Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GIVEN THE INFORMATION ABOVE: What are the calculations for the following ratios: 1. Working Capital | 2. Current Ratio | 3. Return on Stockholders' Equity

GIVEN THE INFORMATION ABOVE:

What are the calculations for the following ratios: 1. Working Capital | 2. Current Ratio | 3. Return on Stockholders' Equity | 4. EPS (assume all shares are already weighted) and use "Basic" for Walmart | 5. Payout Ratio | 6. Debt to Assets Ratio | 7. Times Interest Earned

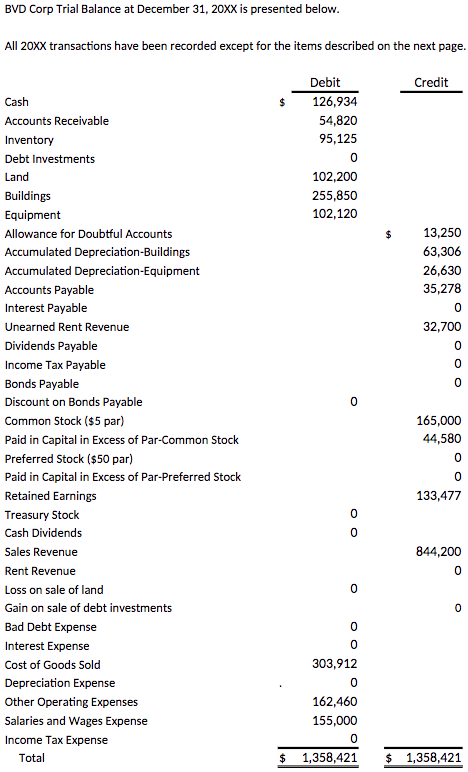

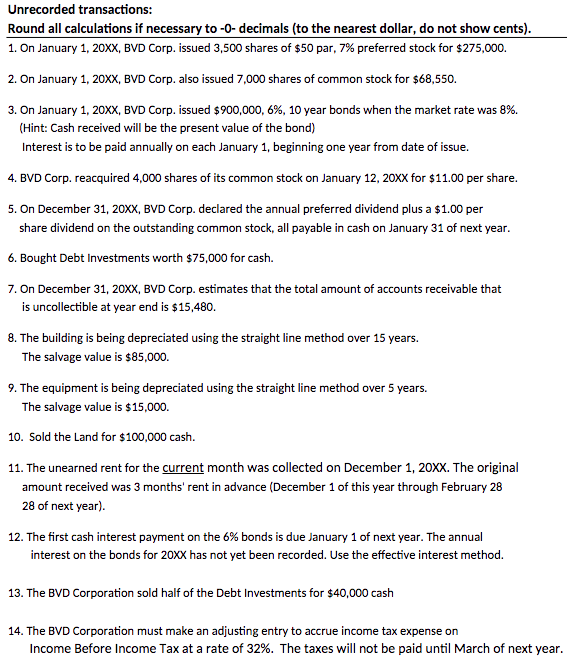

BVD Corp Trial Balance at December 31,20XX is presented below. All anyY traneartinne have heon rarnriled ovront far the itame doerrihed an the nevt nare 3. On January 1,20X, BVD Corp. issued $900,000,6%,10 year bonds when the market rate was 8%. (Hint: Cash received will be the present value of the bond) Interest is to be paid annually on each January 1 , beginning one year from date of issue. 4. BVD Corp. reacquired 4,000 shares of its common stock on January 12,20X for $11.00 per share. 5. On December 31, 20XX, BVD Corp. declared the annual preferred dividend plus a $1.00 per share dividend on the outstanding common stock, all payable in cash on January 31 of next year. 6. Bought Debt Investments worth $75,000 for cash. 7. On December 31, 20XX, BVD Corp. estimates that the total amount of accounts receivable that is uncollectible at year end is $15,480. 8. The building is being depreciated using the straight line method over 15 years. The salvage value is $85,000. 9. The equipment is being depreciated using the straight line method over 5 years. The salvage value is $15,000. 10. Sold the Land for $100,000 cash. 11. The unearned rent for the current month was collected on December 1,20XX. The original amount received was 3 months' rent in advance (December 1 of this year through February 28 28 of next year). 12. The first cash interest payment on the 6% bonds is due January 1 of next year. The annual interest on the bonds for 20X has not yet been recorded. Use the effective interest method. 13. The BVD Corporation sold half of the Debt Investments for $40,000 cash 14. The BVD Corporation must make an adjusting entry to accrue income tax expense on Income Before Income Tax at a rate of 32%. The taxes will not be paid until March of next year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started