Answered step by step

Verified Expert Solution

Question

1 Approved Answer

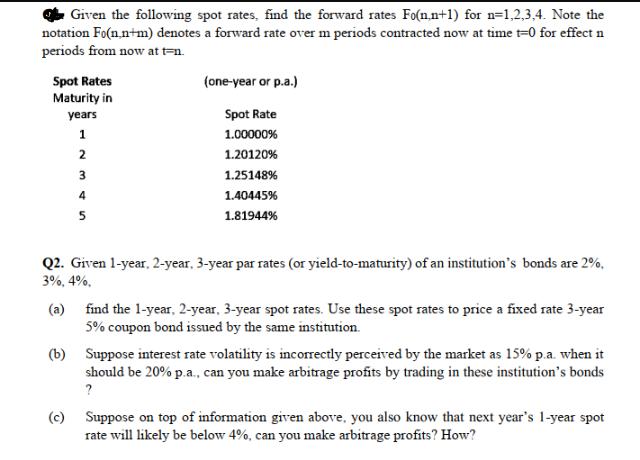

Given the following spot rates, find the forward rates Fo(n.n+1) for n=1,2,3,4. Note the notation Fo(n.n+m) denotes a forward rate over m periods contracted

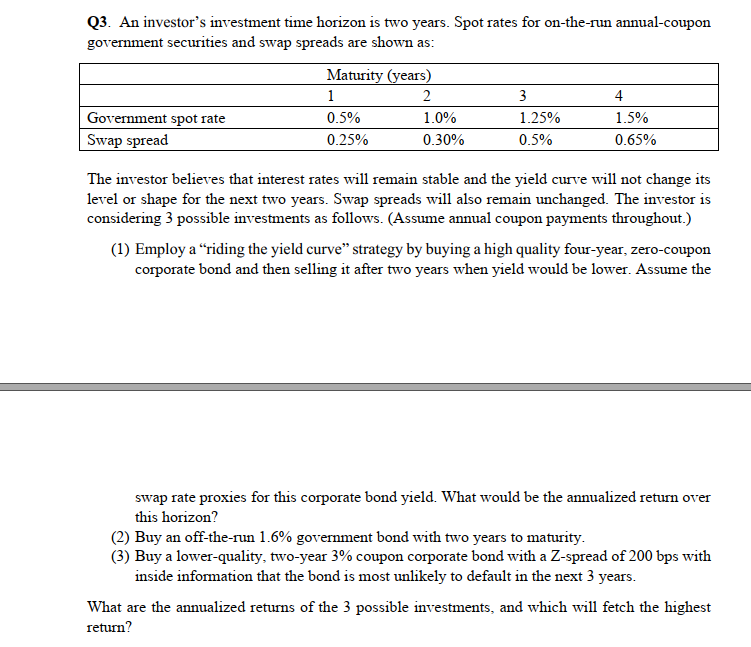

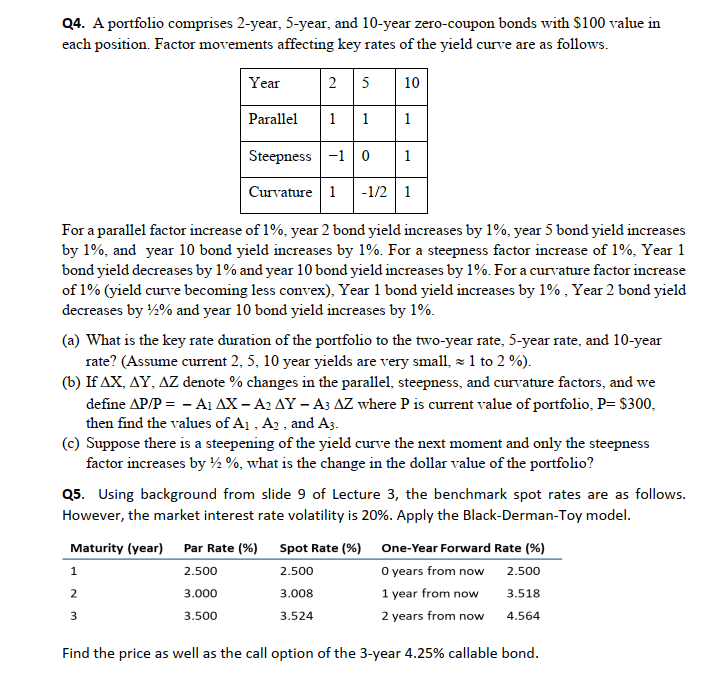

Given the following spot rates, find the forward rates Fo(n.n+1) for n=1,2,3,4. Note the notation Fo(n.n+m) denotes a forward rate over m periods contracted now at time t=0 for effect n periods from now at t=n. Spot Rates Maturity in years 1 2 3 4 5 (one-year or p.a.) Spot Rate 1.00000% 1.20120% 1.25148% 1.40445% 1.81944% Q2. Given 1-year, 2-year, 3-year par rates (or yield-to-maturity) of an institution's bonds are 2%. 3%, 4%, (a) (c) find the 1-year, 2-year, 3-year spot rates. Use these spot rates to price a fixed rate 3-year 5% coupon bond issued by the same institution. (b) Suppose interest rate volatility is incorrectly perceived by the market as 15% p.a. when it should be 20% p.a., can you make arbitrage profits by trading in these institution's bonds ? Suppose on top of information given above, you also know that next year's 1-year spot rate will likely be below 4%, can you make arbitrage profits? How? Q3. An investor's investment time horizon is two years. Spot rates for on-the-run annual-coupon government securities and swap spreads are shown as: Government spot rate Swap spread Maturity (years) 2 1.0% 0.30% 1 0.5% 0.25% 3 1.25% 0.5% 4 1.5% 0.65% The investor believes that interest rates will remain stable and the yield curve will not change its level or shape for the next two years. Swap spreads will also remain unchanged. The investor is considering 3 possible investments as follows. (Assume annual coupon payments throughout.) (1) Employ a "riding the yield curve" strategy by buying a high quality four-year, zero-coupon corporate bond and then selling it after two years when yield would be lower. Assume the swap rate proxies for this corporate bond yield. What would be the annualized return over this horizon? (2) Buy an off-the-run 1.6% government bond with two years