Given the following information listed below (PLEASE SHOW WORKING), Work out the questions in the last photo

Work out the following questions from the information above (PLEASE SHOW WORKING)

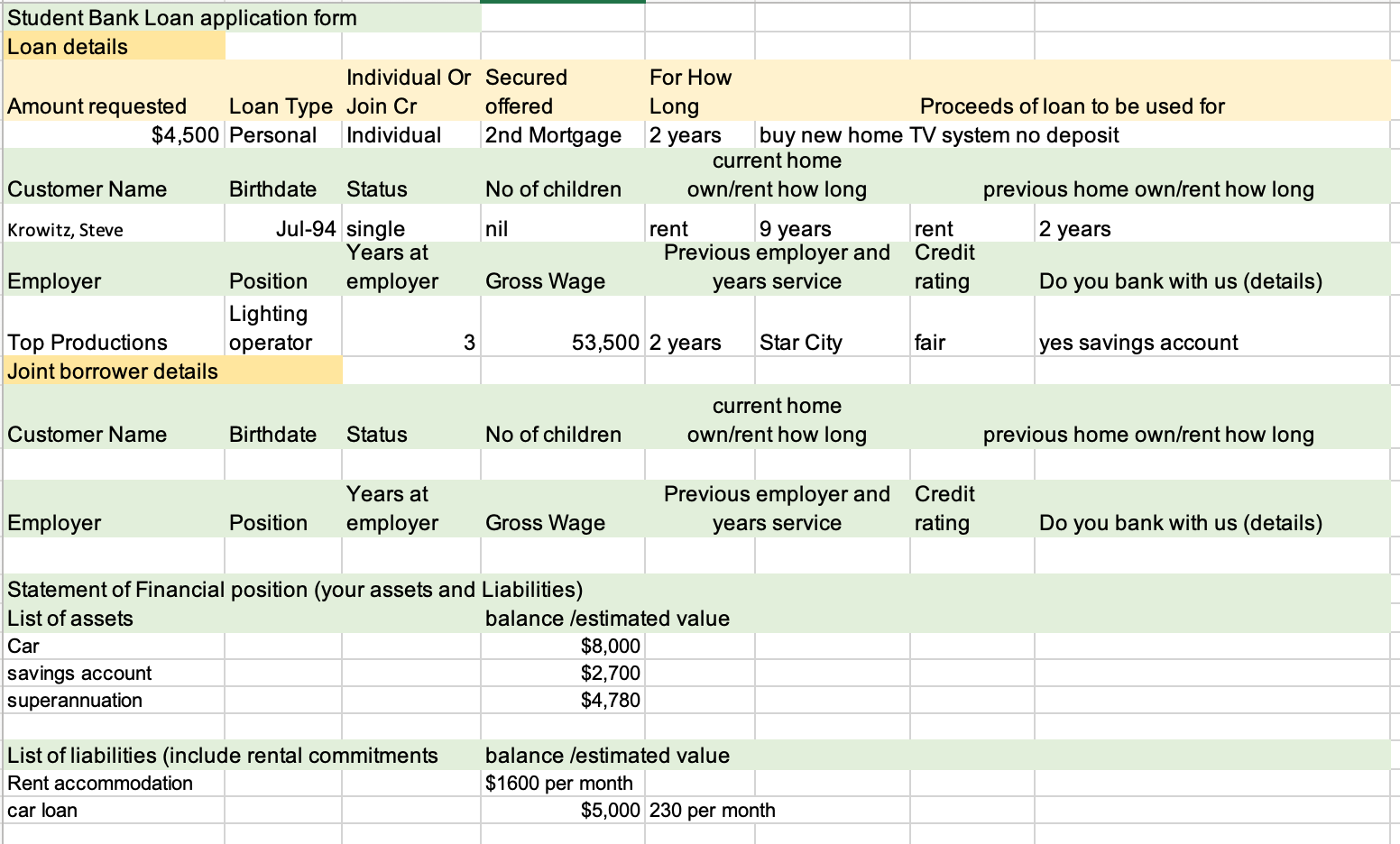

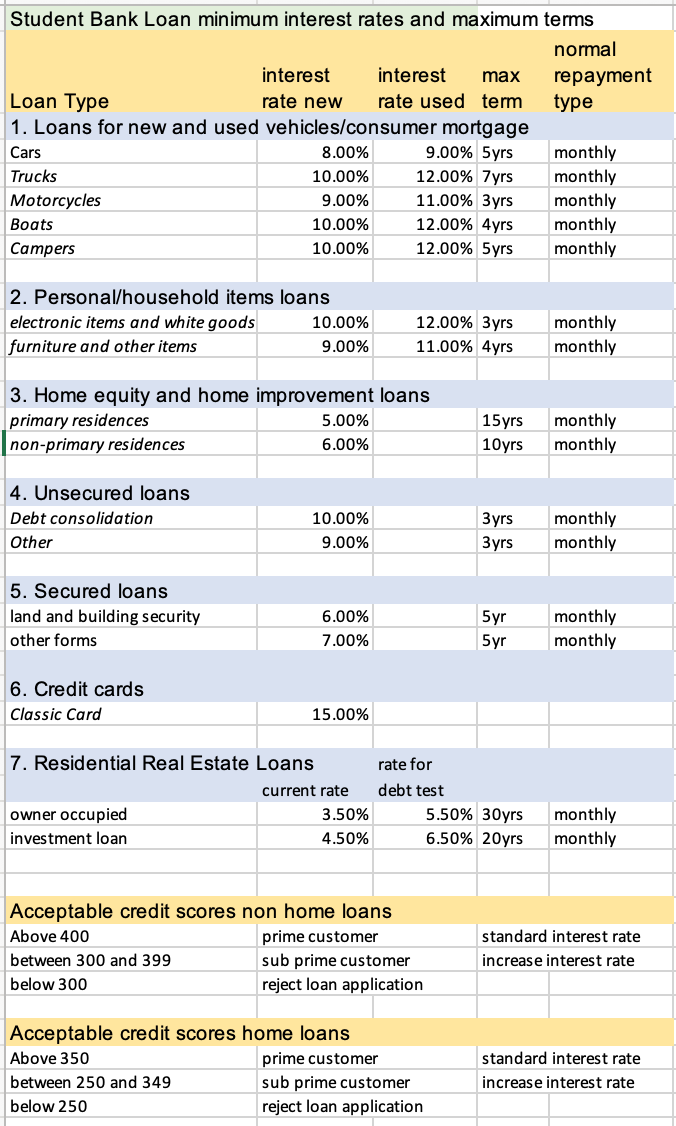

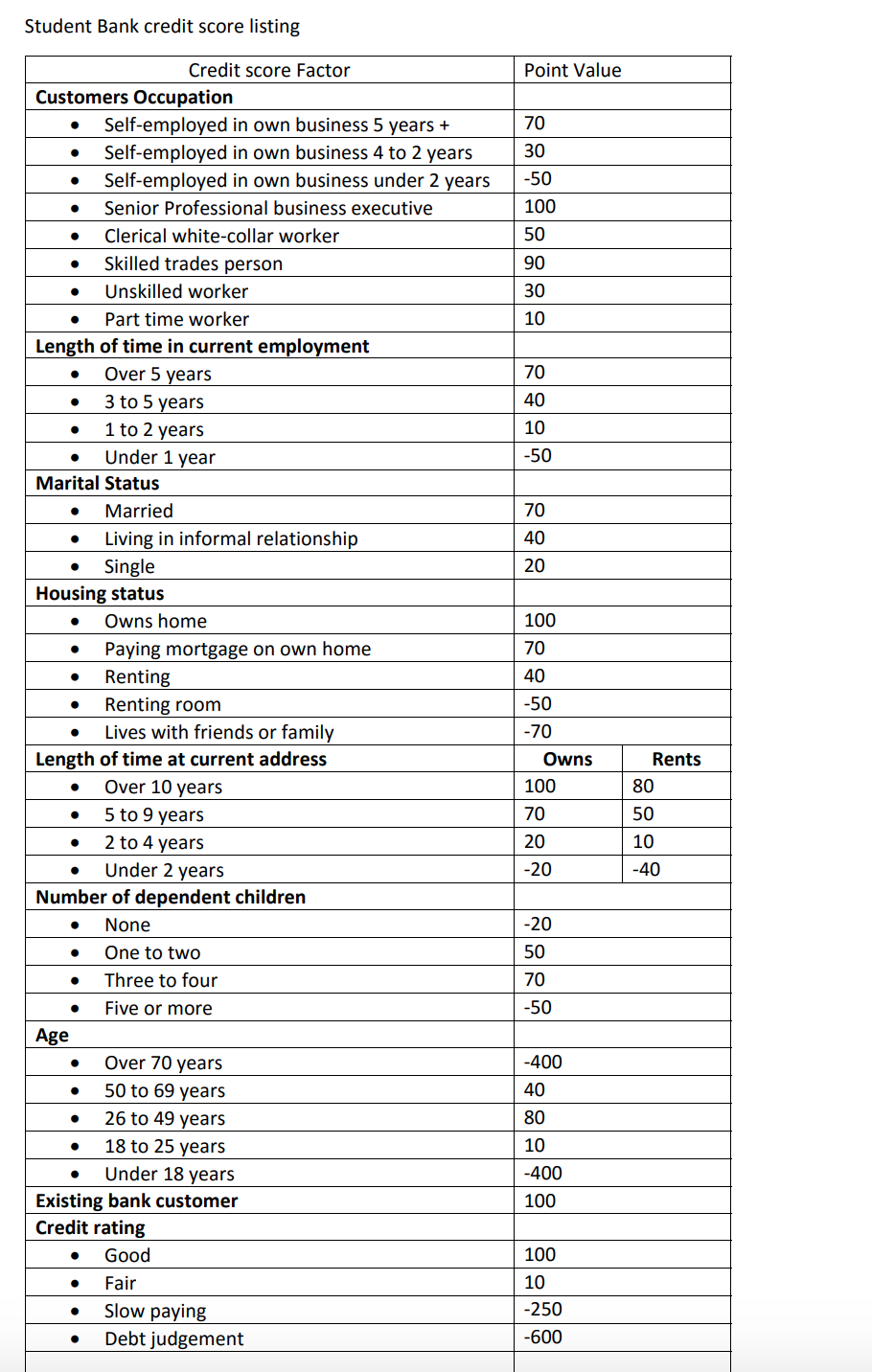

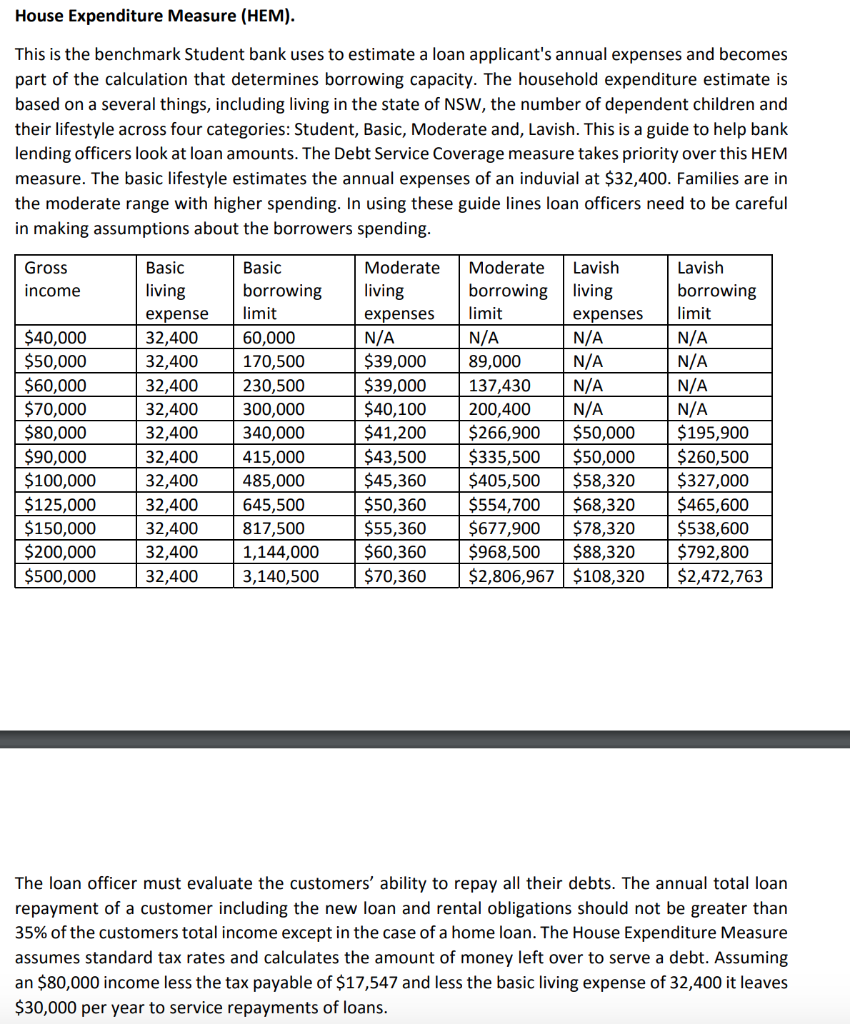

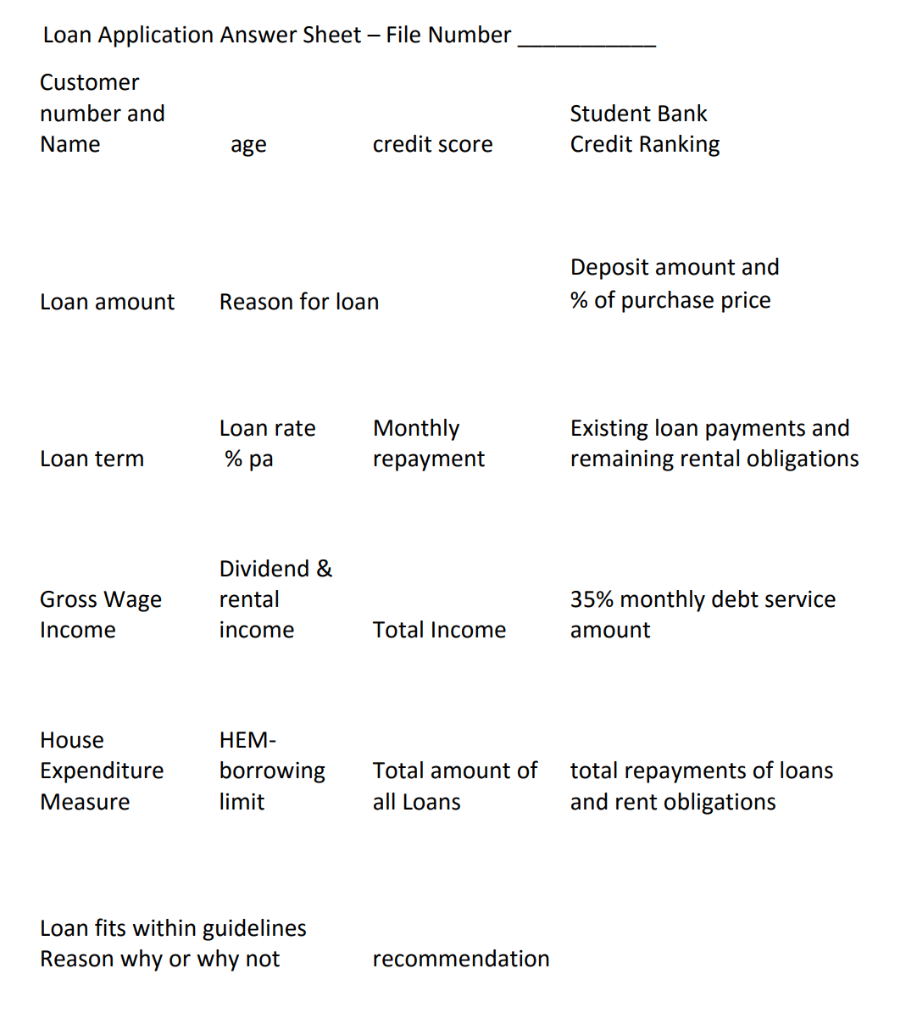

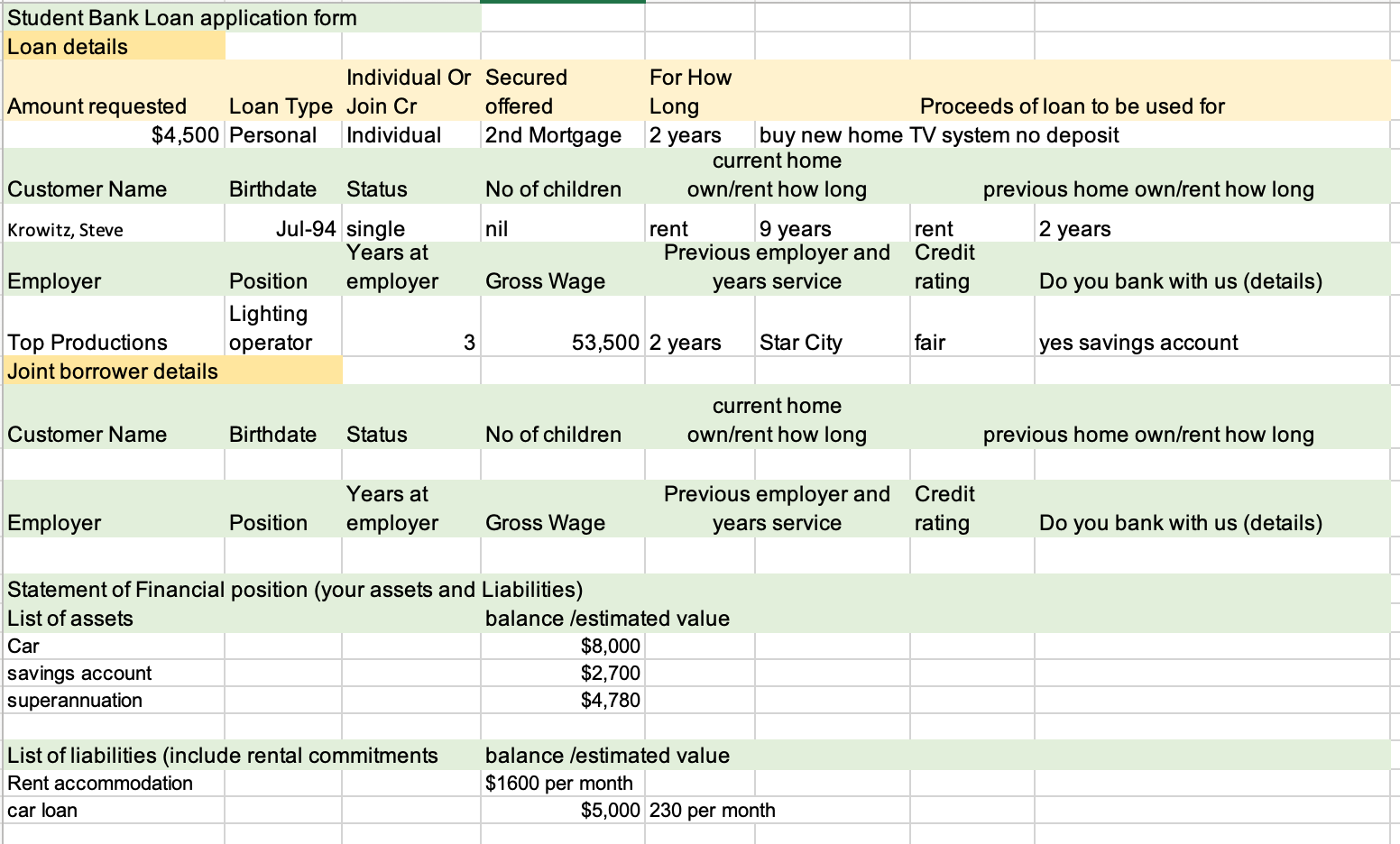

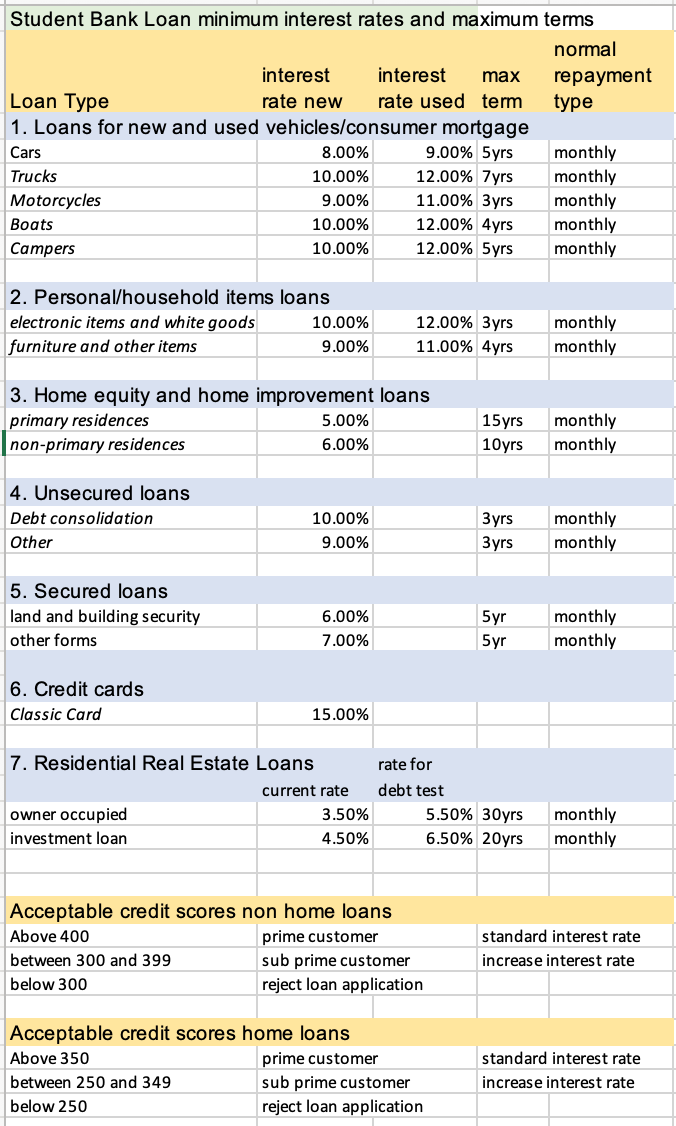

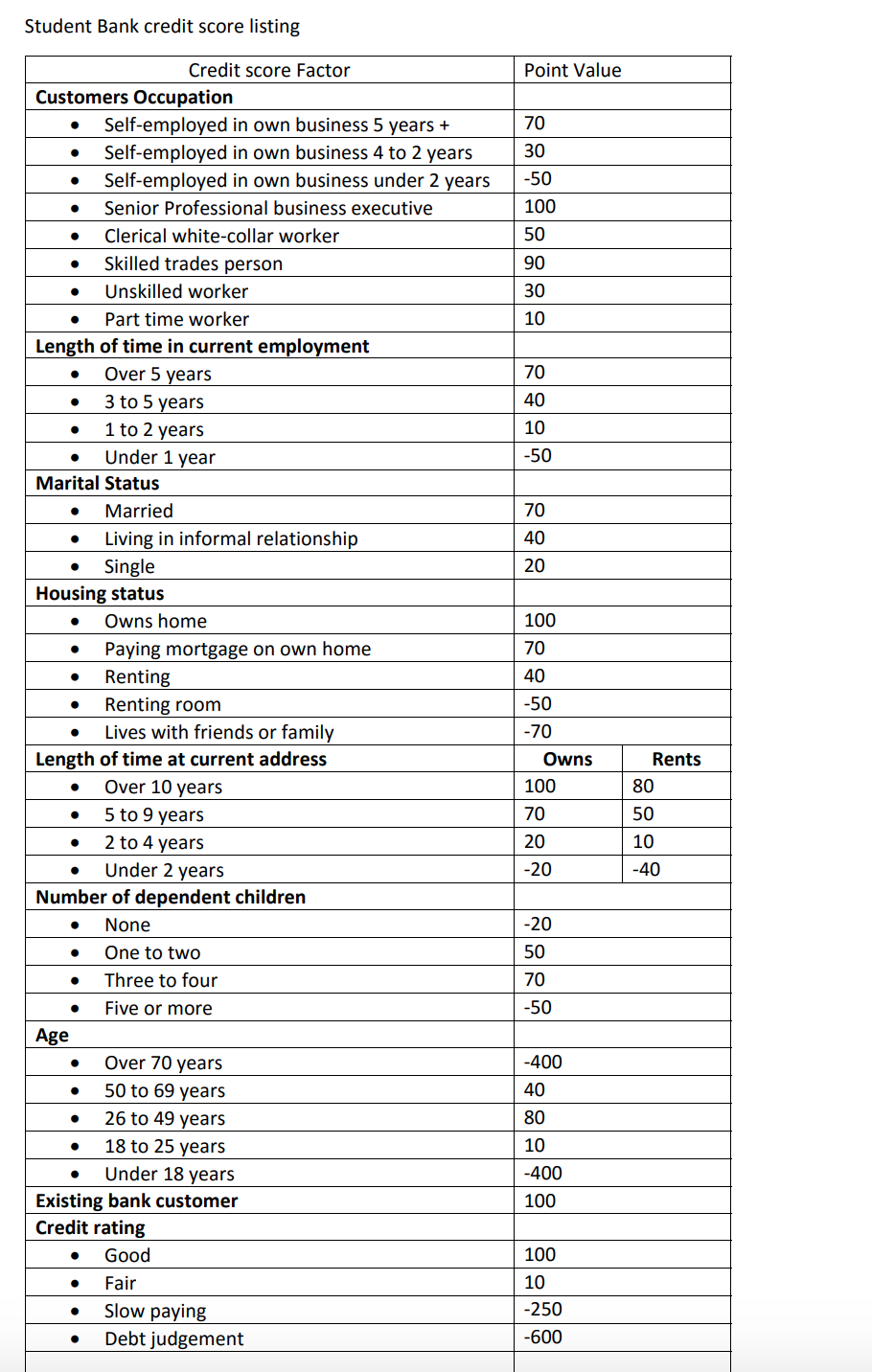

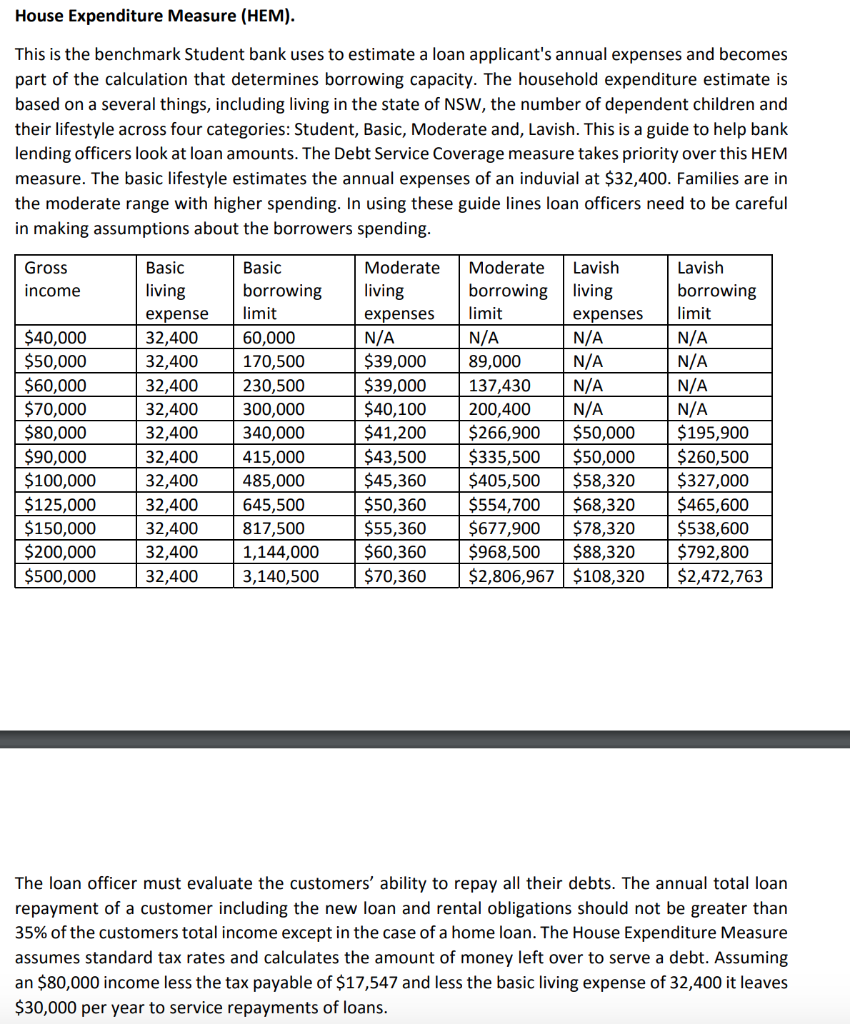

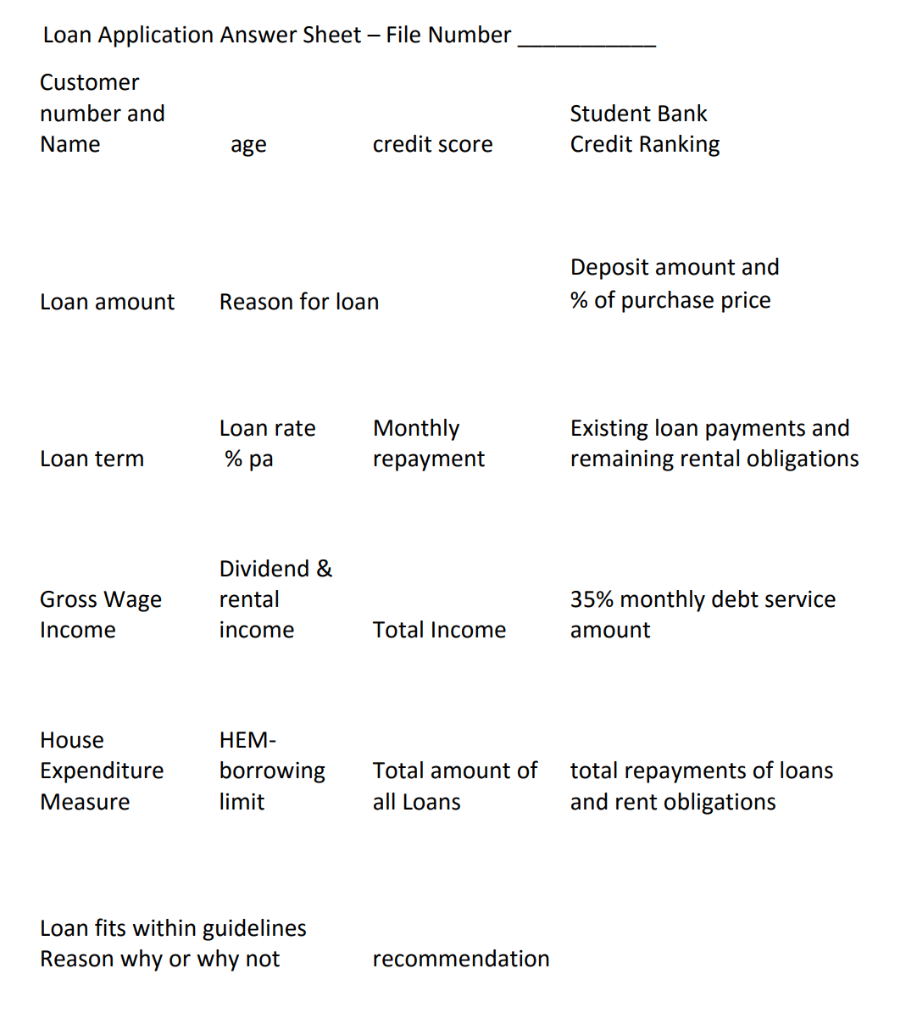

Student Bank Loan application form Loan details Individual Or Secured Amount requested Loan Type Join Cr offered $4,500 Personal Individual 2nd Mortgage Customer Name Birth date Status No of children For How Long Proceeds of loan to be used for 2 years buy new home TV system no deposit current home own/rent how long previous home own/rent how long rent 9 years rent 2 years Previous employer and Credit years service rating Do you bank with us (details) nil Gross Wage Krowitz, Steve Jul-94 single Years at Employer Position employer Lighting Top Productions operator Joint borrower details 3 53,500 2 years Star City fair yes savings account current home own/rent how long Customer Name Birthdate Status No of children previous home own/rent how long Previous employer and Years at employer Employer Credit rating Position Gross Wage years service Do you bank with us (details) Statement of Financial position (your assets and Liabilities) List of assets balance lestimated value Car $8,000 savings account $2,700 superannuation $4,780 List of liabilities (include rental commitments Rent accommodation car loan balance lestimated value $1600 per month $5,000 230 per month Student Bank Loan minimum interest rates and maximum terms normal interest interest max repayment Loan Type rate new rate used term type 1. Loans for new and used vehicles/consumer mortgage Cars 8.00% 9.00% 5yrs monthly Trucks 10.00% 12.00% 7yrs monthly Motorcycles 9.00% 11.00% 3yrs monthly Boats 10.00% 12.00% 4yrs monthly Campers 10.00% 12.00% 5yrs monthly 2. Personal/household items loans electronic items and white goods 10.00% furniture and other items 9.00% 12.00% 3yrs 11.00% 4yrs monthly monthly 3. Home equity and home improvement loans primary residences 5.00% non-primary residences 6.00% 15 yrs 10yrs monthly monthly 4. Unsecured loans Debt consolidation Other 10.00% 9.00% 3yrs 3yrs monthly monthly 5. Secured loans land and building security other forms 6.00% 7.00% 5yr 5yr monthly monthly 6. Credit cards Classic Card 15.00% 7. Residential Real Estate Loans current rate owner occupied 3.50% investment loan 4.50% rate for debt test 5.50% 30yrs 6.50% 20yrs monthly monthly Acceptable credit scores non home loans Above 400 prime customer between 300 and 399 sub prime customer below 300 reject loan application standard interest rate increase interest rate Acceptable credit scores home loans Above 350 prime customer between 250 and 349 sub prime customer below 250 reject loan application standard interest rate increase interest rate Student Bank credit score listing Point Value . 70 . 30 -50 . 100 . 50 O 90 30 10 70 40 10 -50 . 