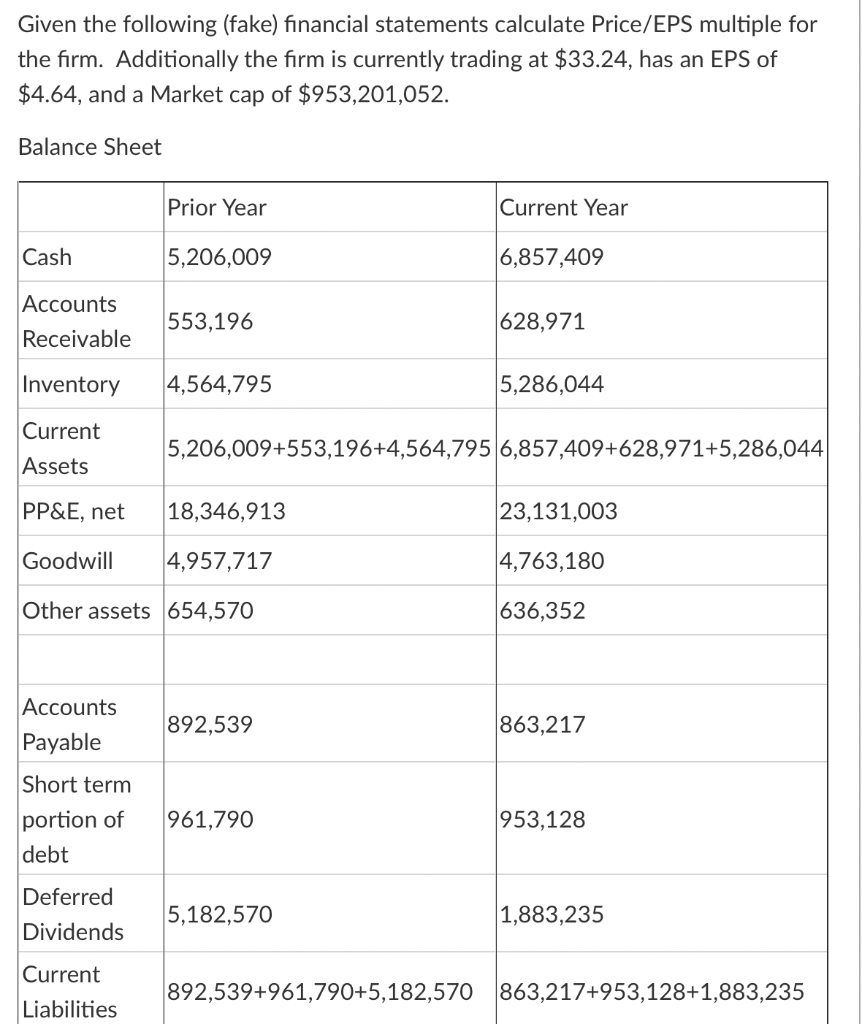

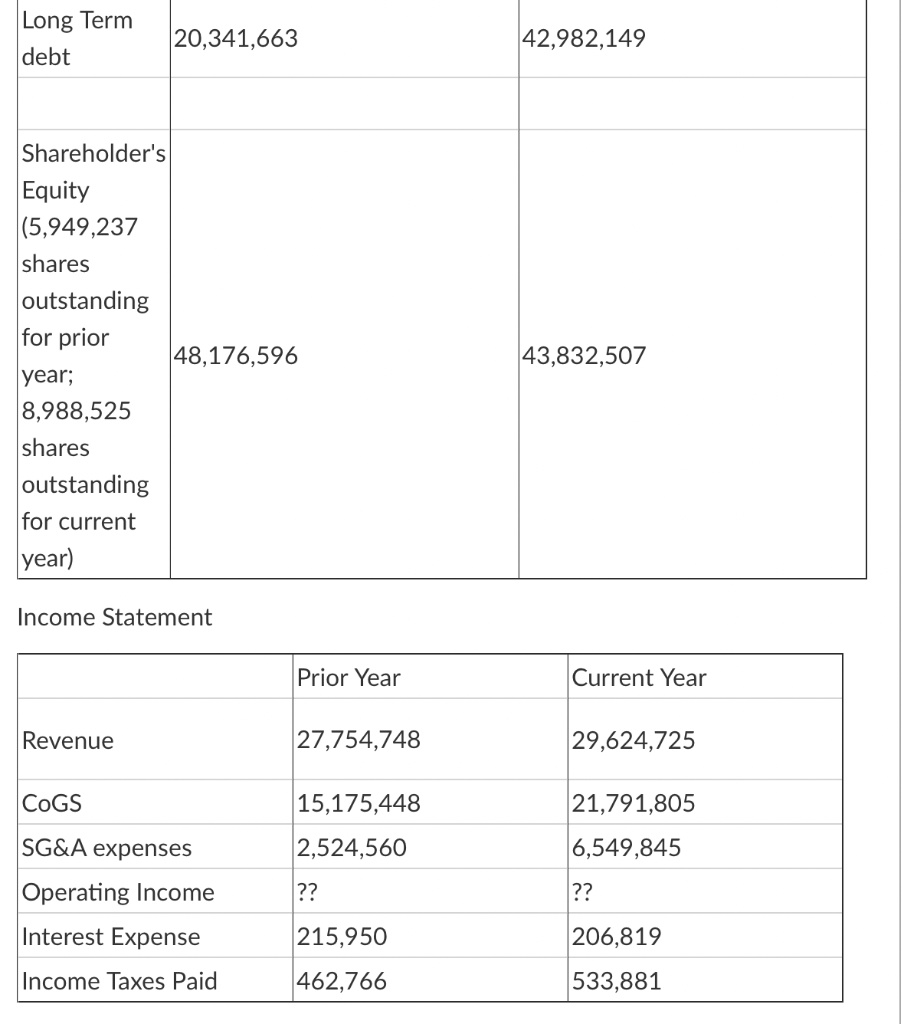

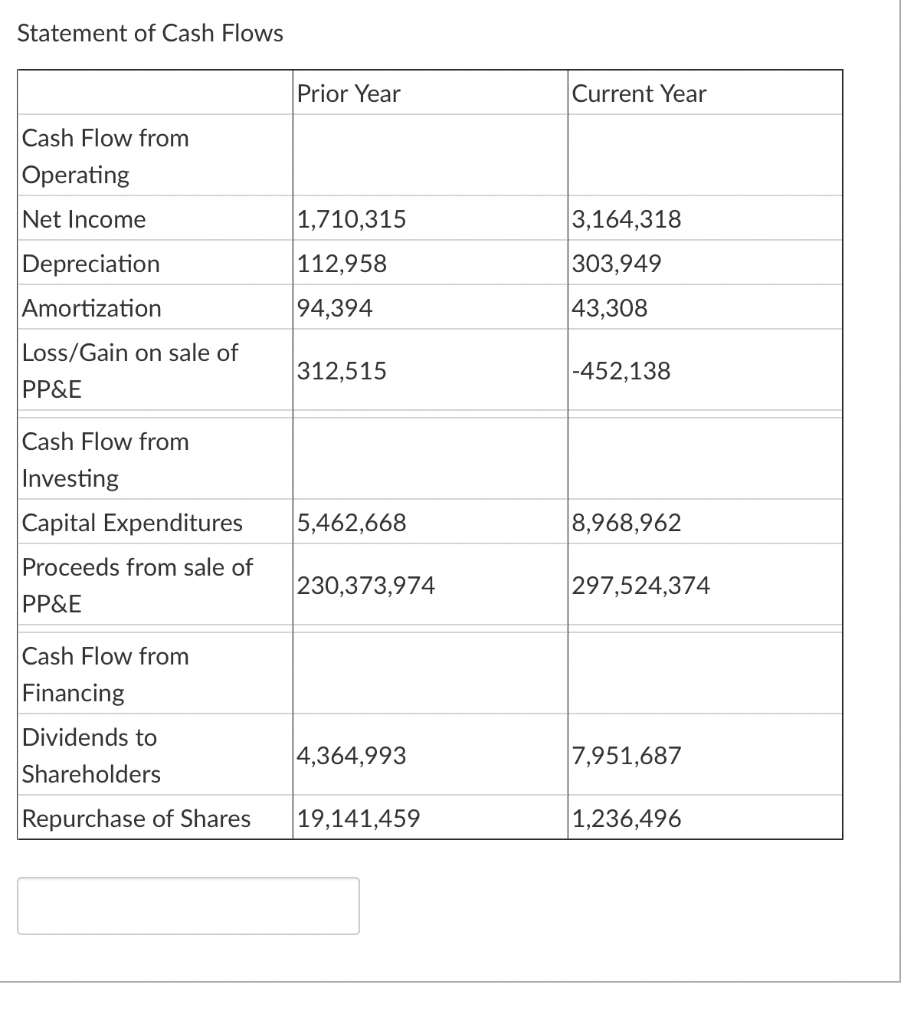

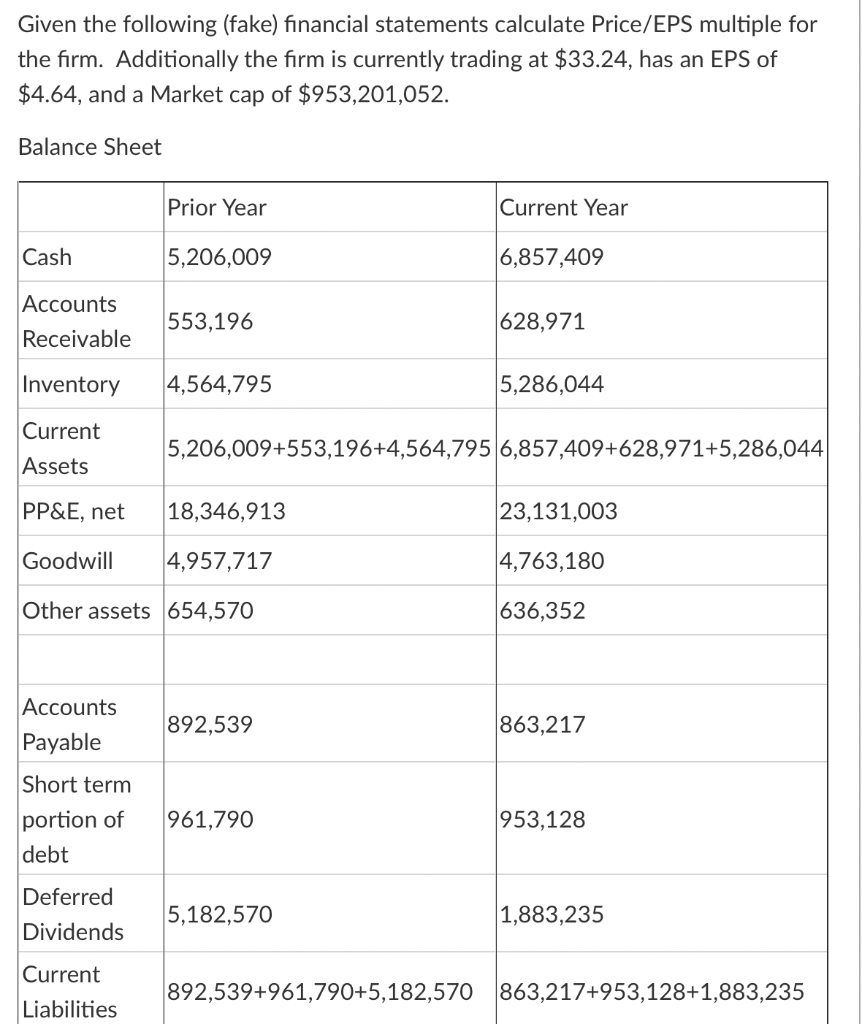

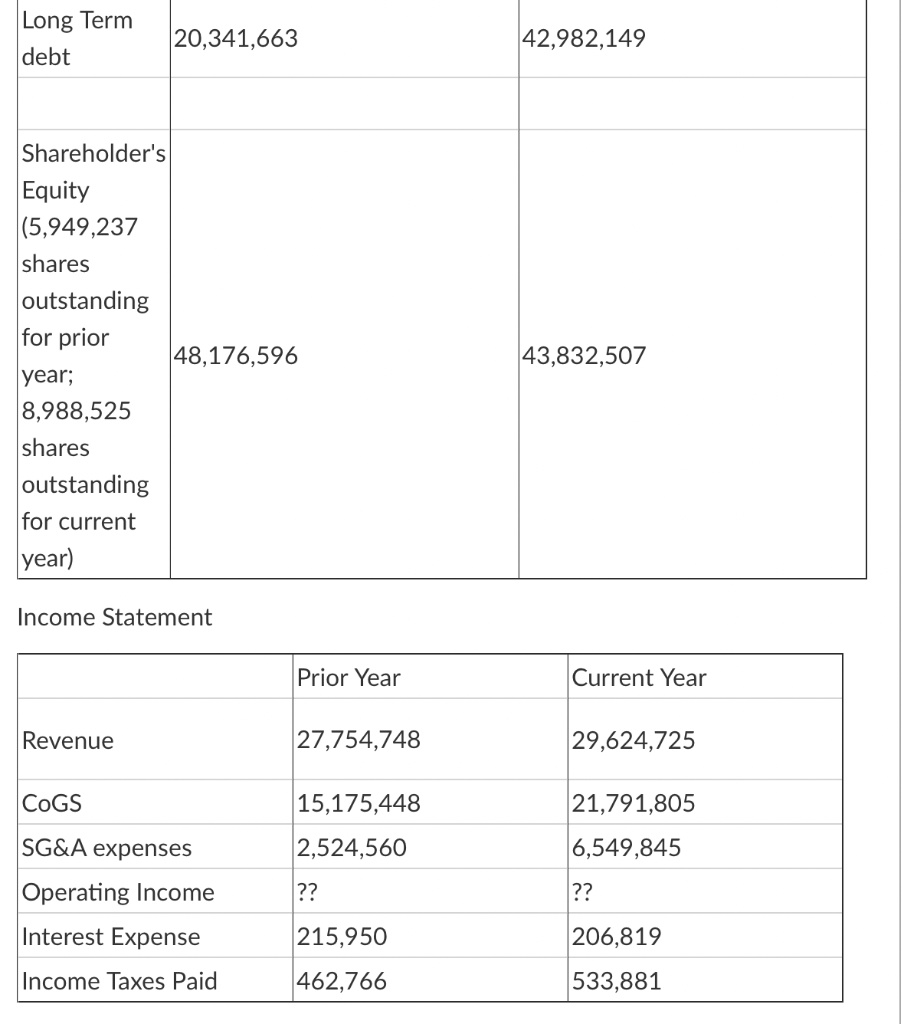

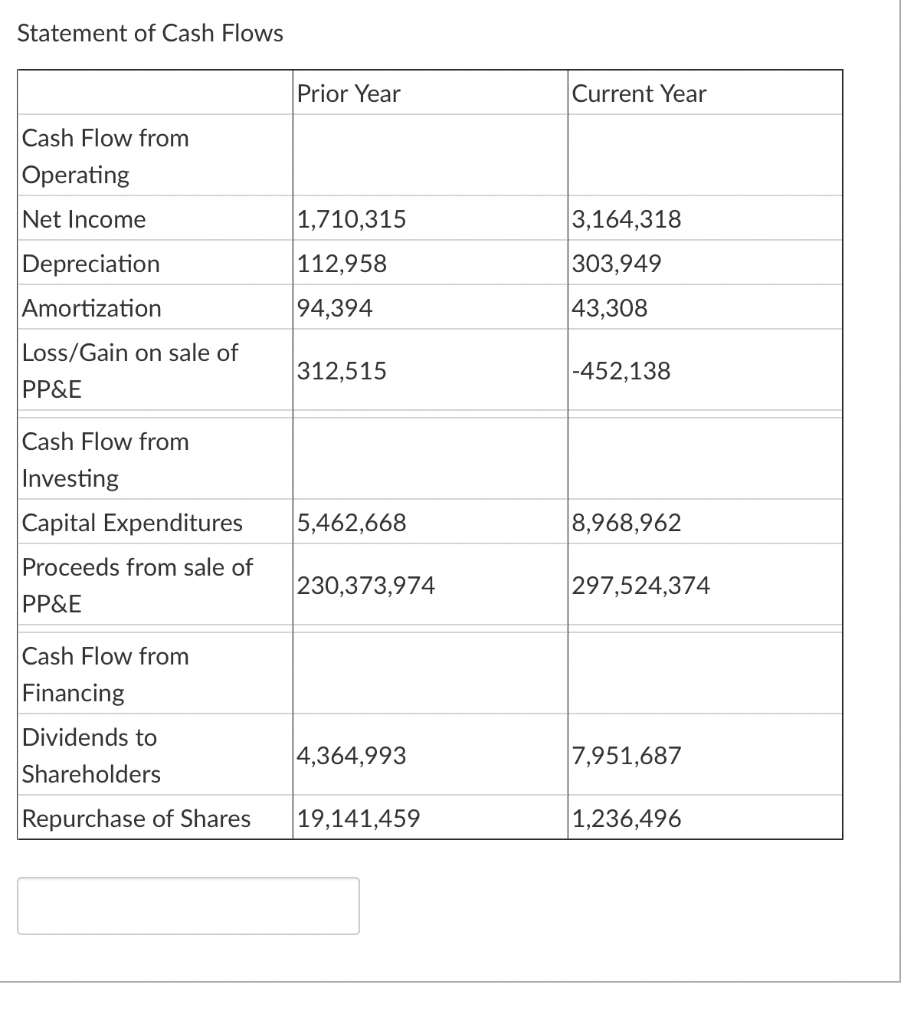

Given the following (fake) financial statements calculate Price/EPS multiple for the firm. Additionally the firm is currently trading at $33.24, has an EPS of $4.64, and a Market cap of $953,201,052. Balance Sheet Prior Year Current Year Cash 5,206,009 6,857,409 Accounts 553,196 628,971 Receivable Inventory 4,564,795 5,286,044 Current 5,206,009+553,196+4,564,795 6,857,409+628,971+5,286,044 Assets