Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the following financial statements for ARGON Corporation, and assuming that ARGON paid a common dividend of $80,000 in 2010, what is the company's financing

Given the following financial statements for ARGON Corporation, and assuming that ARGON paid a common dividend of $80,000 in 2010, what is the company's financing cash flow for 2010?

I

I

Please show all work, and full explanation of Part A and B. Thank you!

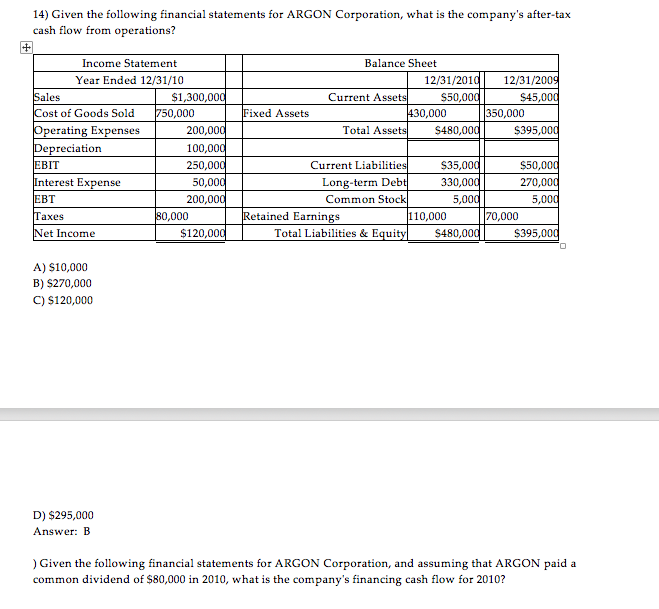

14) Given the following financial statements for ARGON Corporation, what is the company's after-tax cash flow from operations? Income Statemnent Balance Sheet 12/31/201d 12/31/2009 12/31/201 S50,0 12/31/2 $45 Year Ended 12/31/10 ales ost of Goods Sold $1,300,00 50,000 Current Asset ixed Assets 30,000 350,000 200,00 100,00 250,00 50,00 200,00 Total As $480,0 $395,0 erating Ex reciation $35,0 330,0 5,0 Current Liabiliti S50 270 BIT Long-term Debt Common St nterest Expense EBT axes 0,000 Retained Earnings 110,000 70,000 et Income $120,00 Total Liabilities&Equit $480,0 S395,0 A) S10,000 B) $270,000 C) S120,000 D) $295,000 Answer: B ) Given the following financial statements for ARGON Corporation, and assuming that ARGON paid a common dividend of $80,000 in 2010, what is the company's financing cash flow for 2010Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started