Question

Given the following abbreviated income statement, what would the statement look like for 2020 if sales are expected to grow 6% and fixed costs will

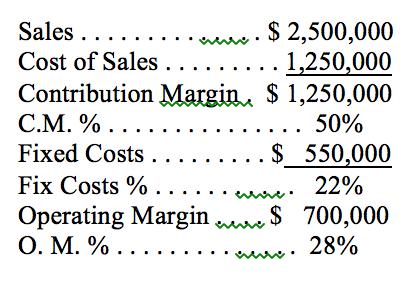

Given the following abbreviated income statement, what would the statement look like for 2020 if sales are expected to grow 6% and fixed costs will remain the same as 2019? Calculate and show the 2020 statement side by side with the 2019 statement. Also, please calculate and explain the breakeven point for the company 2019 and 2020. Calculate the and show the sales dollars required (based on 2020 statement) if the company desired an operating margin of $1,250,000. Finally, describe the actions the company might take to lower its breakeven point in sales dollar and, given a very competitive market, which actions might be more desirable than others?

Sales ... ww.S 2,500,000 ... 1,250,000 Cost of Sales Contribution Margin. $ 1,250,000 C.M. % .... Fixed Costs.. Fix Costs % .. . . Operating Margin w$ 700,000 O. M. %... 50% $ _ 550,000 22% 28%

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A 2019 2020 Sales 2500000 2650000 Cost of Sales 1250000 1325000 Contribution Margin 1250000 1325000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started