Answered step by step

Verified Expert Solution

Question

1 Approved Answer

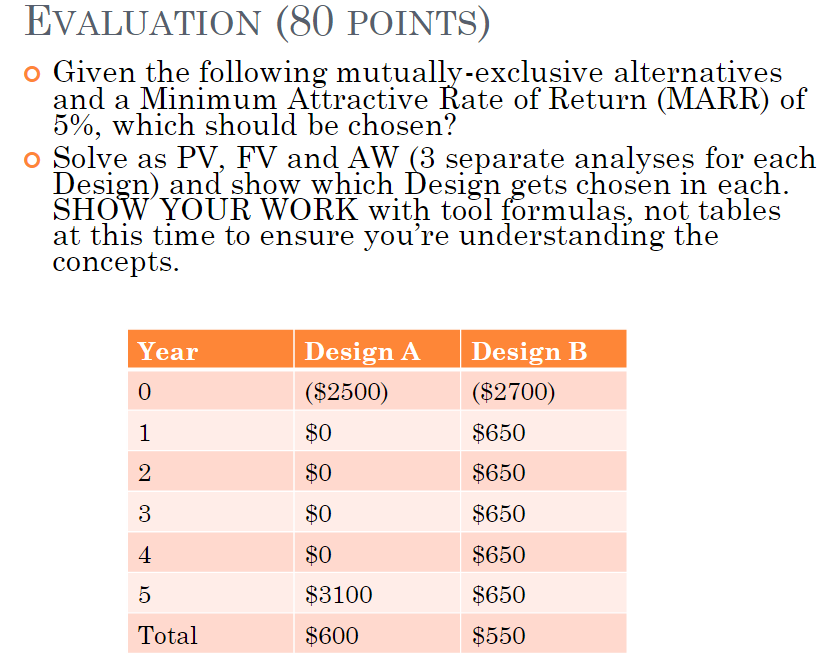

Given the following mutually-exclusive alternatives and a Minimum Attractive Rate of Return (MARR) of5%, which should be chosen? FIND AW( POINTS FOR THIS ANSWER ONLY)

Given the following mutually-exclusive alternatives

Given the following mutually-exclusive alternatives

and a Minimum Attractive Rate of Return (MARR) of5%, which should be chosen?

FIND AW( POINTS FOR THIS ANSWER ONLY)

EVALUATION (80 POINTS) o Given the following mutually-exclusive alternatives and a Minimum Attractive Rate of Return (MARR) of 5%, which should be chosen? o Solve as PV, FV and AW (3 separate analyses for each Design) and show which Design gets chosen in each SHOW YOUR WORK with tool formulas, not tables at this time to ensure you're understanding the concepts. Design A Design B (S2500) $0 $0 $0 $0 $3100 $600 Year ($2700) $650 $650 $650 $650 $650 $550 0 4 TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started