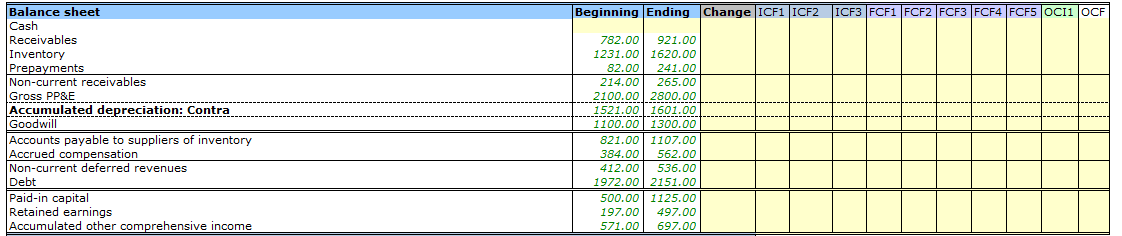

Given the following spreadsheet/ information:

Please provide the following balances for Year 2:

Please provide the following balances for Year 2:

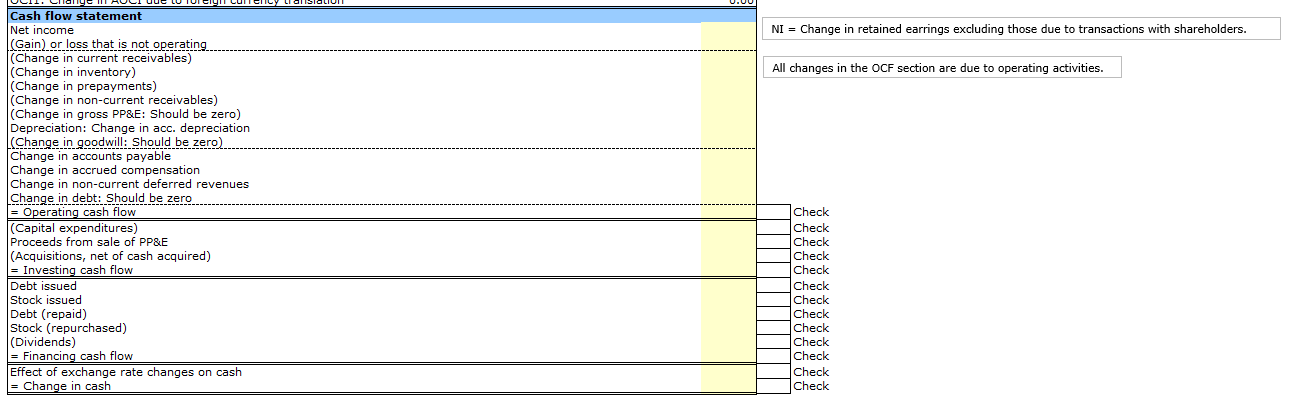

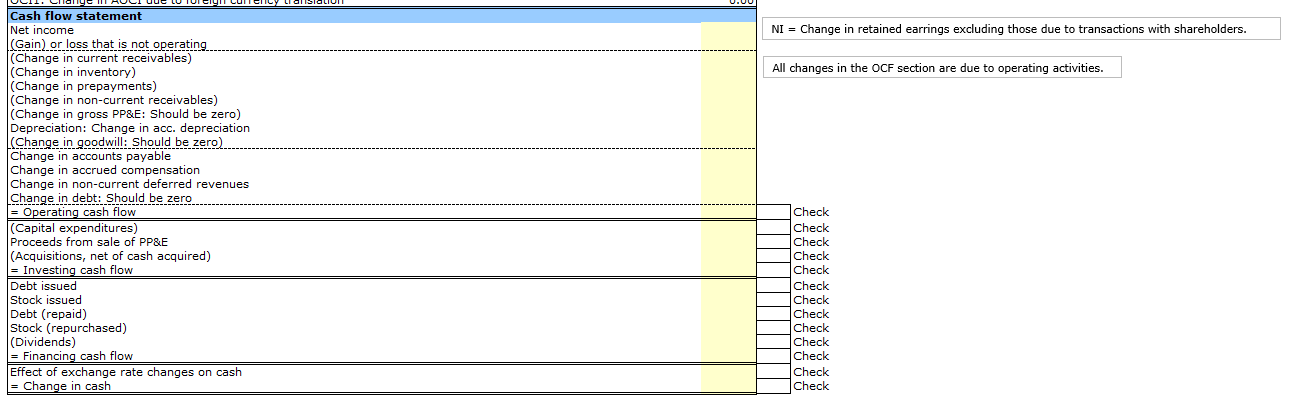

| Net income | |

| OCF adjustment for gain | |

| OCF adjustment for current receivables | |

| OCF adjustment for inventories | |

| OCF adjustment for prepayments | |

| OCF adjustment for non-current receivables | |

| OCF adjustment for depreciation | |

| OCF adjustment for accounts payable | |

| OCF adjustment for accrued compensation | |

| OCF adjustment for non-current deferred revenues | |

| Operating cash flow | |

| (Capital expenditures) | |

| Proceeds from sale of PPE | |

| Acquisitions net of cash acquired | |

| Investing cash flow | |

| Financing cash flow | |

| Effect of exchange rate changes on cash |

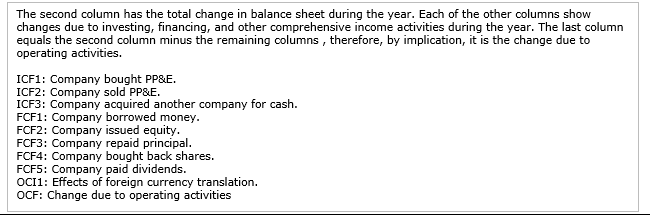

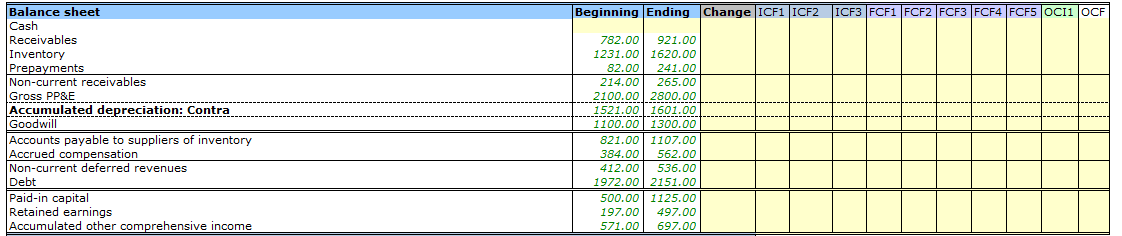

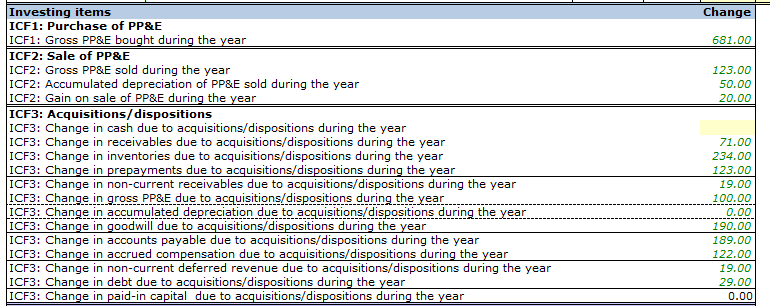

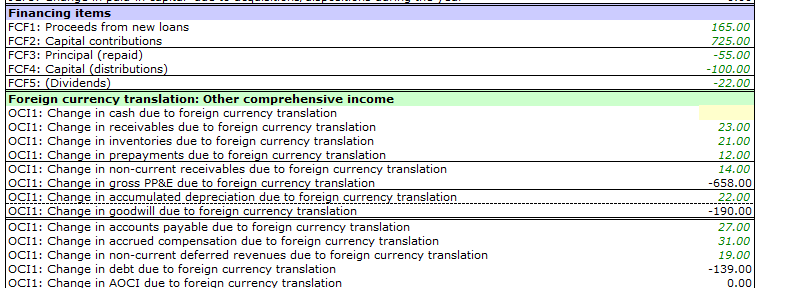

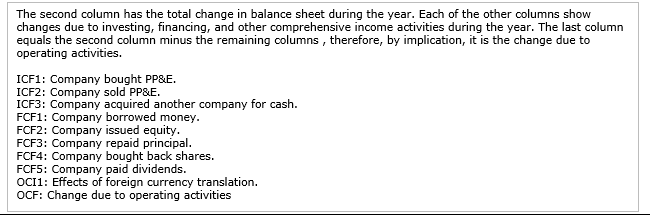

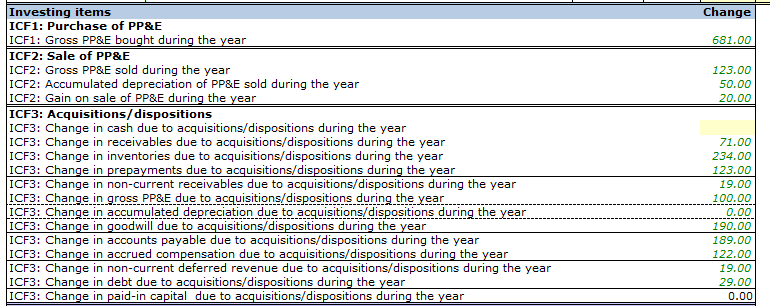

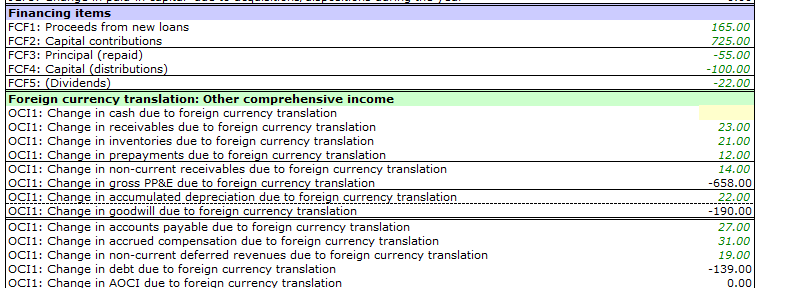

The second column has the total change in balance sheet during the year. Each of the other columns show changes due to investing, financing, and other comprehensive income activities during the year. The last column equals the second column minus the remaining columns, therefore, by implication, it is the change due to operating activities. ICF1: Company bought PP\&E. ICF2: Company sold PP\&E. ICF3: Company acquired another company for cash. FCF1: Company borrowed money. FCF2: Company issued equity. FCF3: Company repaid principal. FCF4: Company bought back shares. FCF5: Company paid dividends. OCI1: Effects of foreign currency translation. OCF: Change due to operating activities \begin{tabular}{l} \hline \hline Investing items \\ ICF1: Purchase of PP\&E \\ ICF1: Gross PP\&E bought during the year \\ \hline \hline ICF2: Sale of PP\&E \\ ICF2: Gross PP\&E sold during the year \\ ICF2: Accumulated depreciation of PP\&E sold during the year \\ ICF2: Gain on sale of PP\&E during the year \\ \hline ICF3: Acquisitions/dispositions \\ ICF3: Change in cash due to acquisitions/dispositions during the year \\ ICF3: Change in receivables due to acquisitions/dispositions during the year \\ ICF3: Change in inventories due to acquisitions/dispositions during the year \\ ICF3: Change in prepayments due to acquisitions/dispositions during the year \\ \hline ICF3: Change in non-current receivables due to acquisitions/dispositions during the year \\ ICF3: Change in gross PP\&E due to acquisitions/dispositions during the year \\ \hline ICF3:-Change in accumulated depreciation due to acquisitions/dispositions during the year \\ \hline ICF3: Change in goodwill due to acquisitions/dispositions during the year \\ \hline ICF3: Change in accounts payable due to acquisitions/dispositions during the year \\ ICF3: Change in accrued compensation due to acquisitions/dispositions during the year \\ \hline ICF3: Change in non-current deferred revenue due