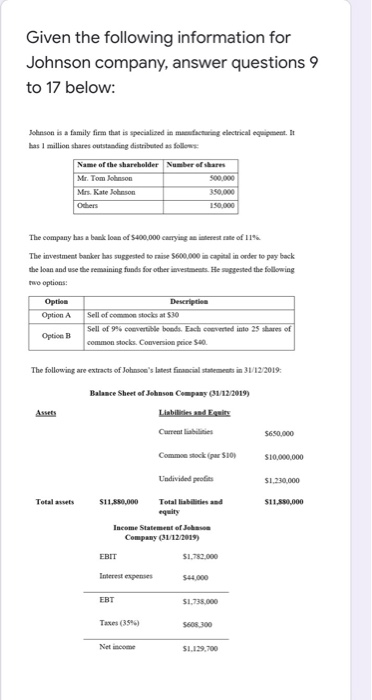

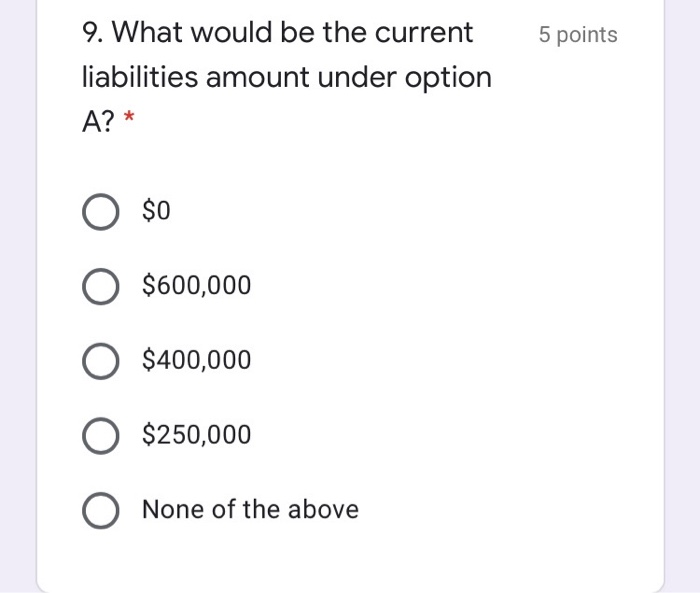

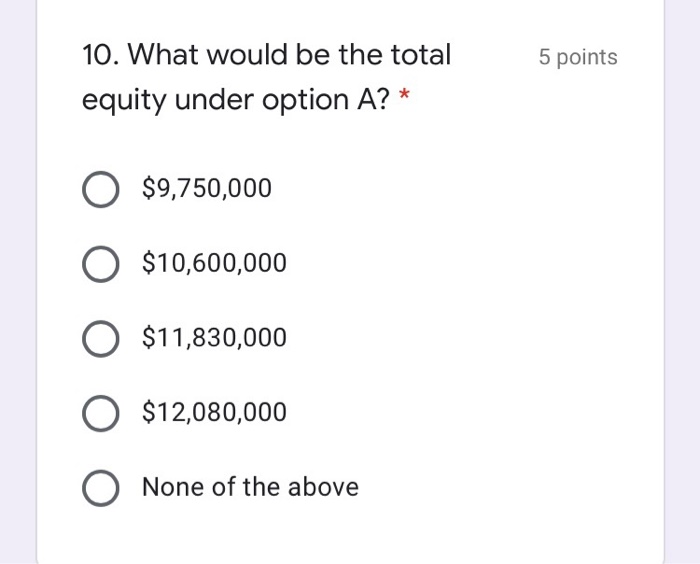

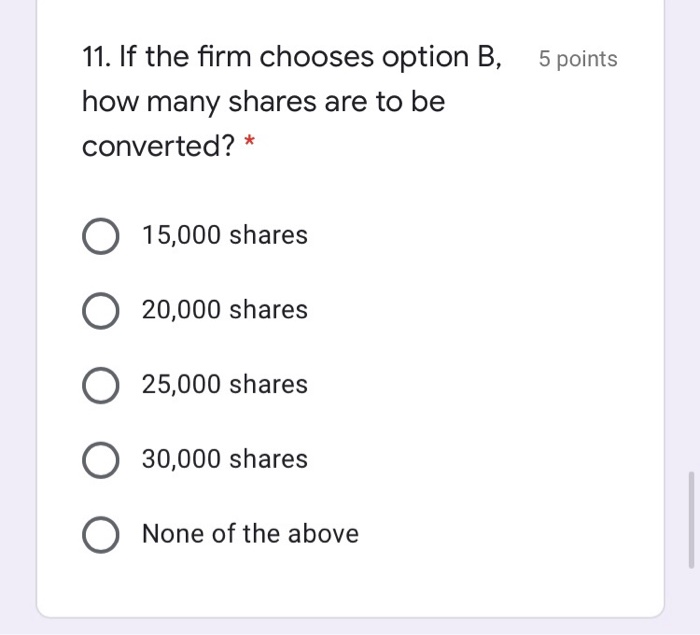

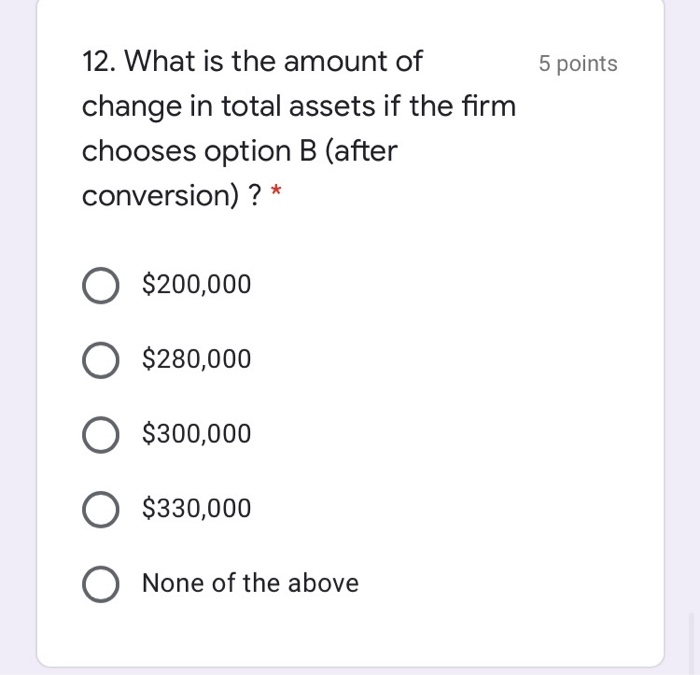

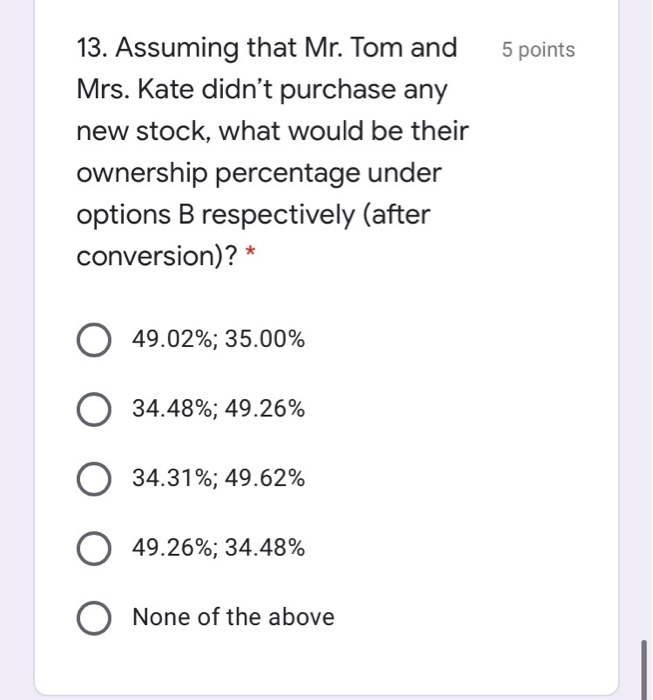

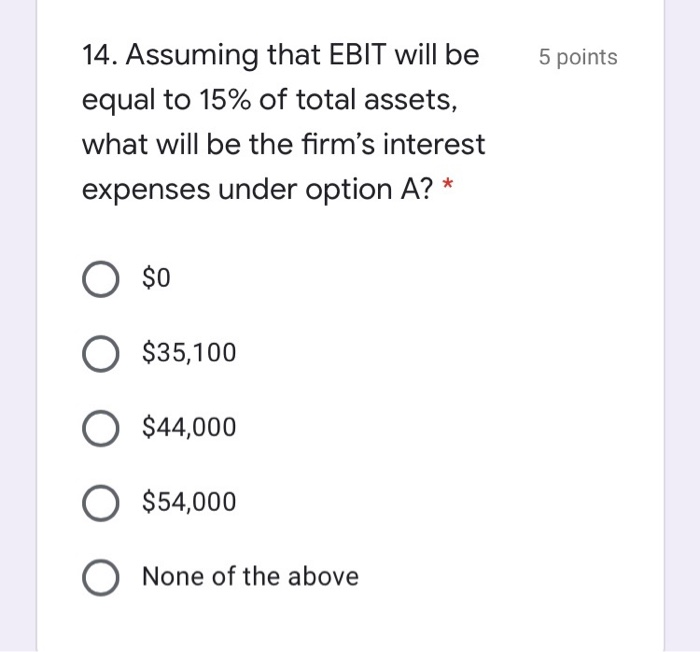

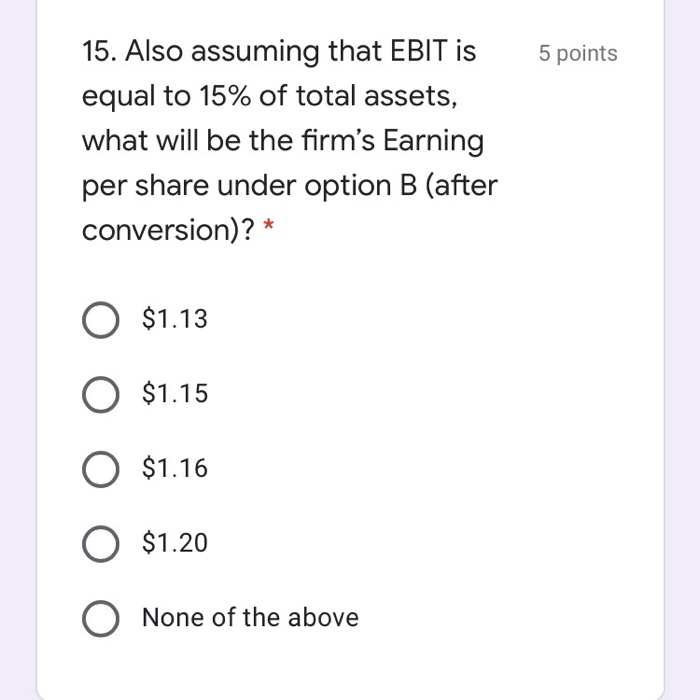

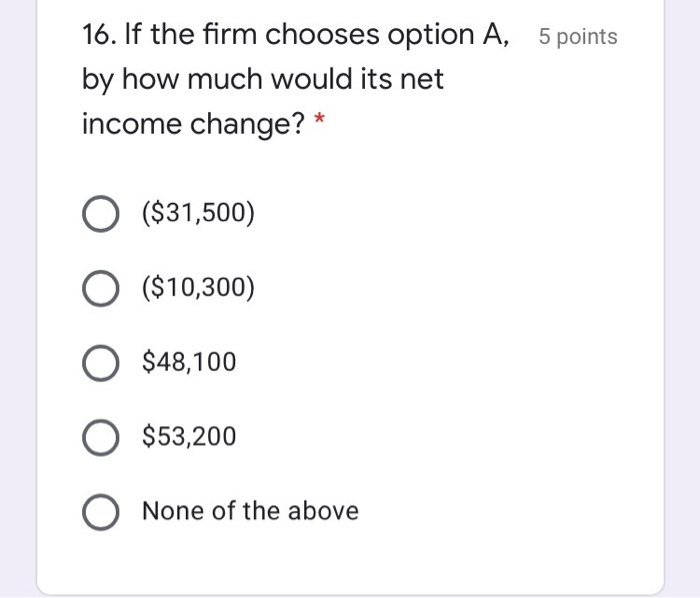

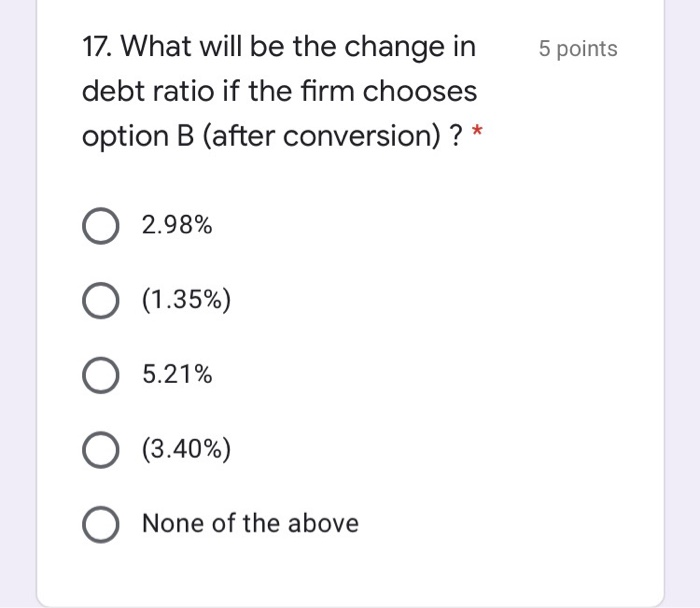

Given the following information for Johnson company, answer questions 9 to 17 below: Johnson is a family firm that is specialized in manufacturing electrical equipment. It has 1 million shares outstanding distributed as follows Name of the shareholder Number of shares Mr. Tom Johnson Mirs. Kate Johnson 350.000 500.000 Others 150.000 The company has