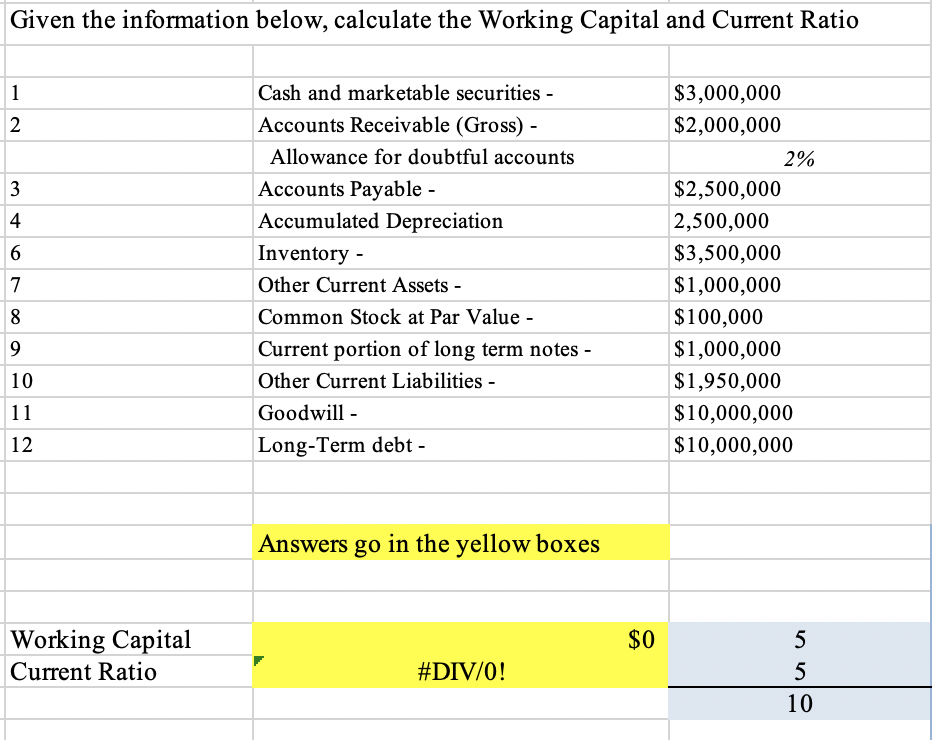

Given the information below, calculate the Working Capital and Current Ratio 1 2 3 4 6 7 8 9 10 11 12 Cash and

Given the information below, calculate the Working Capital and Current Ratio 1 2 3 4 6 7 8 9 10 11 12 Cash and marketable securities - $3,000,000 Accounts Receivable (Gross) - $2,000,000 Allowance for doubtful accounts 2% Accounts Payable - Accumulated Depreciation Inventory - Other Current Assets - $2,500,000 2,500,000 $3,500,000 $1,000,000 Common Stock at Par Value - $100,000 Goodwill - Current portion of long term notes - Other Current Liabilities - Long-Term debt- $1,000,000 $1,950,000 $10,000,000 $10,000,000 Working Capital Answers go in the yellow boxes Current Ratio $0 5 #DIV/0! 5 55 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Working Capital and Current Ratio follow these steps Step 1 Calculate Current Asset...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started