to acquisitions/dispositions during the year \\ ICF3: Change in debt due to acquisitions/dispositions during the year \\ \hline ICF3: Change in paid-in capital due to acquisitions/dispositions during the year \\ \hline \hline \end{tabular} \begin{tabular}{|l|} \hline \hline Financing items \\ FCF1: Proceeds from new loans \\ FCF2: Capital contributions \\ \hline FCF3: Principal (repaid) \\ FCF4: Capital (distributions) \\ \hline FCF5: (Dividends) \\ \hline \hline Foreign currency translation: Other comprehensive income \\ OCI1: Change in cash due to foreign currency translation \\ OCI1: Change in receivables due to foreign currency translation \\ OCI1: Change in inventories due to foreign currency translation \\ OCI1: Change in prepayments due to foreign currency translation \\ \hline OCI1: Change in non-current receivables due to foreign currency translation \\ OCI1: Change in gross PP\&E due to foreign currency translation \\ \hline OCI1: Change in accumulated depreciation due to foreign currency translation \\ \hline OCI1: Change in goodwill due to foreign currency translation \\ \hline \hline OCI1: Change in accounts payable due to foreign currency translation \\ OCI1: Change in accrued compensation due to foreign currency translation \\ OCI1: Change in non-current deferred revenues due to foreign currency translation \\ OCI1: Change in debt due to foreign currency translation \\ OCI1: Change in AOCI due to foreign currency translation \end{tabular}

Please provide the following balances for Year 2:

Please provide the following balances for Year 2: