Answered step by step

Verified Expert Solution

Question

1 Approved Answer

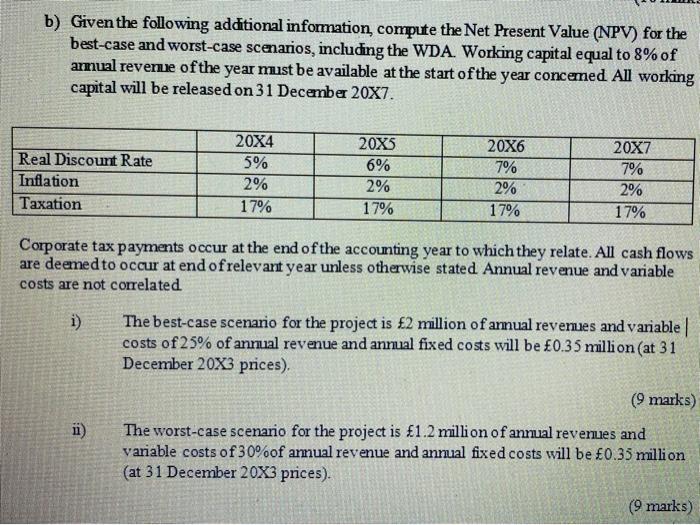

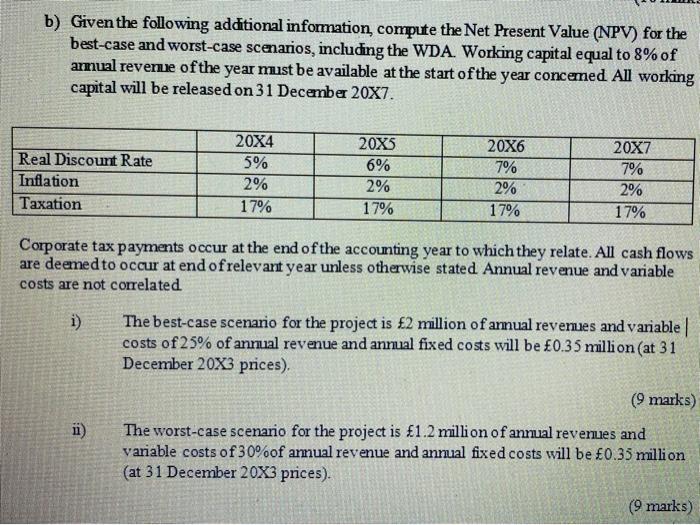

Given the following additional information, compute the Net Present Value (NPV) for the best-case and worst-case scenarios, including the WDA. Working capital equal to 8%

Given the following additional information, compute the Net Present Value (NPV) for the best-case and worst-case scenarios, including the WDA. Working capital equal to 8% of annual revenue of the year must be available at the start of the year concerned. All working capital will be released on 31 December 20X7.

b) Given the following additional information compute the Net Present Value (NPV) for the best-case and worst-case scenarios, including the WDA. Working capital equal to 8% of annual revenue of the year must be available at the start of the year concemed All working capital will be released on 31 December 20X7. Real Discount Rate Inflation Taxation 20X4 5% 2% 17% 20X5 6% 2% 17% 20X6 7% 2% 17% 20X7 7% 2% 17% Corporate tax payments occur at the end of the accounting year to which they relate. All cash flows are deemed to occur at end of relevant year unless otherwise stated Annual revenue and variable costs are not correlated i) The best-case scenario for the project is 2 million of annual revenues and variable costs of 25% of annual revenue and annual fixed costs will be 0.35 million (at 31 December 20X3 prices). (9 marks) i) The worst-case scenario for the project is 1.2 million of annual revenues and variable costs of 30%of amual revenue and annual fixed costs will be 0.35 million (at 31 December 20X3 prices). (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started