Answered step by step

Verified Expert Solution

Question

1 Approved Answer

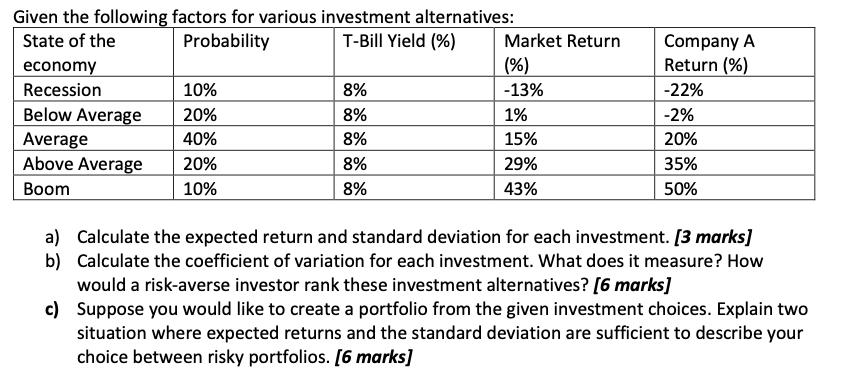

Given the following factors for various investment alternatives: State of the Probability T-Bill Yield (%) economy Recession 10% Below Average 20% Average 40% Above

Given the following factors for various investment alternatives: State of the Probability T-Bill Yield (%) economy Recession 10% Below Average 20% Average 40% Above Average 20% Boom 10% 8% 8% 8% 8% 8% Market Return (%) -13% 1% 15% 29% 43% Company A Return (%) -22% -2% 20% 35% 50% a) Calculate the expected return and standard deviation for each investment. [3 marks] b) Calculate the coefficient of variation for each investment. What does it measure? How would a risk-averse investor rank these investment alternatives? [6 marks] c) Suppose you would like to create a portfolio from the given investment choices. Explain two situation where expected returns and the standard deviation are sufficient to describe your choice between risky portfolios. [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Expected return and standard deviation for each investment TBill Yield Expected return 018 028 008...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started