70 Credit score Factor Customers Occupation Self-employed in own business 5 years + Self-employed in own business 4 to 2 years Self-employed in own business under 2 years Senior Professional business executive Clerical white collar worker Skilled trades person Unskilled worker Part time worker Length of time in current employment Over 5 years 3 to 5 years 1 to 2 years Under 1 year Marital Status Married Living in informal relationship Single Housing status Owns home Paying mortgage on own home Renting Renting room Lives with friends or family Length of time at current address Over 10 years 5 to 9 years 2 to 4 years Under 2 years Number of dependent children None One to two Three to four 40 . 20 0 100 70 . 40 -50 -70 Owns 100 70 Rents 80 50 20 10 -20 -40 -20 50 . . 70 Five or more -50 . -400 40 . 80 O 10 -400 Age Over 70 years 50 to 69 years 26 to 49 years 18 to 25 years Under 18 years Existing bank customer Credit rating Good Fair Slow paying Debt judgement 100 100 10 -250 -600 O House Expenditure Measure (HEM). This is the benchmark Student bank uses to estimate a loan applicant's annual expenses and becomes part of the calculation that determines borrowing capacity. The household expenditure estimate is based on a several things, including living in the state of NSW, the number of dependent children and their lifestyle across four categories: Student, Basic, Moderate and, Lavish. This is a guide to help bank lending officers look at loan amounts. The Debt Service Coverage measure takes priority over this HEM measure. The basic lifestyle estimates the annual expenses of an induvial at $32,400. Families are in the moderate range with higher spending. In using