Answered step by step

Verified Expert Solution

Question

1 Approved Answer

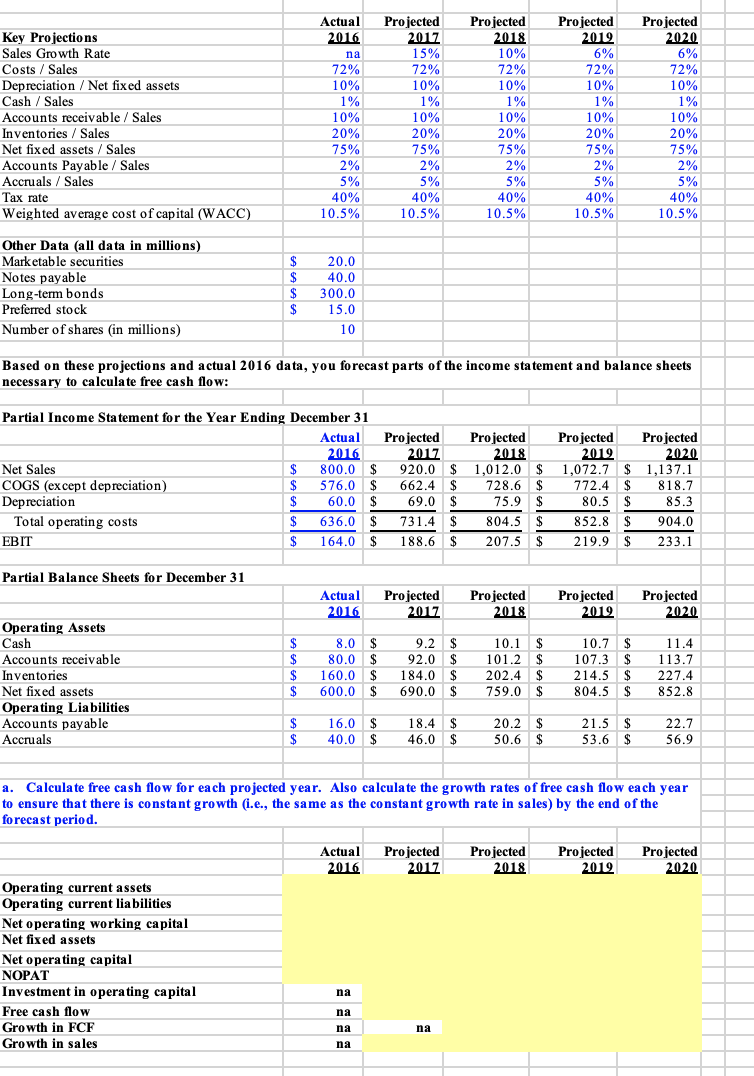

Given the Data, please Calculate free cash flow for each projected year. Also calculate the growth rates of free cash flow each year to ensure

Given the Data, please

| Calculate free cash flow for each projected year. Also calculate the growth rates of free cash flow each year to ensure that there is constant growth (i.e., the same as the constant growth rate in sales) by the end of the forecast period. |

Based on these projections and actual 2016 data, you forecast parts of the income statement and balance sheets necessary to calculate free cash flow: Partial Income Statement for the Year Ending December 31 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline & & \multirow{2}{*}{\begin{tabular}{r} Actual \\ 2016 \end{tabular}} & \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{r} Projected \\ 2017 \end{tabular}}} & \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{r} Projected \\ 2018 \end{tabular}}} & \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{r} Projected \\ 2019 \\ \end{tabular}}} & \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{r} Projected \\ 2020 \end{tabular}}} \\ \hline & & & & & & & & & & \\ \hline Net Sales & $ & 800.0 & $ & 920.0 & $ & 1,012.0 & $ & 1,072.7 & $ & 1,137.1 \\ \hline COGS (except depreciation) & $ & 576.0 & $ & 662.4 & $ & 728.6 & $ & 772.4 & $ & 818.7 \\ \hline Depreciation & $ & 60.0 & $ & 69.0 & $ & 75.9 & $ & 80.5 & $ & 85.3 \\ \hline Total operating costs & $ & 636.0 & $ & 731.4 & $ & 804.5 & $ & 852.8 & $ & 904.0 \\ \hline EBIT & $ & 164.0 & $ & 188.6 & $ & 207.5 & $ & 219.9 & $ & 233.1 \\ \hline \end{tabular} Partial Balance Sheets for December 31 Operating current assets Operating current liabilities Net operating working capital Net fixed assets Net operating capital NOPAT Investment in operating capital Free cash flow Growth in FCF Growth in sales na

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started