Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the following information: State Probability X Y Boom .15 2% -30% Normal .50 10% 18% Recession .35 15% 31% a. Calculate the expected return

Given the following information:

State Probability X Y

Boom .15 2% -30%

Normal .50 10% 18%

Recession .35 15% 31%

a. Calculate the expected return and the standard deviation for X and Y respectively.

b. What is the expected return for a portfolio with an investment of $7,000 in asset X and $3,000 in asset Y? [Hint: Calculate portfolio weights, Wx and Wy , first.]

c. Calculate the standard deviation for this portfolio using three methods:

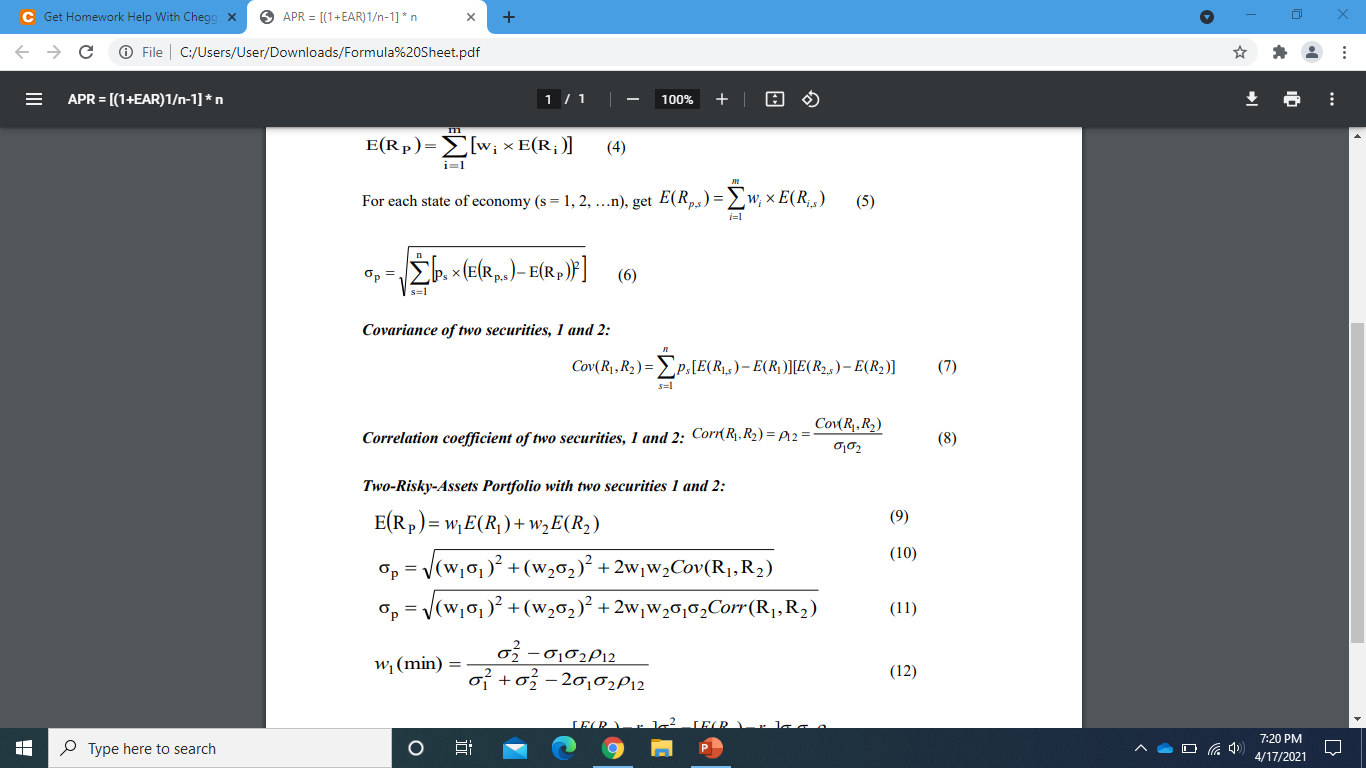

- Use Formulas (5) and (6)

- Use Formula (10)

- Use Formulas (11)

SHOW HOW TO DO MANUALLY. WITHOUT EXCEL PLEASE.

C Get Homework Help With Chegg X APR = [(1 + EAR)1-1] *n 0 File C:/Users/User/Downloads/Formula%20Sheet.pdf APR = [(1+EAR)1-1] *n 1 1 1 100% + E(Rp)=[w; x E(R;)] (4) For each state economy (s = 1, 2, ...n), get E(R) = w; E(R) (5) El. ((Reps)- E(Rp)}] (6) Covariance of two securities, 1 and 2: Cov(Ry, R)= P[E(Rz) E(R)]E[R,) E(R)] (7) S=1 Cov(R, R) Correlation coefficient of two securities, 1 and 2: Cor(R1,R2) = P2 = (8) Two-Risky-Assets Portfolio with two securities 1 and 2: (9) (10) E(Rp)= w; E(R, )+w2E(R2) Op = V(w,g)? +(W202)+ 2w,w2Cov(R,,R2) op (w,g)2+(w202)+ 2w,W2070,Corr(R,,R2) oz w (min) = o +o - 20,02P12 (11) -0102P12 (12) INP. 2 IAP 7:20 PM Type here to search 4/17/2021 C Get Homework Help With Chegg X APR = [(1 + EAR)1-1] *n 0 File C:/Users/User/Downloads/Formula%20Sheet.pdf APR = [(1+EAR)1-1] *n 1 1 1 100% + E(Rp)=[w; x E(R;)] (4) For each state economy (s = 1, 2, ...n), get E(R) = w; E(R) (5) El. ((Reps)- E(Rp)}] (6) Covariance of two securities, 1 and 2: Cov(Ry, R)= P[E(Rz) E(R)]E[R,) E(R)] (7) S=1 Cov(R, R) Correlation coefficient of two securities, 1 and 2: Cor(R1,R2) = P2 = (8) Two-Risky-Assets Portfolio with two securities 1 and 2: (9) (10) E(Rp)= w; E(R, )+w2E(R2) Op = V(w,g)? +(W202)+ 2w,w2Cov(R,,R2) op (w,g)2+(w202)+ 2w,W2070,Corr(R,,R2) oz w (min) = o +o - 20,02P12 (11) -0102P12 (12) INP. 2 IAP 7:20 PM Type here to search 4/17/2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started