinvested earnings Accumulated other comprehensive income loss Treasury stock, at cost 1,217 and 1,207 shares, respectively EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 4,224 2,421 47571 $ 6,824 $ 6,657 6,749 $ $ 2.95 2.93 13.721 Source: 10-K. 2,965 1,580 8,337 41,537 $ 757) ($25,398) 24,799 Coca-Cola's comparatively high profit margins give creditors confidence that the beverage maker is a successful business that can continue attracting new capital from investors. A company's ability to maintain its funding capability is an essential component of a strong credit profile. In qualitative terms, Coca-Cola strives to ensure its future profitability through heavy ad- vertising aimed at reinforcing its almost universally recognized brand name. Observe that in the operating margin calculation, the deduction of other income called for by the formula includes an addback of one negative figure (Other Nonoperating Expense). Note as well that the formula does not call 25,346 71 Sowree 10-K