Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the following information, determine the burdened hourly wage rate for a carpenter. Assume the carpenters take full advantage of the retirement benefit. Wage

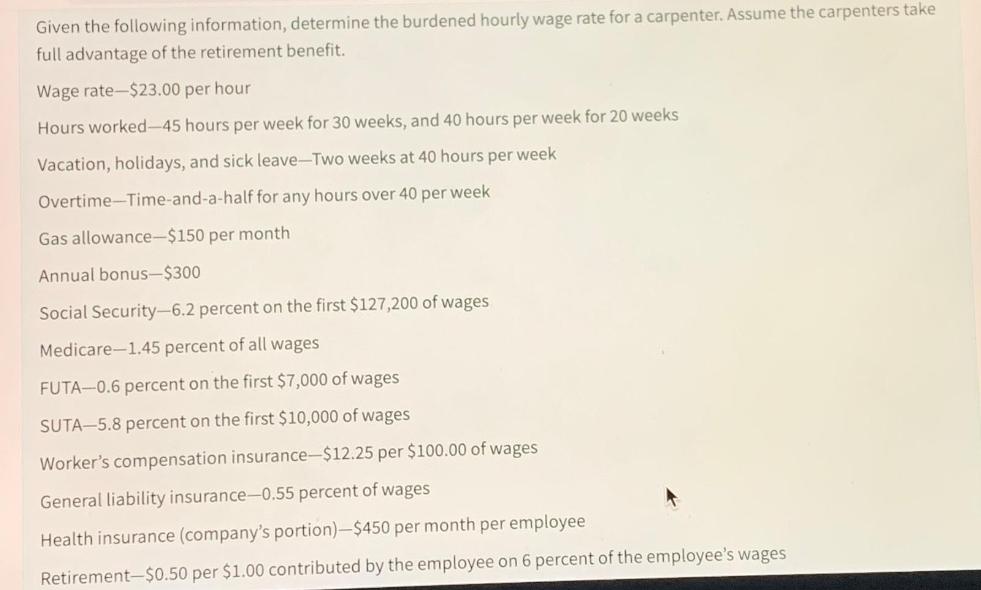

Given the following information, determine the burdened hourly wage rate for a carpenter. Assume the carpenters take full advantage of the retirement benefit. Wage rate-$23.00 per hour Hours worked-45 hours per week for 30 weeks, and 40 hours per week for 20 weeks Vacation, holidays, and sick leave-Two weeks at 40 hours per week Overtime-Time-and-a-half for any hours over 40 per week Gas allowance-$150 per month Annual bonus-$300 Social Security-6.2 percent on the first $127,200 of wages Medicare-1.45 percent of all wages FUTA-0.6 percent on the first $7,000 of wages SUTA-5.8 percent on the first $10,000 of wages Worker's compensation insurance-$12.25 per $100.00 of wages General liability insurance-0.55 percent of wages Health insurance (company's portion)-$450 per month per employee Retirement-$0.50 per $1.00 contributed by the employee on 6 percent of the employee's wages

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the burdened hourly wage rate for the carpenter we need to account for all the additional costs above the base wage that the employer inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started