Answered step by step

Verified Expert Solution

Question

1 Approved Answer

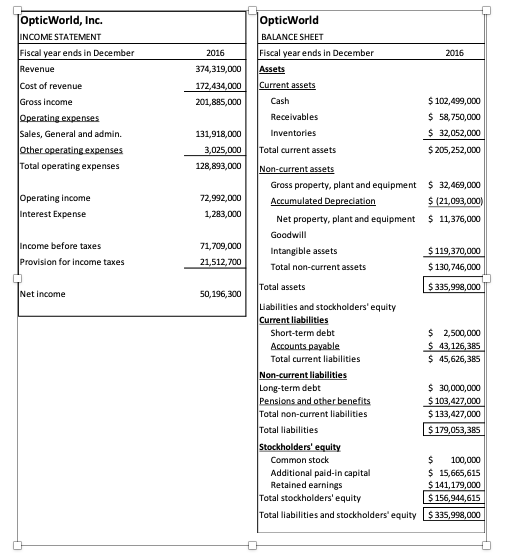

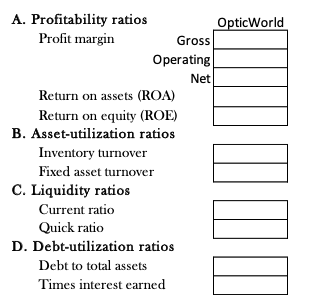

Given the following information for OpticWorld, calculate the financial ratios in the table provided on the next page. Is anyone able to break down how

Given the following information for OpticWorld, calculate the financial ratios in the table provided on the next page.

Is anyone able to break down how inventory turnover, fixed asset turnover, and quick ratio is figured out.

thanks!

TOpticWorld, Inc. INCOME STATEMENT Fiscal year ends in December Revenue 2016 2016 374,319,000 172,434,000 201,885,000 OpticWorld BALANCE SHEET Fiscal year ends in December Assets Current assets Cash Receivables Inventories Cost of revenue Gross income Operating expenses Sales, General and admin. Other operating expenses Total operating expenses $ 102,499,000 $ 58,750,000 $ 32,052,000 $ 205,252,000 131,918,000 3,025,000 128,893,000 Total current assets Operating Income interest Expense 72,992,000 1,283,000 Income before taxes Provision for Income taxes 71,709,000 21,512,700 Net Income 50, 196,300 Non-current assets Gross property, plant and equipment $ 32,469,000 Accumulated Depreciation $ (21,093,000) Net property, plant and equipment $ 11,376,000 Goodwill Intangible assets $ 119,370,000 Total non-current assets $ 130,746,000 Total assets $ 335,998,000 Liabilities and stockholders' equity Current liabilities Short-term debt $ 2,500,000 Accounts payable $ 43,126,385 Total current liabilities $ 45,626,385 Non-current liabilities Long-term debt $ 30,000,000 Pensions and other benefits $ 103,427,000 Total non-current liabilities $ 133,427,000 Total liabilities $ 179,053,385 Stockholders' equity Common stock $ 100,000 Additional paid-in capital $ 15,665,615 Retained earnings $ 141,179,000 Total stockholders' equity $ 156,944,615 Total liabilities and stockholders' equity $ 335,998,000 A. Profitability ratios Optic World Profit margin Gross Operating Net Return on assets (ROA) Return on equity (ROE) B. Asset-utilization ratios Inventory turnover Fixed asset turnover C. Liquidity ratios Current ratio Quick ratio D. Debt-utilization ratios Debt to total assets Times interest earned 111Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started