Answered step by step

Verified Expert Solution

Question

1 Approved Answer

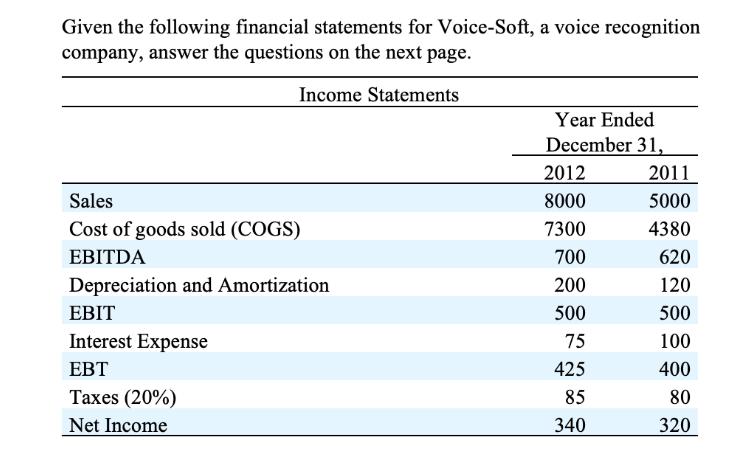

Given the following financial statements for Voice-Soft, a voice recognition company, answer the questions on the next page. Income Statements Year Ended December 31,

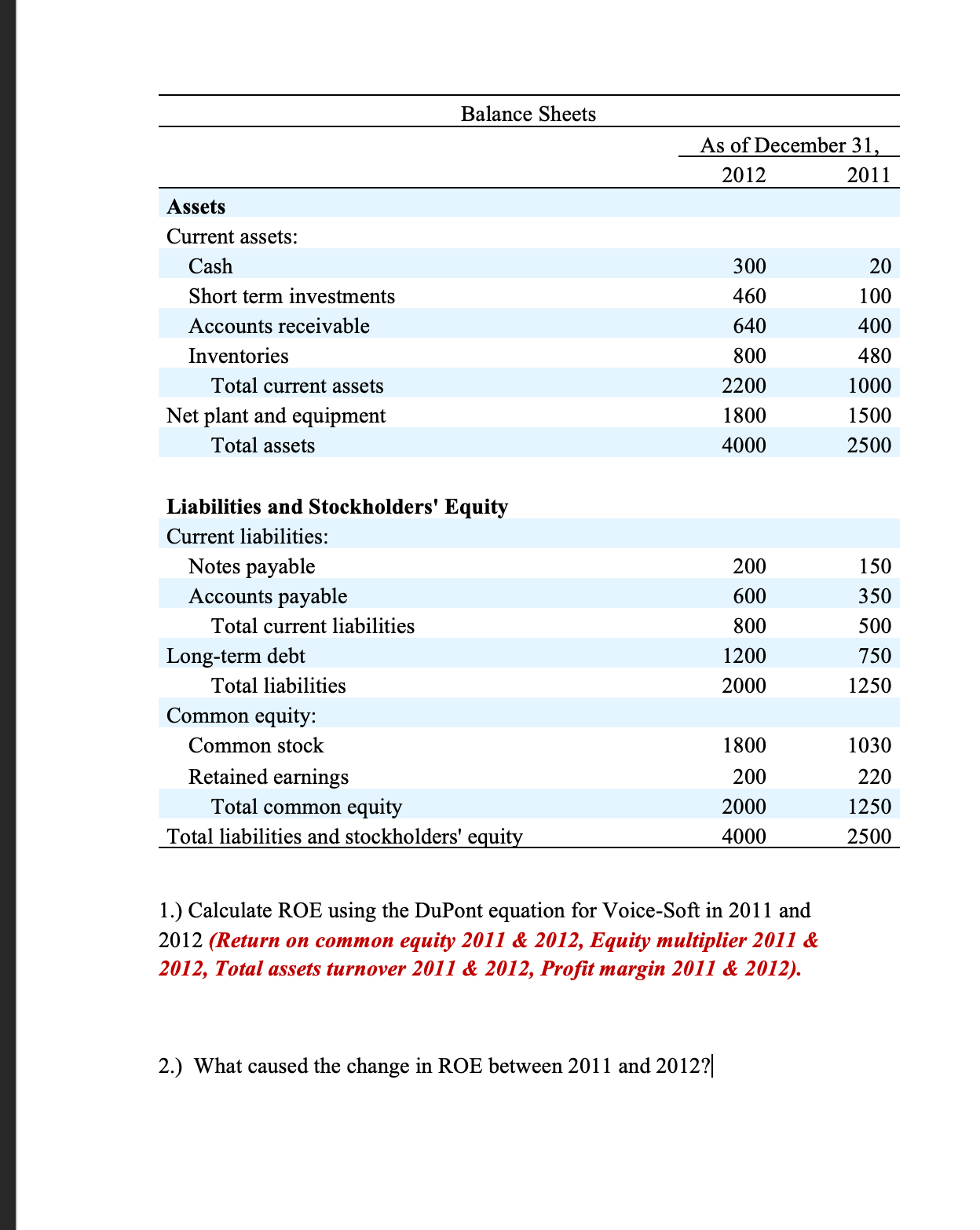

Given the following financial statements for Voice-Soft, a voice recognition company, answer the questions on the next page. Income Statements Year Ended December 31, 2012 2011 Sales 8000 5000 Cost of goods sold (COGS) 7300 4380 EBITDA 700 620 Depreciation and Amortization 200 120 EBIT 500 500 Interest Expense 75 100 EBT 425 400 Taxes (20%) 85 80 Net Income 340 320 Assets Current assets: Cash Short term investments Accounts receivable Inventories Total current assets Net plant and equipment Total assets Balance Sheets As of December 31, 2012 2011 Liabilities and Stockholders' Equity Current liabilities: Notes payable Accounts payable Total current liabilities Long-term debt Total liabilities Common equity: Common stock Retained earnings Total common equity 300 20 460 100 640 400 800 480 2200 1000 1800 1500 4000 2500 200 150 600 350 800 500 1200 750 2000 1250 1800 1030 200 220 2000 1250 4000 2500 Total liabilities and stockholders' equity 1.) Calculate ROE using the DuPont equation for Voice-Soft in 2011 and 2012 (Return on common equity 2011 & 2012, Equity multiplier 2011 & 2012, Total assets turnover 2011 & 2012, Profit margin 2011 & 2012). 2.) What caused the change in ROE between 2011 and 2012?|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Return on Equity can be computed by using the DuPont Eq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started