to maturity. (3) Buy a lower-quality, two-year 3% coupon corporate bond with a Z-spread of 200 bps with inside information that the bond is most unlikely to default in the next 3 years. What are the annualized returns of the 3 possible investments, and which will fetch the highest return? Q4. A portfolio comprises 2-year, 5-year, and 10-year zero-coupon bonds with $100 value in each position. Factor movements affecting key rates of the yield curve are as follows. 25 Year 1 1 Steepness -1 0 Curvature Parallel For a parallel factor increase of 1%, year 2 bond yield increases by 1%, year 5 bond yield increases by 1%, and year 10 bond yield increases by 1%. For a steepness factor increase of 1%, Year 1 bond yield decreases by 1% and year 10 bond yield increases by 1%. For a curvature factor increase of 1% (yield curve becoming less convex), Year 1 bond yield increases by 1%, Year 2 bond yield decreases by 12% and year 10 bond yield increases by 1%. 1 10 (a) What is the key rate duration of the portfolio to the two-year rate, 5-year rate, and 10-year rate? (Assume current 2, 5, 10 year yields are very small, 1 to 2 %). (b) If AX, AY, AZ denote % changes in the parallel, steepness, and curvature factors, and we define AP/P = - A1 AX-A2 AY - A3 AZ where P is current value of portfolio, P= $300, then find the values of A1, A2, and A3. 2 1 1 1-1/2 1 (c) Suppose there is a steepening of the yield curve the next moment and only the steepness factor increases by %, what is the change in the dollar value of the portfolio? 3 Q5. Using background from slide 9 of Lecture 3, the benchmark spot rates are as follows. However, the market interest rate volatility is 20%. Apply the Black-Derman-Toy model. Maturity (year) Par Rate (%) Spot Rate (%) 2.500 2.500 3.000 3.008 3.500 3.524 One-Year Forward Rate (%) 0 years from now 2.500 1 year from now 3.518 2 years from now 4.564 Find the price as well as the call option of the 3-year 4.25% callable bond.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Forward rates F012 120120 F023 125148 F034 140445 Q2 a Spot rates 1Y 2 2Y 1 305 1 15 3Y 1 403 1 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started