a bank loan of $400,000 carrying an interest rate of 11% The investment banker has suggested to raise $600.000 in capital in order to pay back the loan and use the remaining funds for other investments. He suggested the following wwe options Option Description Option A Sell of common stocks 530 Sell of 9% convertible bonds. Each converted into 25 shares of Option common stocks. Conversion price 540 The following are extracts of Johnson's latest financial statements in 30/12/2019 Balance Sheet of Johnson Company /12/2019) $650.000 Common stock (10) $10.000.000 Undivided peolis $1.230.000 Totales $11.890.000 $11.880,000 Total liabilities and equity Income Statement of Jobs Company (31/12/2019) EBIT $1,722.000 Interest expenses 544.000 EBT $1,738.000 Taxes (35%) 5605.300 Netice $1.129,700 5 points 9. What would be the current liabilities amount under option A? * O $0 $600,000 $400,000 O $250,000 O None of the above 5 points 10. What would be the total equity under option A?* $9,750,000 $10,600,000 $11,830,000 O $12,080,000 O None of the above 11. If the firm chooses option B, 5 points how many shares are to be converted? * O 15,000 shares 20,000 shares 25,000 shares 30,000 shares O None of the above 5 points 12. What is the amount of change in total assets if the firm chooses option B (after conversion) ? * O $200,000 $280,000 O $300,000 O $330,000 None of the above 5 points 13. Assuming that Mr. Tom and Mrs. Kate didn't purchase any new stock, what would be their ownership percentage under options B respectively (after conversion)? * 49.02%; 35.00% 34.48%; 49.26% 34.31%; 49.62% 49.26%; 34.48% O None of the above 5 points 14. Assuming that EBIT will be equal to 15% of total assets, what will be the firm's interest expenses under option A? * $0 $35,100 O $44,000 $54,000 None of the above 5 points 15. Also assuming that EBIT is equal to 15% of total assets, what will be the firm's Earning per share under option B (after conversion)? * O $1.13 O $1.15 O $1.16 $1.20 None of the above 16. If the firm chooses option A, 5 points by how much would its net income change? * ($31,500) ($10,300) $48,100 $53,200 None of the above 5 points 17. What will be the change in debt ratio if the firm chooses option B (after conversion) ? * O 2.98% O (1.35%) O 5.21% O (3.40%) None of the above