Question

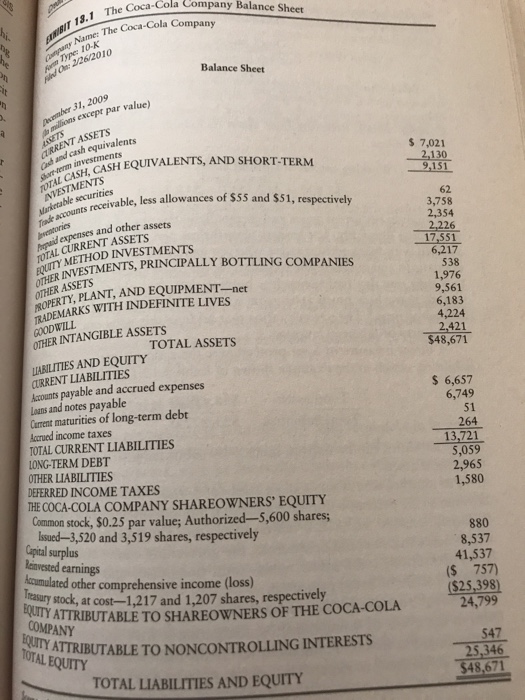

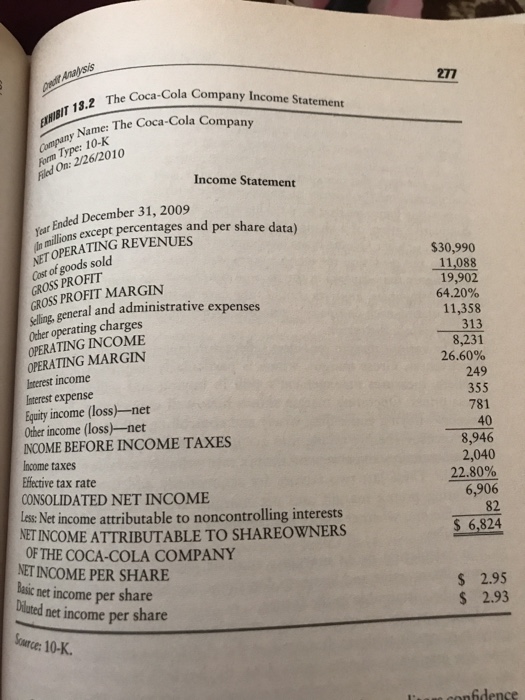

Given the Balance sheet and Income Statement of Coca-Cola (Exhibit 13.1 and 13.2 on pages 267 & 277 in the Financial statement analysis- A practitioner's

Given the Balance sheet and Income Statement of Coca-Cola (Exhibit 13.1 and 13.2 on pages 267 & 277 in the Financial statement analysis- A practitioner's guide textbook), calculate its Net Margin, Return on Equity, Receivables turnover, Inventory turnover, and Total debt to cash flow (assuming Coca-Cola had $30 million Cash flow from operations).

b) Assume also that the Coca-Colas Expected annual growth in earnings is 6% and investors required rate of return is 9%, calculate the following: Dividend payout ratio, Dividend rate, its Stock price, and Price-earnings ratio.

2.How are equity valuation models analogous to the yield-to-maturity calculation for a bond?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started