Given the following information, complete your Balance Sheet and Perform Closing Entries: Close all revenue accounts to Retained Earnings. Close all expense accounts to Retained Earnings. Close all Dividend accounts to Retained Earnings.

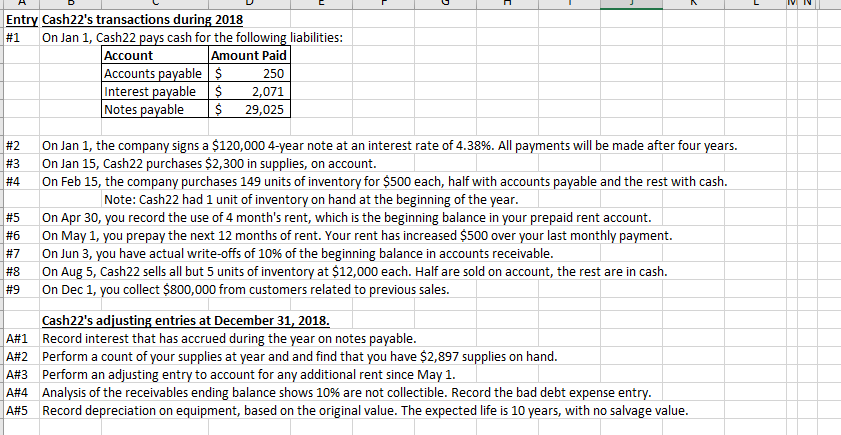

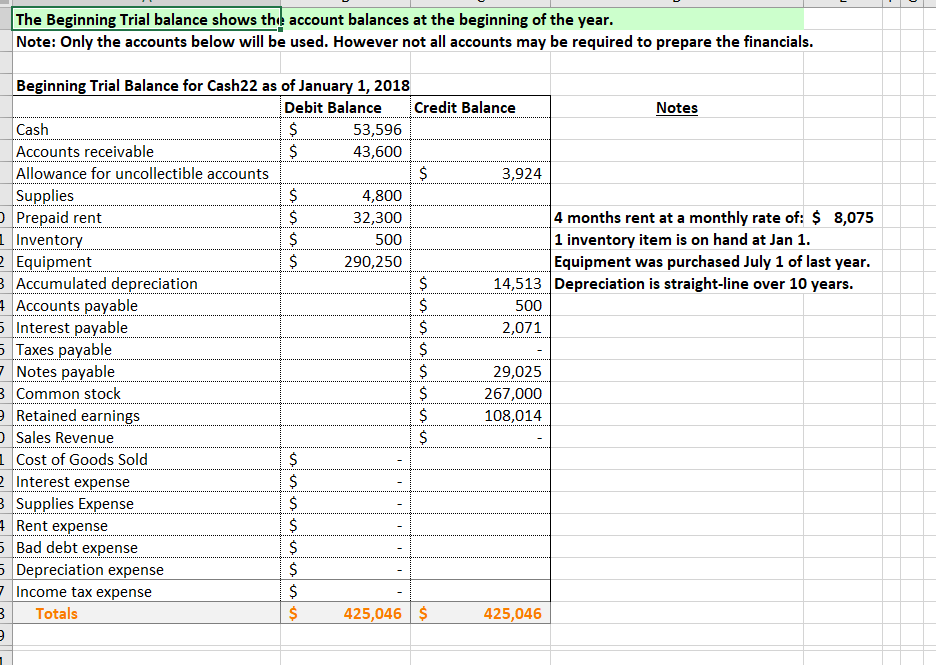

Entry Cash22's transactions during 2018 #1 On Jan 1, Cash22 pays cash for the following liabilities: Amount Paid 250 Account Accounts payable Interest payable $2,071 Notes payable 29,025 #2 #3 #4 On Jan 1, the company signs a $120,000 4-year note at an interest rate of 4.38%. All payments will be made after four years. On Jan 15, Cash22 purchases $2,300 in supplies, on account. On Feb 15, the company purchases 149 units of inventory for $500 each, half with accounts payable and the rest with cash. Note: Cash22 had 1 unit of inventory on hand at the beginning of the year #5 #6 #7 #8 #9 On Apr 30, you record the use of 4 month's rent, which is the beginning balance in your prepaid rent account. On May 1, you prepay the next 12 months of rent. Your rent has increased $500 over your last monthly payment. On Jun 3, you have actual write-offs of 10% of the beginning balance in accounts receivable On Aug 5, Cash22 sells all but 5 units of inventory at $12,000 each. Half are sold on account, the rest are in cash. On Dec 1, you collect $800,000 from customers related to previous sales. A#1 A#2 A#3 4 A#5 Cash22's adiusting entries at December 31, 2018 Record interest that has accrued during the year on notes payable Perform a count of your supplies at year and and find that you have $2,897 supplies on hand Perform an adjusting entry to account for any additional rent since May 1. Analysis of the receivables ending balance shows 10% are not collectible. Record the bad debt expense entry Record depreciation on equipment, based on the original value. The expected life is 10 years, with no salvage value The Beginning Trial balance shows the account balances at the beginning of the year Note: Only the accounts below will be used. However not all accounts may be required to prepare the financial:s Beginning Trial Balance for Cash22 as of January 1, 2018 Debit Balance Credit Balance Notes Cash Accounts receivable Allowance for uncollectible accounts Supplies Prepaid rent Invento Equipment Accumulated depreciation Accounts pavable 53,596 43,600 3,924 4,800 32,300 500 290,250 4 months rent at a monthly rate of: $ 8,075 1 inventory item is on hand at Jan 1 Equipment was purchased July 1 of last year 14,513Depreciation is straight-line over 10 years 500 2,071 5 Interest pavable Taxes pavable 29,025 267,000 108,014 7Notes payable Common stock Retained earnings Sales Revenue Cost of Goods Sold Interest expense Supplies Expense Rent expense ad debt expense 5 Depreciation expense 7 Income tax expense Totals 425,046$ 425,046