PP&E, net 18,346,913 23,131,003 Goodwill 4,957,717 4,763,180 Other assets 654,570 636,352 Accounts 892,539 863,217 Payable Short term portion of 961,790 953,128 debt Deferred 5,182,570 1,883,235 Dividends Current 892,539+961,790+5,182,570 863,217+953,128+1,883,235 Liabilities Long Term debt Shareholder's Equity (5,949,237 shares outstanding for prior year; 8,988,525 shares outstanding for current year) Income Statement Revenue COGS SG&A expenses Operating Income Interest Expense Income Taxes Paid 20,341,663 48,176,596 Prior Year 27,754,748 15,175,448 2,524,560 ?? 215,950 462,766 42,982,149 43,832,507 Current Year 29,624,725 21,791,805 6,549,845 ?? 206,819 533,881 Statement of Cash Flows Cash Flow from Operating Net Income Depreciation Amortization Loss/Gain on sale of PP&E Cash Flow from Investing Capital Expenditures Proceeds from sale of PP&E Cash Flow from Financing Dividends to Shareholders Repurchase of Shares Prior Year 1,710,315 112,958 94,394 312,515 5,462,668 230,373,974 4,364,993 19,141,459 Current Year 3,164,318 303,949 43,308 -452,138 8,968,962 297,524,374 7,951,687 1,236,496 Given the following (fake) financial statements calculate Price/EPS multiple for the firm. Additionally the firm is currently trading at $33.24, has an EPS of $4.64, and a Market cap of $953,201,052. Balance