Answered step by step

Verified Expert Solution

Question

1 Approved Answer

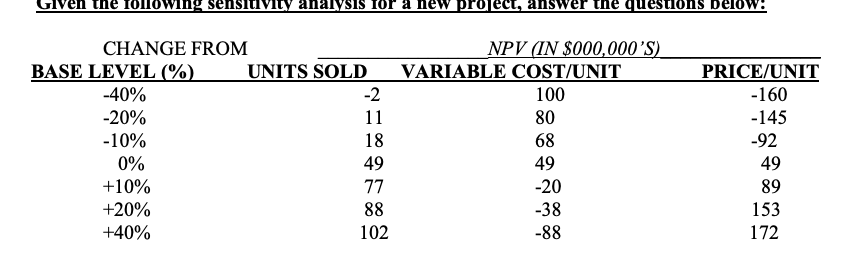

Given the following sensitivity analysis for a new project, answer the questions below 1. What is the expected NPV in $000,000s? a. 49 b. 18

Given the following sensitivity analysis for a new project, answer the questions below

1. What is the expected NPV in $000,000s?

a. 49 b. 18 c. -2 d. Can Not Be Determined

2. What is the expected NPV if the Projects Variable Cost were 20% higher than Base (expected)?

-20 b. -38 c. -92 d. None

3. Which input variable would cause you the most concern?

Units Sold b. Cost of Capital c. Variable cost d. Price per Unit

CHANGE FROM NPV(IN$000,000 'S) BASE LEVEL (\%) \begin{tabular}{ccc} \hline UNITS SOLD & VARIABLE COST/UNIT & PRICE/UNIT \\ \hline-2 & 100 & -160 \\ 11 & 80 & -145 \\ 18 & 68 & -92 \\ 49 & 49 & 49 \\ 77 & -20 & 89 \\ 88 & -38 & 153 \\ 102 & -88 & 172 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started