these guide lines loan officers need to be careful in making assumptions about the borrowers spending. Gross income $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 $125,000 $150,000 $200,000 $500,000 Basic living expense 32,400 32,400 32,400 32,400 32,400 32,400 32,400 32,400 32,400 32,400 32,400 Basic borrowing limit 60,000 170,500 230,500 300,000 340,000 415,000 485,000 645,500 817,500 1,144,000 3,140,500 Moderate living expenses N/A $39,000 $39,000 $40,100 $41,200 $43,500 $45,360 $50,360 $55,360 $60,360 $70,360 Moderate Lavish borrowing living limit expenses N/A N/A 89,000 N/A 137,430 N/A 200,400 N/A $266,900 $50,000 $335,500 $50,000 $405,500 $58,320 $554,700 $68,320 $677,900 $78,320 $968,500 $88,320 $2,806,967 $108,320 Lavish borrowing limit N/A N/A N/A N/A $195,900 $260,500 $327,000 $465,600 $538,600 $792,800 $2,472,763 HHH The loan officer must evaluate the customers' ability to repay all their debts. The annual total loan repayment of a customer including the new loan and rental obligations should not be greater than 35% of the customers total income except in the case of a home loan. The House Expenditure Measure assumes standard tax rates and calculates the amount of money left over to serve a debt. Assuming an $80,000 income less the tax payable of $17,547 and less the basic living expense of 32,400 it leaves $30,000 per year to service repayments of loans. Loan Application Answer Sheet - File Number Customer number and Name Student Bank Credit Ranking age credit score Deposit amount and % of purchase price Loan amount Reason for loan Loan rate % pa Monthly repayment Existing loan payments and