Question

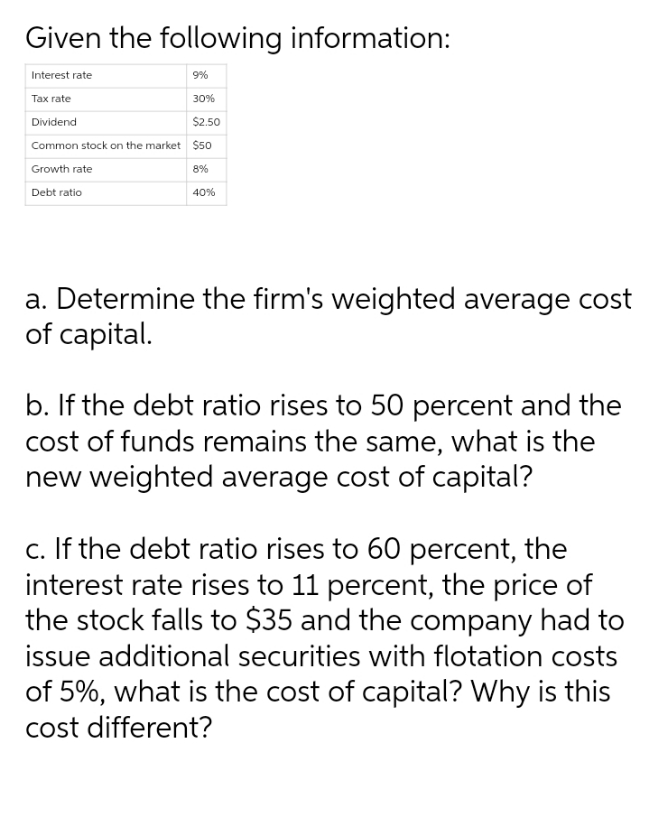

Given the following information: Interest rate Tax rate Dividend 9% 30% $2.50 Common stock on the market $50 Growth rate Debt ratio 8% 40%

Given the following information: Interest rate Tax rate Dividend 9% 30% $2.50 Common stock on the market $50 Growth rate Debt ratio 8% 40% a. Determine the firm's weighted average cost of capital. b. If the debt ratio rises to 50 percent and the cost of funds remains the same, what is the new weighted average cost of capital? c. If the debt ratio rises to 60 percent, the interest rate rises to 11 percent, the price of the stock falls to $35 and the company had to issue additional securities with flotation costs of 5%, what is the cost of capital? Why is this cost different?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the firms weighted average cost of capital WACC we first need to calculate the cost o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Mechanics Statics

Authors: Russell C. Hibbeler

15th Edition

0134814975, 978-0134814971

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App