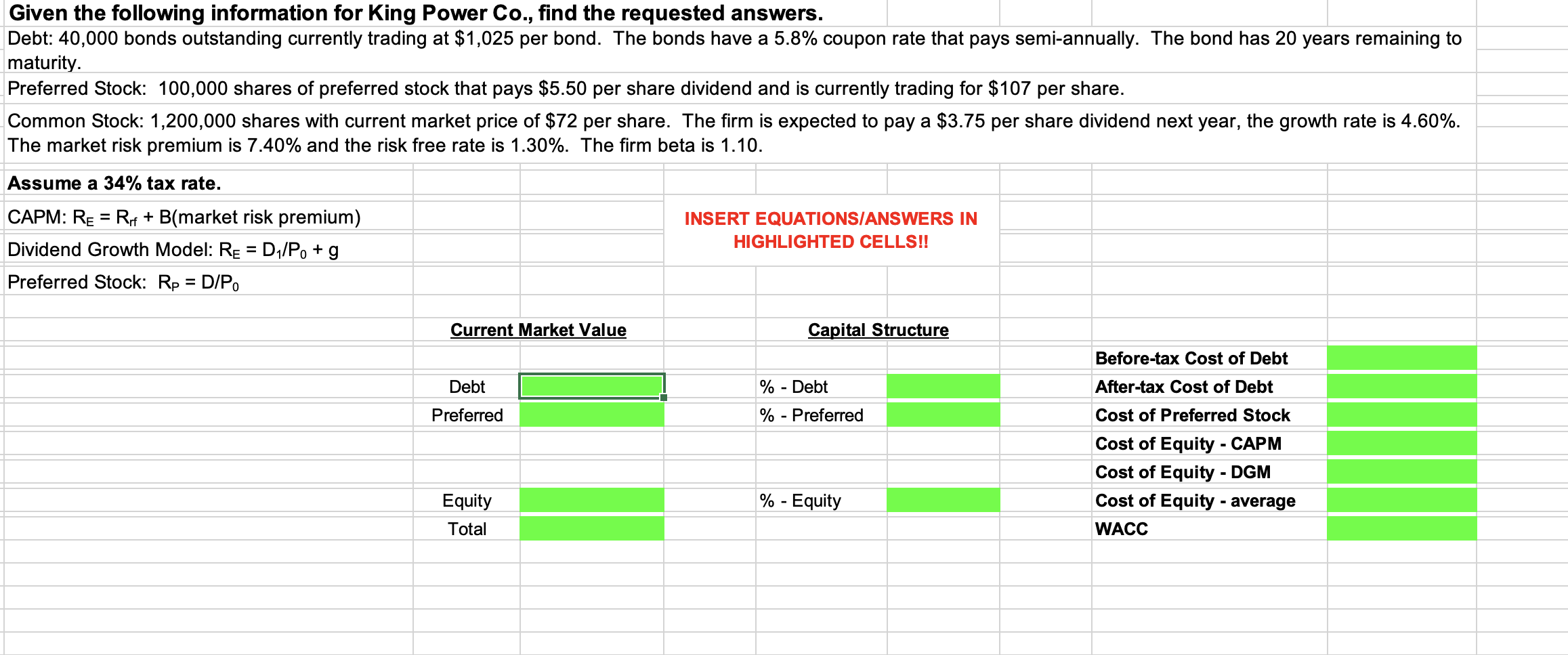

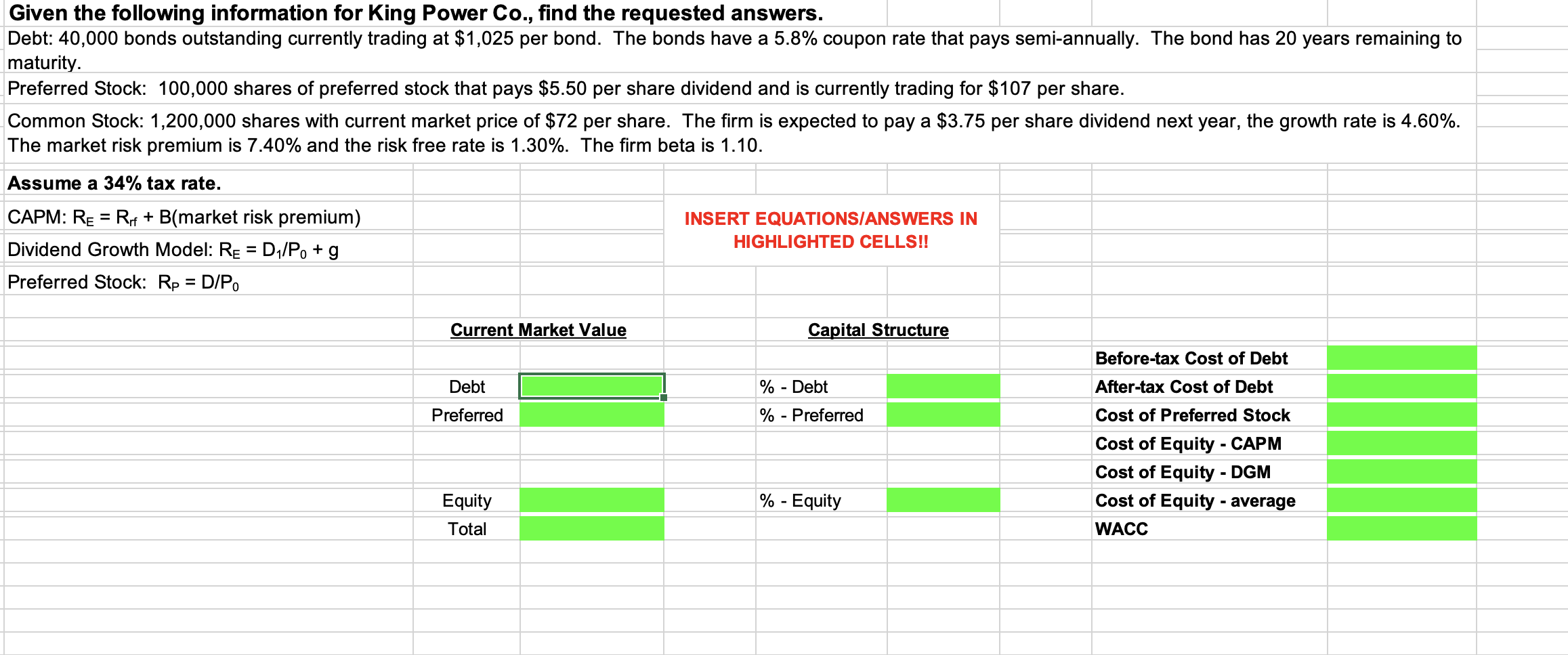

Given the following information for King Power Co., find the requested answers. Debt: 40,000 bonds outstanding currently trading at $1,025 per bond. The bonds have a 5.8% coupon rate that pays semi-annually. The bond has 20 years remaining to maturity. Preferred Stock: 100,000 shares of preferred stock that pays $5.50 per share dividend and is currently trading for $107 per share. Common Stock: 1,200,000 shares with current market price of $72 per share. The firm is expected to pay a $3.75 per share dividend next year, the growth rate is 4.60%. The market risk premium is 7.40% and the risk free rate is 1.30%. The firm beta is 1.10. Assume a 34% tax rate. CAPM: RE = Rp + B(market risk premium) Dividend Growth Model: Re = D/P, +g Preferred Stock: Rp = D/P. INSERT EQUATIONS/ANSWERS IN HIGHLIGHTED CELLS!! = Current Market Value Capital Structure Before-tax Cost of Debt Debt After-tax Cost of Debt % - Debt % - Preferred Preferred Cost of Preferred Stock Cost of Equity - CAPM Cost of Equity - DGM Cost of Equity - average WACC % - Equity Equity Total Given the following information for King Power Co., find the requested answers. Debt: 40,000 bonds outstanding currently trading at $1,025 per bond. The bonds have a 5.8% coupon rate that pays semi-annually. The bond has 20 years remaining to maturity. Preferred Stock: 100,000 shares of preferred stock that pays $5.50 per share dividend and is currently trading for $107 per share. Common Stock: 1,200,000 shares with current market price of $72 per share. The firm is expected to pay a $3.75 per share dividend next year, the growth rate is 4.60%. The market risk premium is 7.40% and the risk free rate is 1.30%. The firm beta is 1.10. Assume a 34% tax rate. CAPM: RE = Rp + B(market risk premium) Dividend Growth Model: Re = D/P, +g Preferred Stock: Rp = D/P. INSERT EQUATIONS/ANSWERS IN HIGHLIGHTED CELLS!! = Current Market Value Capital Structure Before-tax Cost of Debt Debt After-tax Cost of Debt % - Debt % - Preferred Preferred Cost of Preferred Stock Cost of Equity - CAPM Cost of Equity - DGM Cost of Equity - average WACC % - Equity Equity Total