remaining rental obligations Loan term Gross Wage Income Dividend & rental income 35% monthly debt service amount Total Income House Expenditure Measure HEM- borrowing limit Total amount of all Loans total repayments of loans and rent obligations Loan fits within guidelines Reason why or why not recommendation Student Bank Loan application form Loan details Individual Or Secured Amount requested Loan Type Join Cr offered $4,500 Personal Individual 2nd Mortgage Customer Name Birth date Status No of children For How Long Proceeds of loan to be used for 2 years buy new home TV system no deposit current home own/rent how long previous home own/rent how long rent 9 years rent 2 years Previous employer and Credit years service rating Do you bank with us (details) nil Gross Wage Krowitz, Steve Jul-94 single Years at Employer Position employer Lighting Top Productions operator Joint borrower details 3 53,500 2 years Star City fair yes savings account current home own/rent how long Customer Name Birthdate Status No of children previous home own/rent how long Previous employer and Years at employer Employer Credit rating Position Gross Wage years service Do you bank with us (details) Statement of Financial position (your assets and Liabilities) List of assets balance lestimated value Car $8,000 savings account $2,700 superannuation $4,780 List of liabilities (include rental commitments Rent accommodation car loan balance lestimated value $1600 per month $5,000 230 per month Student Bank Loan minimum interest rates and maximum terms normal interest interest max repayment Loan Type rate new rate used term type 1. Loans for new and