Answered step by step

Verified Expert Solution

Question

1 Approved Answer

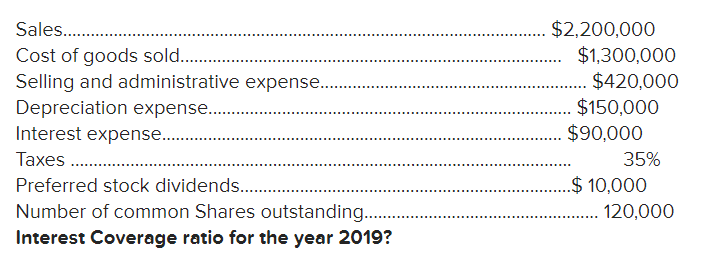

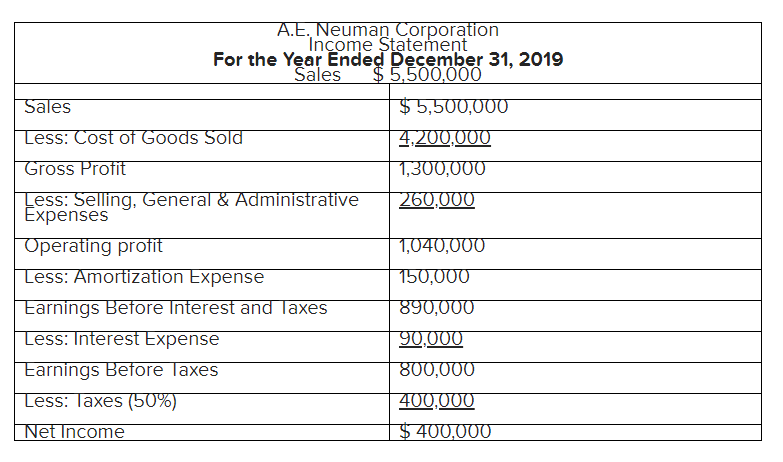

Given the financial information for the A.E. Neuman Corporation. Calculate Return on Assets for 2019. Sales......... Cost of goods sold.......... Selling and administrative expense...... Depreciation

Given the financial information for the A.E. Neuman Corporation. Calculate Return on Assets for 2019.

