Answered step by step

Verified Expert Solution

Question

1 Approved Answer

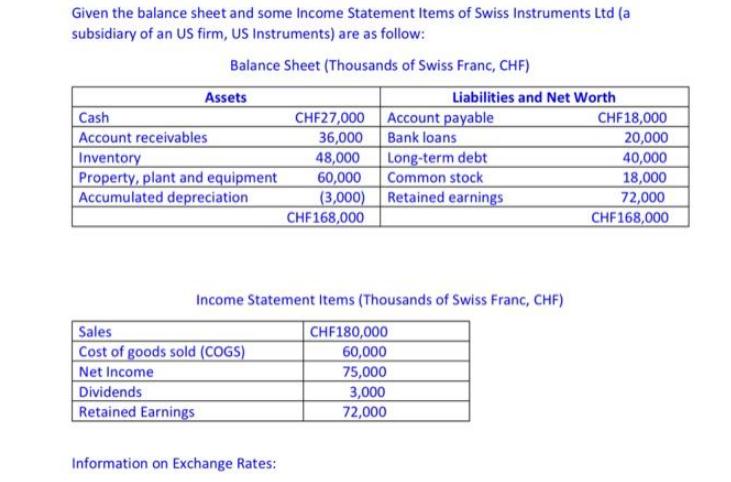

Given the balance sheet and some Income Statement Items of Swiss Instruments Ltd (a subsidiary of an US firm, US Instruments) are as follow:

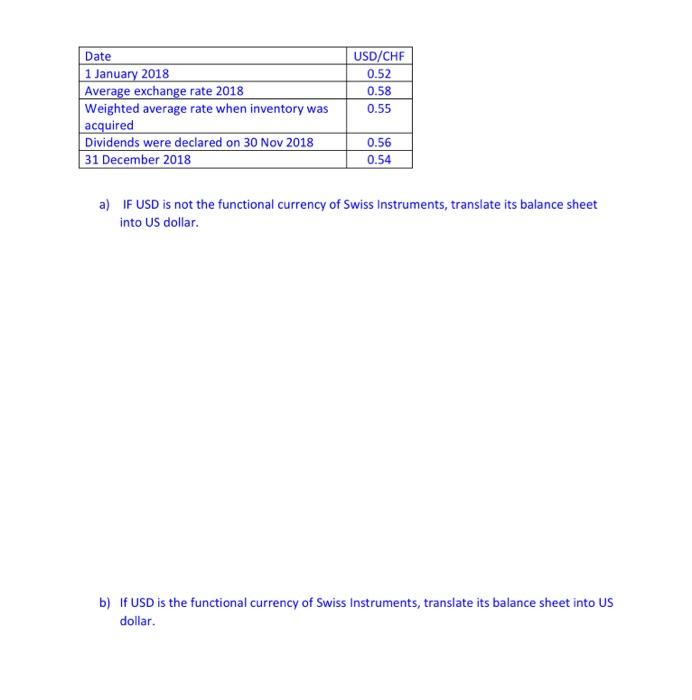

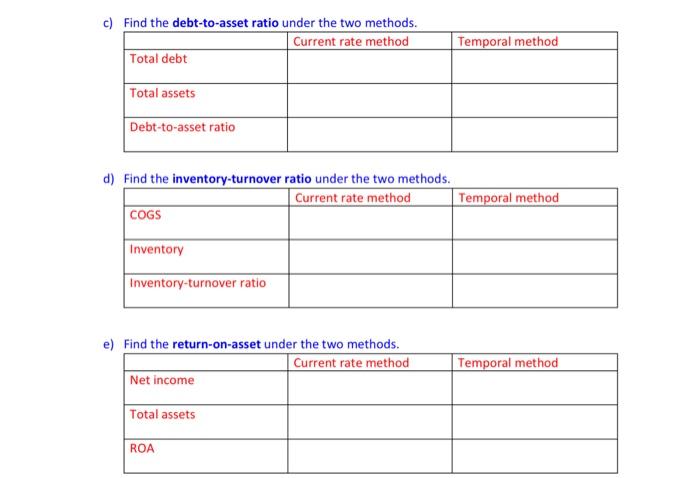

Given the balance sheet and some Income Statement Items of Swiss Instruments Ltd (a subsidiary of an US firm, US Instruments) are as follow: Balance Sheet (Thousands of Swiss Franc, CHF) Assets Cash Account receivables Inventory Property, plant and equipment Accumulated depreciation Dividends Retained Earnings Sales Cost of goods sold (COGS) Net Income CHF27,000 36,000 48,000 60,000 (3,000) CHF168,000 Information on Exchange Rates: Liabilities and Net Worth Account payable Bank loans Income Statement Items (Thousands of Swiss Franc, CHF) CHF180,000 60,000 75,000 3,000 72,000 Long-term debt Common stock Retained earnings CHF18,000 20,000 40,000 18,000 72,000 CHF168,000 Date 1 January 2018 Average exchange rate 2018 Weighted average rate when inventory was acquired Dividends were declared on 30 Nov 2018 31 December 2018 USD/CHF 0.52 0.58 0.55 0.56 0.54 a) IF USD is not the functional currency of Swiss Instruments, translate its balance sheet into US dollar. b) If USD is the functional currency of Swiss Instruments, translate its balance sheet into US dollar. c) Find the debt-to-asset ratio under the two methods. Current rate method Total debt Total assets Debt-to-asset ratio d) Find the inventory-turnover ratio under the two methods. Current rate method COGS Inventory Inventory-turnover ratio e) Find the return-on-asset under the two methods. Current rate method Net income Total assets ROA Temporal method Temporal method Temporal method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 1 a If USD is not the functional currency of Swiss Instruments Given the rates 1 January 2018 USDCHF 05231 December 2018 USDCHF 054 Using these rates we can convert the Swiss Instruments Ltd bala...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started