Question

Given the cash flows in the table below for mutually exclusive projects Alpha and Beta, which project do you recommend if using a cost of

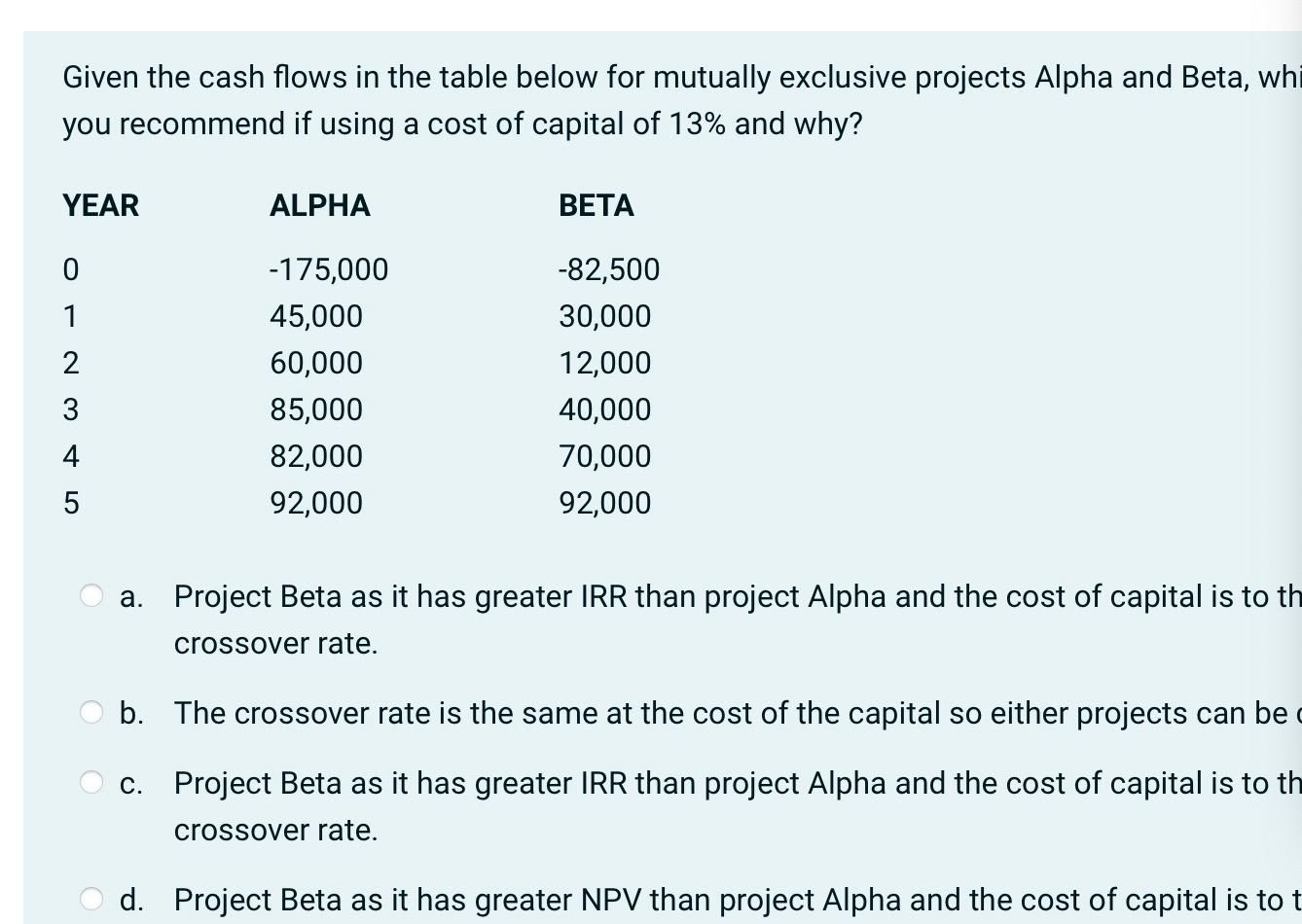

Given the cash flows in the table below for mutually exclusive projects Alpha and Beta, which project do you recommend if using a cost of capital of 13% and why?

YEAR ALPHA BETA

0 -175,000 -82,500

1 45,000 30,000

2 60,000 12,000

3 85,000 40,000

4 82,000 70,000

5 92,000 92,000

a. Project Beta as it has greater IRR than project Alpha and the cost of capital is to the right of the crossover rate.

b. The crossover rate is the same at the cost of the capital so either projects can be chosen.

c. Project Beta as it has greater IRR than project Alpha and the cost of capital is to the left of the crossover rate.

d. Project Beta as it has greater NPV than project Alpha and the cost of capital is to the left of the crossover rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started