Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 21 year(s) from now, you are planning a trip to Machu Picchu and estimated that you will need 48531 SEK to be able

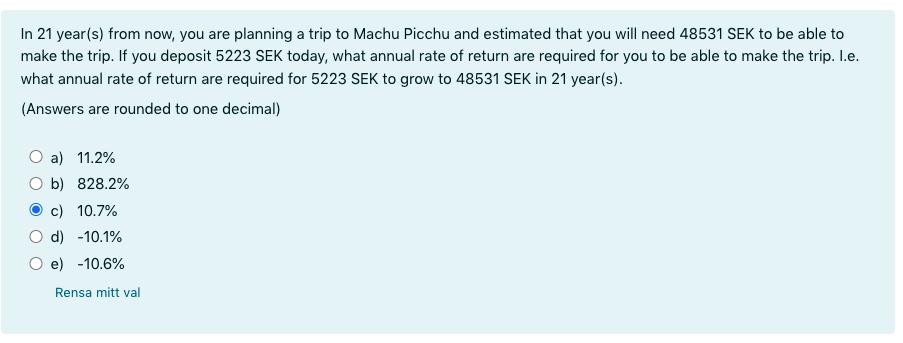

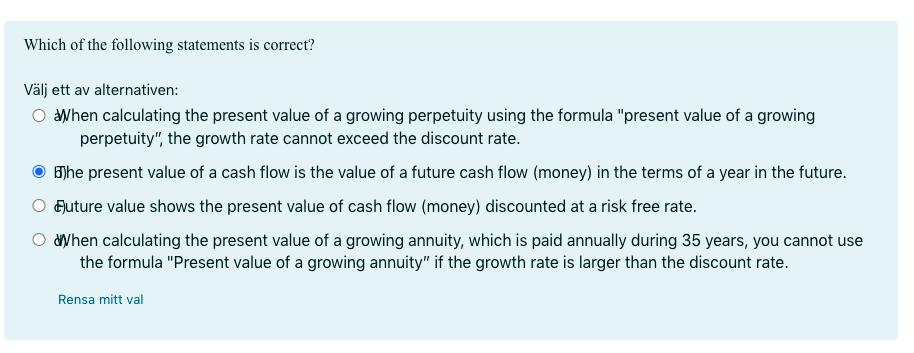

In 21 year(s) from now, you are planning a trip to Machu Picchu and estimated that you will need 48531 SEK to be able to make the trip. If you deposit 5223 SEK today, what annual rate of return are required for you to be able to make the trip. I.e. what annual rate of return are required for 5223 SEK to grow to 48531 SEK in 21 year(s). (Answers are rounded to one decimal) a) 11.2% b) 828.2% c) 10.7% d) -10.1% e) -10.6% Rensa mitt val Which of the following statements is correct? Vlj ett av alternativen: O When calculating the present value of a growing perpetuity using the formula "present value of a growing perpetuity", the growth rate cannot exceed the discount rate. The present value of a cash flow is the value of a future cash flow (money) in the terms of a year in the future. Future value shows the present value of cash flow (money) discounted at a risk free rate. O When calculating the present value of a growing annuity, which is paid annually during 35 years, you cannot use the formula "Present value of a growing annuity" if the growth rate is larger than the discount rate. Rensa mitt val

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started