Answered step by step

Verified Expert Solution

Question

1 Approved Answer

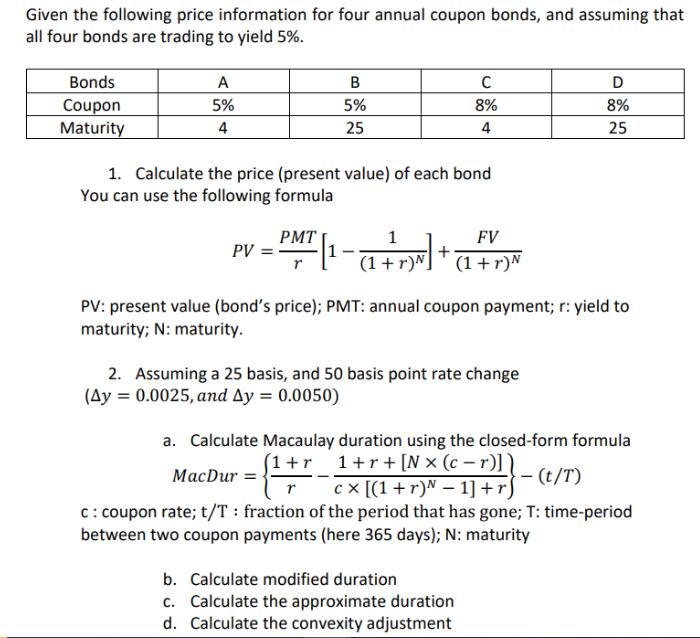

Given the following price information for four annual coupon bonds, and assuming that all four bonds are trading to yield 5%. Bonds Coupon Maturity

Given the following price information for four annual coupon bonds, and assuming that all four bonds are trading to yield 5%. Bonds Coupon Maturity A 5% 4 PV B 5% 25 1. Calculate the price (present value) of each bond You can use the following formula PMT C 8% 4 1 FV + (1+r)N (1 + r) N PV: present value (bond's price); PMT: annual coupon payment; r: yield to maturity; N: maturity. 2. Assuming a 25 basis, and 50 basis point rate change (Ay = 0.0025, and Ay = 0.0050) b. Calculate modified duration c. Calculate the approximate duration d. Calculate the convexity adjustment D 8% 25 a. Calculate Macaulay duration using the closed-form formula (1+r MacDur = 1+r+ [Nx (c-r)]] cx [(1 + r)N - 1] +rf r c: coupon rate; t/T: fraction of the period that has gone; T: time-period between two coupon payments (here 365 days); N: maturity - (t/T)

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for the bonds 1 Present value of ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started