Sheet Prior Year Current Year Cash 5,206,009 6,857,409 Accounts 553,196 628,971 Receivable Inventory 4,564,795 5,286,044 Current 5,206,009+553,196+4,564,795 6,857,409+628,971+5,286,044 Assets PP&E, net 18,346,913 23,131,003 Goodwill 4,957,717 4,763,180 Other assets 654,570 636,352 Accounts 892,539 863,217 Payable Short term portion of 961,790 953,128 debt Deferred 5,182,570 1,883,235 Dividends Current 892,539+961,790+5,182,570 863,217+953,128+1,883,235 Liabilities Long Term debt Shareholder's Equity (5,949,237 shares outstanding for prior year; 8,988,525 shares outstanding for current year) Income Statement Revenue COGS SG&A expenses Operating Income Interest Expense Income Taxes Paid 20,341,663 48,176,596 Prior Year 27,754,748 15,175,448 2,524,560 ?? 215,950 462,766 42,982,149 43,832,507 Current Year 29,624,725 21,791,805 6,549,845 ?? 206,819 533,881 Statement of Cash Flows Cash Flow from Operating Net Income Depreciation Amortization Loss/Gain on sale of PP&E Cash Flow from Investing Capital Expenditures Proceeds from sale of PP&E Cash Flow from Financing Dividends to Shareholders Repurchase of Shares Prior Year 1,710,315 112,958 94,394 312,515 5,462,668 230,373,974 4,364,993 19,141,459 Current Year 3,164,318 303,949 43,308 -452,138 8,968,962 297,524,374 7,951,687 1,236,496