Answered step by step

Verified Expert Solution

Question

1 Approved Answer

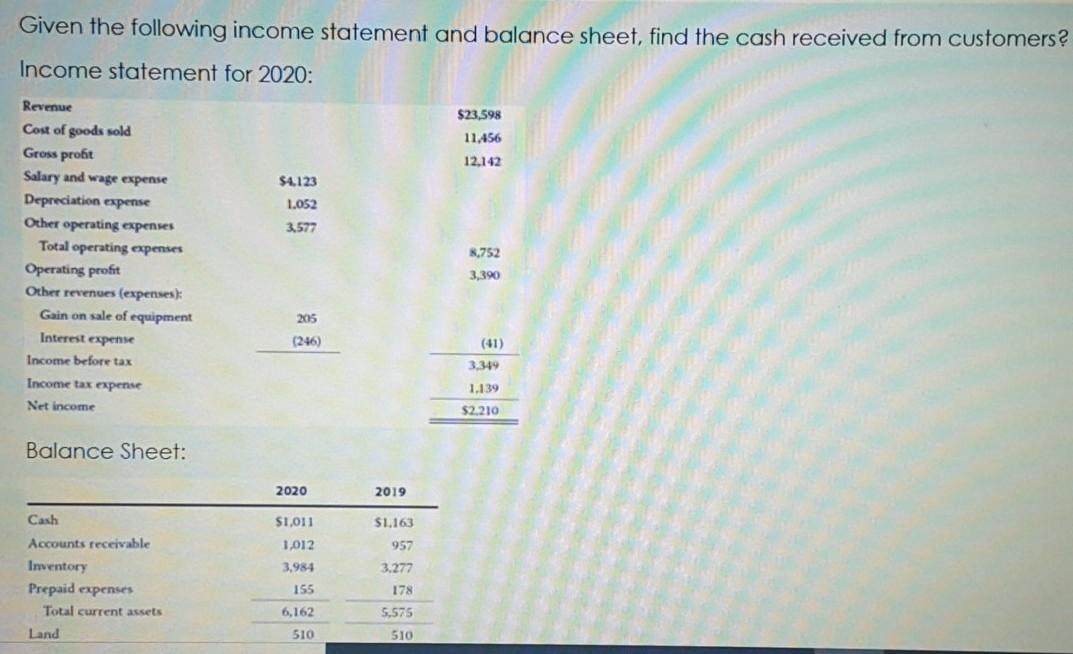

Given the following income statement and balance sheet, find the cash received from customers? Income statement for 2020: $23,598 11.456 12.142 $4.123 1.052 3577 Revenue

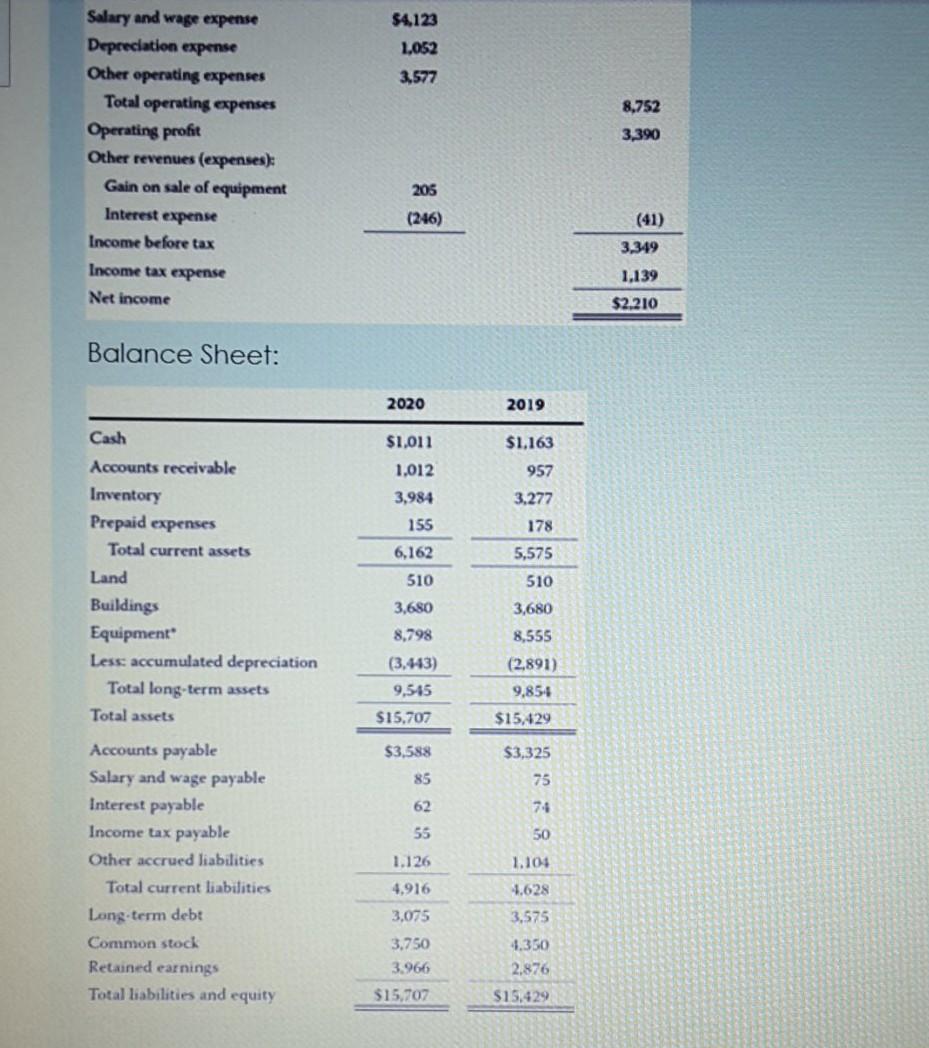

Given the following income statement and balance sheet, find the cash received from customers? Income statement for 2020: $23,598 11.456 12.142 $4.123 1.052 3577 Revenue Cost of goods sold Gross profit Salary and wage expense Depreciation expense Other operating expenses Total operating expenses Operating profit Other revenues (expenses): Gain on sale of equipment Interest expense Income before tax Income tax expense Net Income 8.752 3,390 205 (246) (41) 3.349 1.139 $2210 Balance Sheet: 2020 2019 Cash $1.011 S1.163 1,012 Accounts receivable Inventory Prepaid expenses Total current assets Land 3,984 155 957 3.277 178 5.575 510 6,162 510 $4,123 1,052 3.577 Salary and wage expense Depreciation expense Other operating expenses Total operating expenses Operating profit Other revenues (expenses): Gain on sale of equipment Interest expense Income before tax 8,752 3,390 205 (246) (41) 3,349 1,139 Income tax expense Net income $2.210 Balance Sheet: 2020 2019 $1,163 $1,011 1,012 957 3,984 155 3.277 178 6,162 Cash Accounts receivable Inventory Prepaid expenses Total current assets Land Buildings Equipment Less accumulated depreciation Total long-term assets Total assets 5,575 510 3,680 510 3,680 8,798 (3.443) 9,545 $15.707 8,555 (2,891) 9,854 $15,429 $3,588 $3,325 75 85 62 55 50 1.104 Accounts payable Salary and wage payable Interest payable Income tax payable Other accrued liabilities Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity 4.628 3,575 1.126 4,916 3,075 3.750 3.966 $15.707 4.350 2,876 $15,429

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started