used vehicles/consumer mortgage Cars 8.00% 9.00% 5yrs monthly Trucks 10.00% 12.00% 7yrs monthly Motorcycles 9.00% 11.00% 3yrs monthly Boats 10.00% 12.00% 4yrs monthly Campers 10.00% 12.00% 5yrs monthly 2. Personal/household items loans electronic items and white goods 10.00% furniture and other items 9.00% 12.00% 3yrs 11.00% 4yrs monthly monthly 3. Home equity and home improvement loans primary residences 5.00% non-primary residences 6.00% 15 yrs 10yrs monthly monthly 4. Unsecured loans Debt consolidation Other 10.00% 9.00% 3yrs 3yrs monthly monthly 5. Secured loans land and building security other forms 6.00% 7.00% 5yr 5yr monthly monthly 6. Credit cards Classic Card 15.00% 7. Residential Real Estate Loans current rate owner occupied 3.50% investment loan 4.50% rate for debt test 5.50% 30yrs 6.50% 20yrs monthly monthly Acceptable credit scores non home loans Above 400 prime customer between 300 and 399 sub prime customer below 300 reject loan application standard interest rate increase interest rate Acceptable credit scores home loans Above 350 prime customer between 250 and 349 sub prime customer below 250 reject loan application standard interest rate increase interest rate Student Bank credit score listing Point Value . 70 . 30 -50 . 100 . 50 O 90 30 10 70 40 10 -50 . 70 Credit score Factor Customers Occupation Self-employed in own business 5 years + Self-employed in own business 4 to 2 years Self-employed in own business under 2 years Senior Professional business executive Clerical white collar worker Skilled trades person Unskilled worker Part time worker Length of time in current employment Over 5 years 3 to 