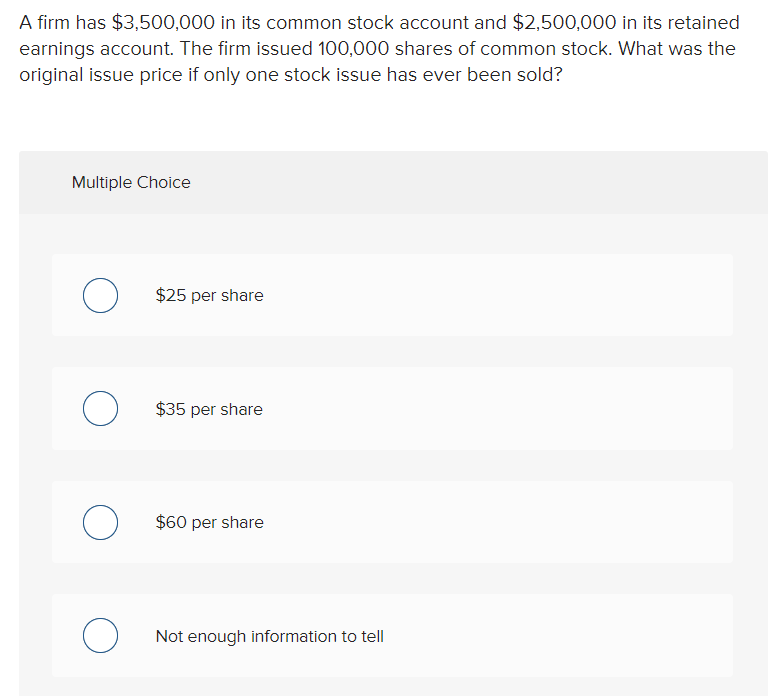

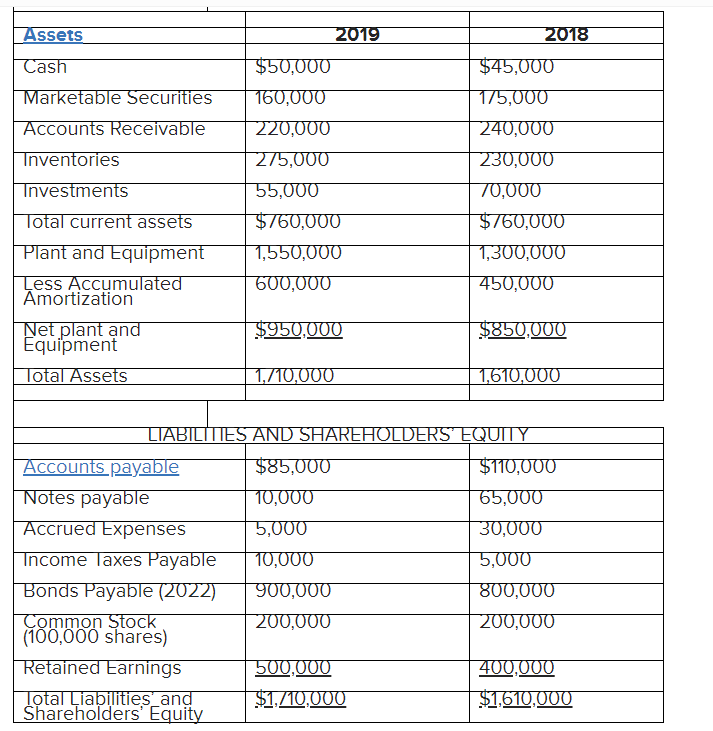

Sales......... Cost of goods sold.......... Selling and administrative expense...... Depreciation expense. Interest expense.......... Taxes .......... Preferred stock dividends.............. Number of common Shares outstanding. Interest Coverage ratio for the year 2019? .........$2,200,000 $1,300,000 $420,000 $150,000 ....... $90,000 35% $ 10,000 120,000 A firm has $3,500,000 in its common stock account and $2,500,000 in its retained earnings account. The firm issued 100,000 shares of common stock. What was the original issue price if only one stock issue has ever been sold? Multiple Choice $25 per share $35 per share $60 per share Not enough information to tell Assets 2019 2018 Cash $50,000 Marketable Securities 160,000 Accounts Receivable Inventories $45,000 1/5,000 240,000 230,000 70,000 $760,000 1,300,000 450,000 220,000 275,000 55,000 $760,000 1,550,000 600,000 Investments Total current assets Plant and Equipment Less Accumulated Amortization Net plant and Equipment Total Assets $950,000 $850,000 1,710,000 1,610,000 LIABILI LIABILITIES AND SHAREHOLDERS' EQUITY Accounts payable $85,000 $110,000 Notes payable 10,000 65,000 Accrued Expenses 5,000 30,000 Income Taxes Payable 10,000 5,000 Bonds Payable (2022) 900,000 800,000 Common Stock 200,000 200,000 (100,000 shares) Retained Earnings 500,000 400,000 Total Liabilities and $1,710,000 $1,610,000 Shareholders' Equity A.E. Neuman Corporation Income Statement For the Year Ended December 31, 2019 Sales $ 5,500,000 Sales $ 5,500,000 Less: Cost of Goods Sold 4,200,000 Gross Profit 1,300,000 Less: Selling, General & Administrative 260.000 Expenses Operating profit 1,040,000 Less: Amortization Expense 150,000 Earnings Before Interest and Taxes 890,000 Less: Interest Expense 90,000 Earnings Before Taxes 800,000 Less: Taxes (50%) 400,000 Net Income $ 400,000 Multiple Choice O 2.4% O 42.8% 23% 29.25%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started