Answered step by step

Verified Expert Solution

Question

1 Approved Answer

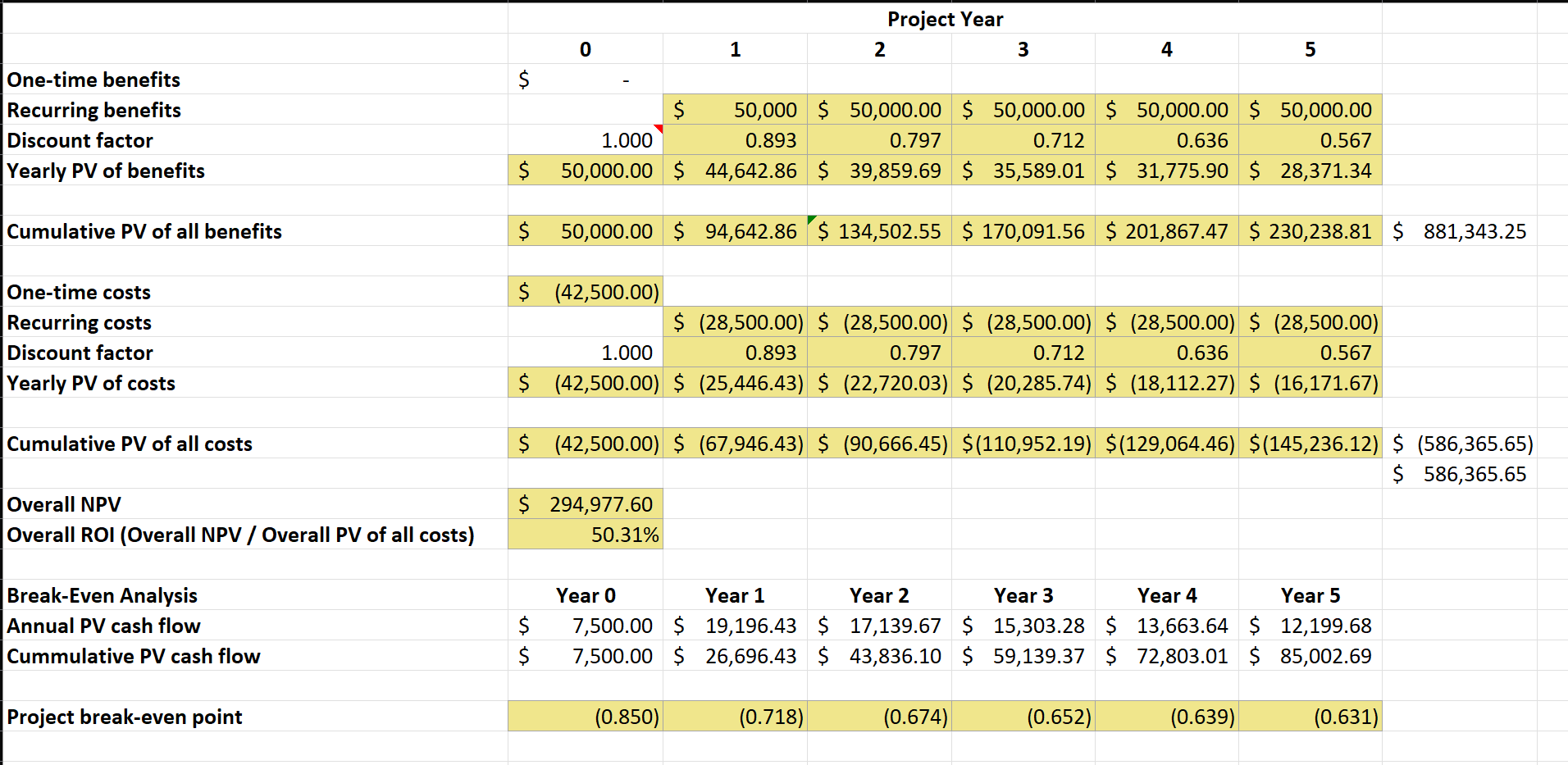

Given the following can you check my image for correctness?Economic Feasibility Workbook This is an individual assignment. Do your own work. Do not compare with

Given the following can you check my image for correctness?Economic Feasibility Workbook

This is an individual assignment. Do your own work. Do not compare with other students' work.

Benefits Worksheet

Examine the 'Benefits' worksheet. Note that there are not any expected onetime benefits for this project. There are, however, significant recurring benefits. We will use the total

recurring benefits in the analysis on the 'Analysis' worksheet.

One Time Costs Worksheet

Examine the onetime costs on the 'One Time Cost' worksheet. You will use the total onetime costs in the analysis on the 'Analysis' worksheet.

Recurring Costs Worksheet

Examine the recurring costs on the 'Recurring Cost' worksheet. You will use the total recurring costs in the analysis on the 'Analysis' worksheet.

Analysis Worksheet

Notice that tables have been created to help you with your analysis.

Investment Rate cell B: This is the investment discount rate to be used in the time value of money calculations on this analysis.

Onetime benefits cell B: There are no onetime benefits.

Recurring benefits range C:G: This row contains the total recurring benefits for each year. In reality, this value will probably start low, spike, plateau, and perhaps decline on a

"real" project, but for the purposes of this analysis, the recurring benefits are consistent each year. Enter or reference the total recurring benefits for each year.

Discount Factor range C:G: Notice the investment rate in cell D Calculate the discount factor for each year. For Year the rate is or a factor of of the discount

rate. To find the discount factor use the formula:

where is the cell containing the discount rate, and is the year number in row Enter the first formula in cell C for Year Reuse the formula to calculate the discount factor

for years

Yearly PV of Benefits range B:G: Multiply the discount rate factor by the net economic benefit for each year. This calculates each year's benefits in today's dollars. For

example, $ today is worth $ at the end of Year due to the time value of money.

Cumulative PV of all benefits range B:G: Calculate a running total of the benefits across years

Onetime Costs cell B: Reference the total onetime costs from the One Time Cost worksheet in cell B Make sure the value is a negative value, since it is a cost.

Recurring Costs range C:G: Reference the total recurring costs from he 'Recurring Costs' worksheet. The values should be negative, since they are costs.

Discount Factor range B:G: Copy the formulas from row to this row assuming you have appropriate absolute references in your formulas or use a similar calculation to

generate the discount factor. You should end up with the same values in row as you did in row

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started