5 years 1 to 2 years Under 1 year Marital Status Married Living in informal relationship Single Housing status Owns home Paying mortgage on own home Renting Renting room Lives with friends or family Length of time at current address Over 10 years 5 to 9 years 2 to 4 years Under 2 years Number of dependent children None One to two Three to four 40 . 20 0 100 70 . 40 -50 -70 Owns 100 70 Rents 80 50 20 10 -20 -40 -20 50 . . 70 Five or more -50 . -400 40 . 80 O 10 -400 Age Over 70 years 50 to 69 years 26 to 49 years 18 to 25 years Under 18 years Existing bank customer Credit rating Good Fair Slow paying Debt judgement 100 100 10 -250 -600 O House Expenditure Measure (HEM). This is the benchmark Student bank uses to estimate a loan applicant's annual expenses and becomes part of the calculation that determines borrowing capacity. The household expenditure estimate is based on a several things, including living in the state of NSW, the number of dependent children and their lifestyle across four categories: Student, Basic, Moderate and, Lavish. This is a guide to help bank lending officers look at loan amounts. The Debt Service Coverage measure takes priority over this HEM measure. The basic lifestyle estimates the annual expenses of an induvial at $32,400. Families are in the moderate range with higher spending. In using these guide lines loan officers need to be careful in making assumptions about the borrowers spending. Gross income $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 $125,000 $150,000 $200,000 $500,000 Basic living expense 32,400 32,400 32,400 32,400 32,400 32,400 32,400 32,400 32,400 32,400 32,400 