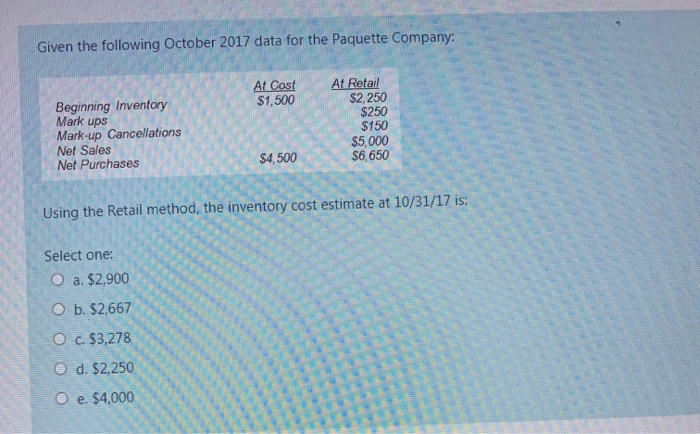

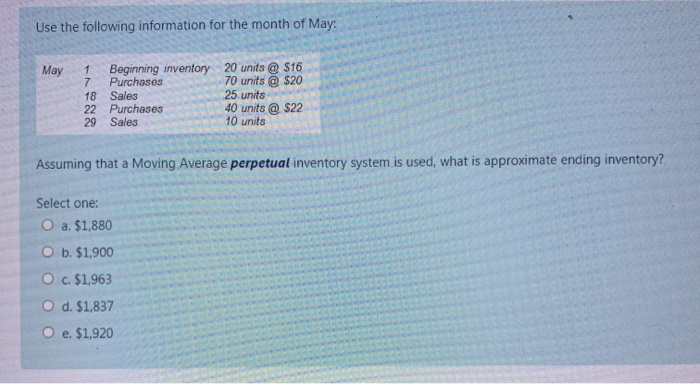

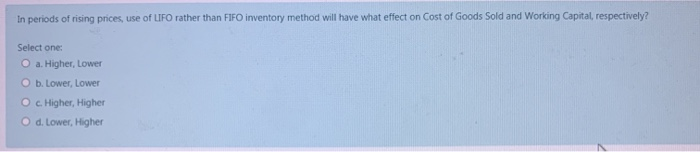

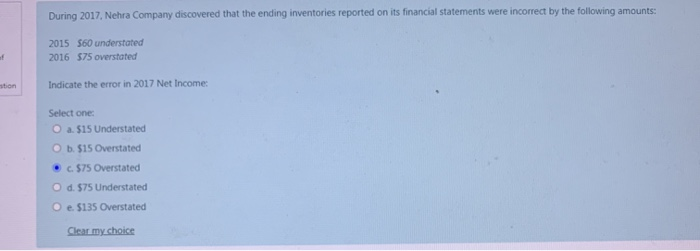

Given the following October 2017 data for the Paquette Company: At Cost $1,500 Mark ups Beginning Inventory Mark-up Cancellations Net Sales Net Purchases At Retail $2,250 $250 $150 $5,000 $6,650 $4,500 Using the Retail method, the inventory cost estimate at 10/31/17 is: Select one: O a. $2,900 O b. $2,667 O c. $3,278 d. $2,250 O e. $4,000 Use the following information for the month of May: May 1 Beginning inventory 20 units @ $16 7 Purchases 70 units @ $20 18 Sales 25 units 22 Purchases 40 units @ $22 29 Sales 10 units Assuming that a Moving Average perpetual inventory system is used, what is approximate ending inventory? Select one: O a $1,880 O b. $1,900 O c. $1,963 O d. $1,837 O e. $1,920 In periods of rising prices, use of LIFO rather than FIFO inventory method will have what effect on Cost of Goods Sold and Working Capital, respectively? Select one: a. Higher, Lower O b. Lower, Lower O c. Higher, Higher O d. Lower, Higher During 2017, Nehra Company discovered that the ending inventories reported on its financial statements were incorrect by the following amounts: 2015 560 understated 2016 $75 overstated Indicate the error in 2017 Net Income: stion Select one: O a. $15 Understated b. 515 Overstated c.$75 Overstated O d. $75 Understated e. $135 Overstated Clear my choice Given the following October 2017 data for the Paquette Company: At Cost $1,500 Mark ups Beginning Inventory Mark-up Cancellations Net Sales Net Purchases At Retail $2,250 $250 $150 $5,000 $6,650 $4,500 Using the Retail method, the inventory cost estimate at 10/31/17 is: Select one: O a. $2,900 O b. $2,667 O c. $3,278 d. $2,250 O e. $4,000 Use the following information for the month of May: May 1 Beginning inventory 20 units @ $16 7 Purchases 70 units @ $20 18 Sales 25 units 22 Purchases 40 units @ $22 29 Sales 10 units Assuming that a Moving Average perpetual inventory system is used, what is approximate ending inventory? Select one: O a $1,880 O b. $1,900 O c. $1,963 O d. $1,837 O e. $1,920 In periods of rising prices, use of LIFO rather than FIFO inventory method will have what effect on Cost of Goods Sold and Working Capital, respectively? Select one: a. Higher, Lower O b. Lower, Lower O c. Higher, Higher O d. Lower, Higher During 2017, Nehra Company discovered that the ending inventories reported on its financial statements were incorrect by the following amounts: 2015 560 understated 2016 $75 overstated Indicate the error in 2017 Net Income: stion Select one: O a. $15 Understated b. 515 Overstated c.$75 Overstated O d. $75 Understated e. $135 Overstated Clear my choice