Question

Given the following cash flow Year 0 Years 1-2 Years 3-10 Years 11-15 -$8,000 -$3,000/year $6,500 in year 3 and increases annually by 8%thereafter

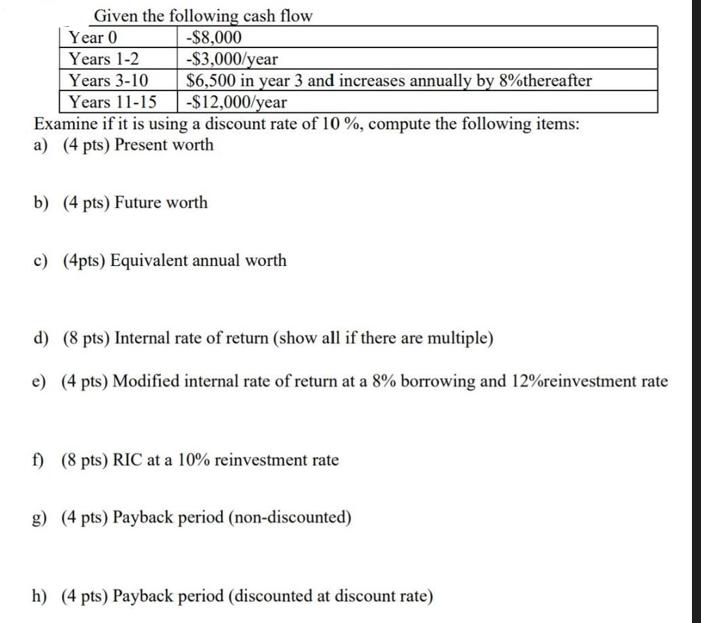

Given the following cash flow Year 0 Years 1-2 Years 3-10 Years 11-15 -$8,000 -$3,000/year $6,500 in year 3 and increases annually by 8%thereafter -$12,000/year Examine if it is using a discount rate of 10%, compute the following items: a) (4 pts) Present worth b) (4 pts) Future worth c) (4pts) Equivalent annual worth d) (8 pts) Internal rate of return (show all if there are multiple) e) (4 pts) Modified internal rate of return at a 8% borrowing and 12% reinvestment rate f) (8 pts) RIC at a 10% reinvestment rate g) (4 pts) Payback period (non-discounted) h) (4 pts) Payback period (discounted at discount rate)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION a Present worth The present worth of the cash flows is the amount of money that would be required today to generate the same amount of cash in the future taking into account the time value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App