Basic borrowing limit 60,000 170,500 230,500 300,000 340,000 415,000 485,000 645,500 817,500 1,144,000 3,140,500 Moderate living expenses N/A $39,000 $39,000 $40,100 $41,200 $43,500 $45,360 $50,360 $55,360 $60,360 $70,360 Moderate Lavish borrowing living limit expenses N/A N/A 89,000 N/A 137,430 N/A 200,400 N/A $266,900 $50,000 $335,500 $50,000 $405,500 $58,320 $554,700 $68,320 $677,900 $78,320 $968,500 $88,320 $2,806,967 $108,320 Lavish borrowing limit N/A N/A N/A N/A $195,900 $260,500 $327,000 $465,600 $538,600 $792,800 $2,472,763 HHH The loan officer must evaluate the customers' ability to repay all their debts. The annual total loan repayment of a customer including the new loan and rental obligations should not be greater than 35% of the customers total income except in the case of a home loan. The House Expenditure Measure assumes standard tax rates and calculates the amount of money left over to serve a debt. Assuming an $80,000 income less the tax payable of $17,547 and less the basic living expense of 32,400 it leaves $30,000 per year to service repayments of loans. Loan Application Answer Sheet - File Number Customer number and Name Student Bank Credit Ranking age credit score Deposit amount and % of purchase price Loan amount Reason for loan Loan rate % pa Monthly repayment Existing loan payments and remaining rental obligations Loan term Gross Wage Income Dividend & rental income 35% monthly debt service amount Total Income House Expenditure Measure HEM- borrowing limit Total amount of all Loans total repayments of loans and rent obligations Loan fits within guidelines Reason why or why not recommendation