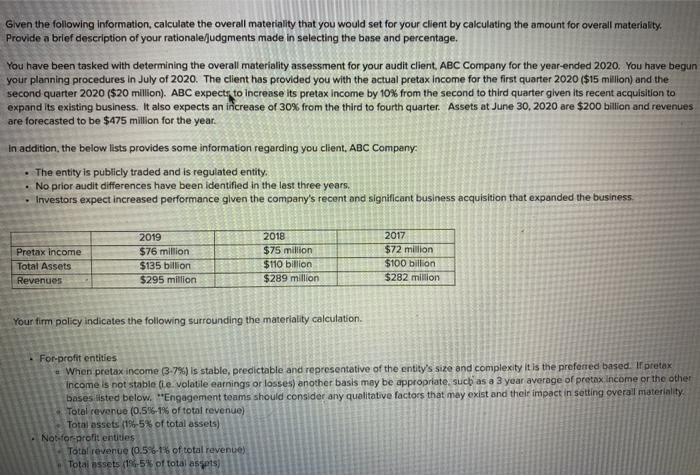

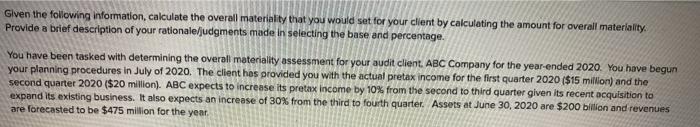

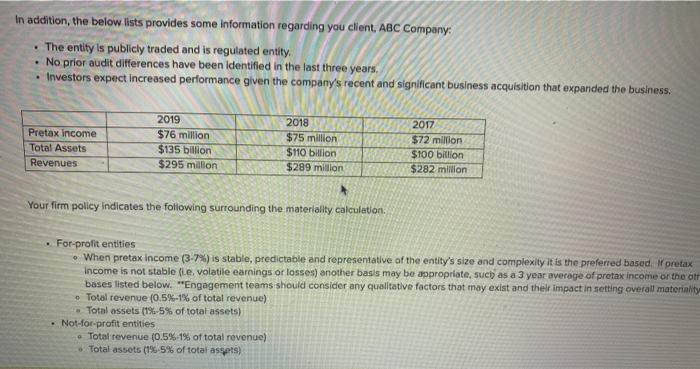

Given the following Information, calculate the overall materiality that you would set for your client by calculating the amount for overall materiality. Provide a brief description of your rationalejudgments made in selecting the base and percentage. You have been tasked with determining the overall materiality assessment for your audit client, ABC Company for the year-ended 2020. You have begun your planning procedures in July of 2020. The client has provided you with the actual pretax income for the first quarter 2020 ($15 million) and the second quarter 2020 ($20 million). ABC expects to increase its pretax Income by 10% from the second to third quarter given its recent acquisition to expand its existing business. It also expects an increase of 30% from the third to fourth quarter. Assets at June 30, 2020 are $200 billion and revenues are forecasted to be $475 million for the year. In addition, the below lists provides some information regarding you client, ABC Company The entity is publicly traded and is regulated entity. No prior audit differences have been identified in the last three years. Investors expect increased performance given the company's recent and significant business acquisition that expanded the business, 2019 Pretax income Total Assets Revenues $76 million $135 billion $295 million 2018 $75 million $110 billion $289 million 2017 $72 milion $100 billion $282 million Your fimm policy indicates the following surrounding the materiality calculation For-profit entities When pretax income 3-7%) is stable, predictable and representative of the entity's size and complexity it is the preferred based. If pretex Income is not stable die volatile earnings or losses) another basis may be appropriate, such as a 3 year average of pretax income or the other bases listed below. "Engagement teams should consider any qualitative factors that may exist and their impact in setting overall materiality Total revenue (0.5%-1% of total revenue) Total assets (19-5% of total assets) Not-for-profit entities Total revenue (0.5 6-1% of total revenue Total assets (18-5% of total assets) Given the following information, calculate the overall materiality that you would set for your client by calculating the amount for overall materiality. Provide a brief description of your rationale/judgments made in selecting the base and percentage. You have been tasked with determining the overall materiality assessment for your audit client ABC Company for the year-ended 2020. You have begun your planning procedures in July of 2020. The client has provided you with the actual pretax income for the first quarter 2020 ($15 million) and the second quarter 2020 ($20 million). ABC expects to increase its pretax income by 10% from the second to third quarter given its recent acquisition to expand its existing business. It also expects an increase of 30% from the third to fourth quarter. Assets at June 30, 2020 are $200 billion and revenues are forecasted to be $475 million for the year. In addition, the below lists provides some information regarding you client. ABC Company: The entity is publicly traded and is regulated entity, No prior audit differences have been identified in the last three years, Investors expect increased performance given the company's recent and significant business acquisition that expanded the business. . Pretax income Total Assets Revenues 2019 $76 million $135 billion $295 million 2018 $75 million $110 billion $289 million 2017 $72 million $100 billion $282 million Your firm policy indicates the following surrounding the materiality calculation. For-profit entities . When pretax income (3-7%) is stable, predictable and representative of the entity's size and complexity it is the preferred based I prelax Income is not stablefie, volatile earnings or losses) another basis may be appropriate, such as a 3 year average of protax income or the oth bases listed below. "Engagement teams should consider any qualitative factors that may exist and their impact in setting overall materiality Total revenue (0.5% 1% of total revenue) Total assets (1%-5% of total assets) Not-for-profit entities Total revenue (0.5% 1% of total revenue) Total assets (1%-5% of total assets)