Answered step by step

Verified Expert Solution

Question

1 Approved Answer

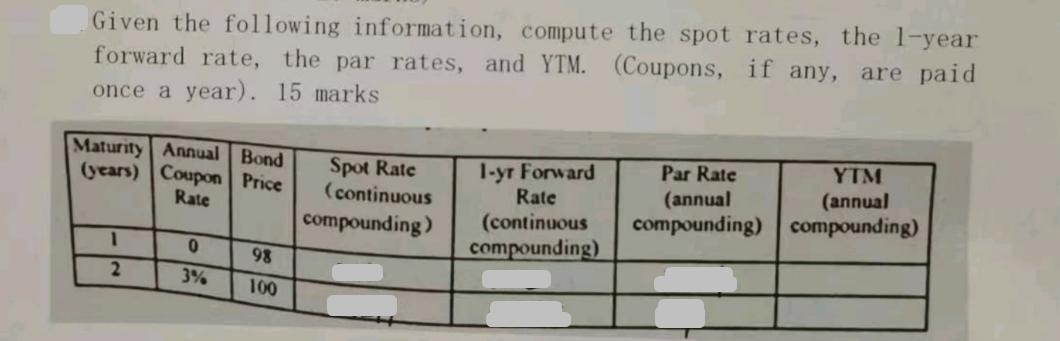

Given the following information, compute the spot rates, the 1-year forward rate, the par rates, and YTM. (Coupons, if any, are paid once a

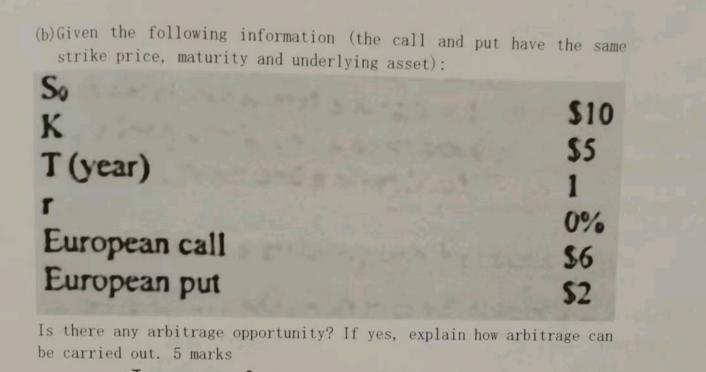

Given the following information, compute the spot rates, the 1-year forward rate, the par rates, and YTM. (Coupons, if any, are paid once a year). 15 marks Maturity Annual Bond (years) Coupon Price Rate 1 2 0 3% 98 100 Spot Rate (continuous 1-yr Forward Rate compounding) (continuous compounding) Par Rate YTM (annual (annual compounding) compounding) (b) Given the following information (the call and put have the same strike price, maturity and underlying asset): So K T (year) T European call European put $10 $5 1 0% $6 $2 Is there any arbitrage opportunity? If yes, explain how arbitrage can be carried out. 5 marks

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Spot Rate The spot rate is the current market price of the bond Since the coupon rate is 0 the spot rate is simply the face value of the bond which is 100 1year Forward Rate The 1year forwa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started