Answered step by step

Verified Expert Solution

Question

1 Approved Answer

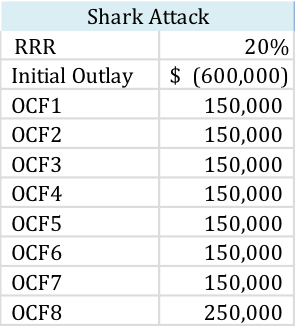

Given the following cash flows for an expansion project, and a required return (cost of capital, risk-adjusted-discount-rate) of 20%, A) Payback period? (The firm has

Given the following cash flows for an expansion project, and a required return (cost of capital, risk-adjusted-discount-rate) of 20%,

A) Payback period? (The firm has established a 5 year payback period).

B) What is the projects projected NPV?

C) What is the projects projected Profitability index?

D) What is the projects projected internal rate of return?

E) Should the firm invest in this project? Why or why not?

Shark Attack 20% Initial outlay (600,000) OCF1 150,000 OCF2 150,000 OCF3 150,000 OCF4 150,000 OCF5 150,000 OCF6 150,000 OCF7 150,000 OCF8 250,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started