Answered step by step

Verified Expert Solution

Question

1 Approved Answer

given the information below evaluate the working capital effectiveness of company A based on its operating and cash conversion cycles as compared to the working

given the information below evaluate the working capital effectiveness of company A based on its operating and cash conversion cycles as compared to the working capital effectiveness of its peer company A

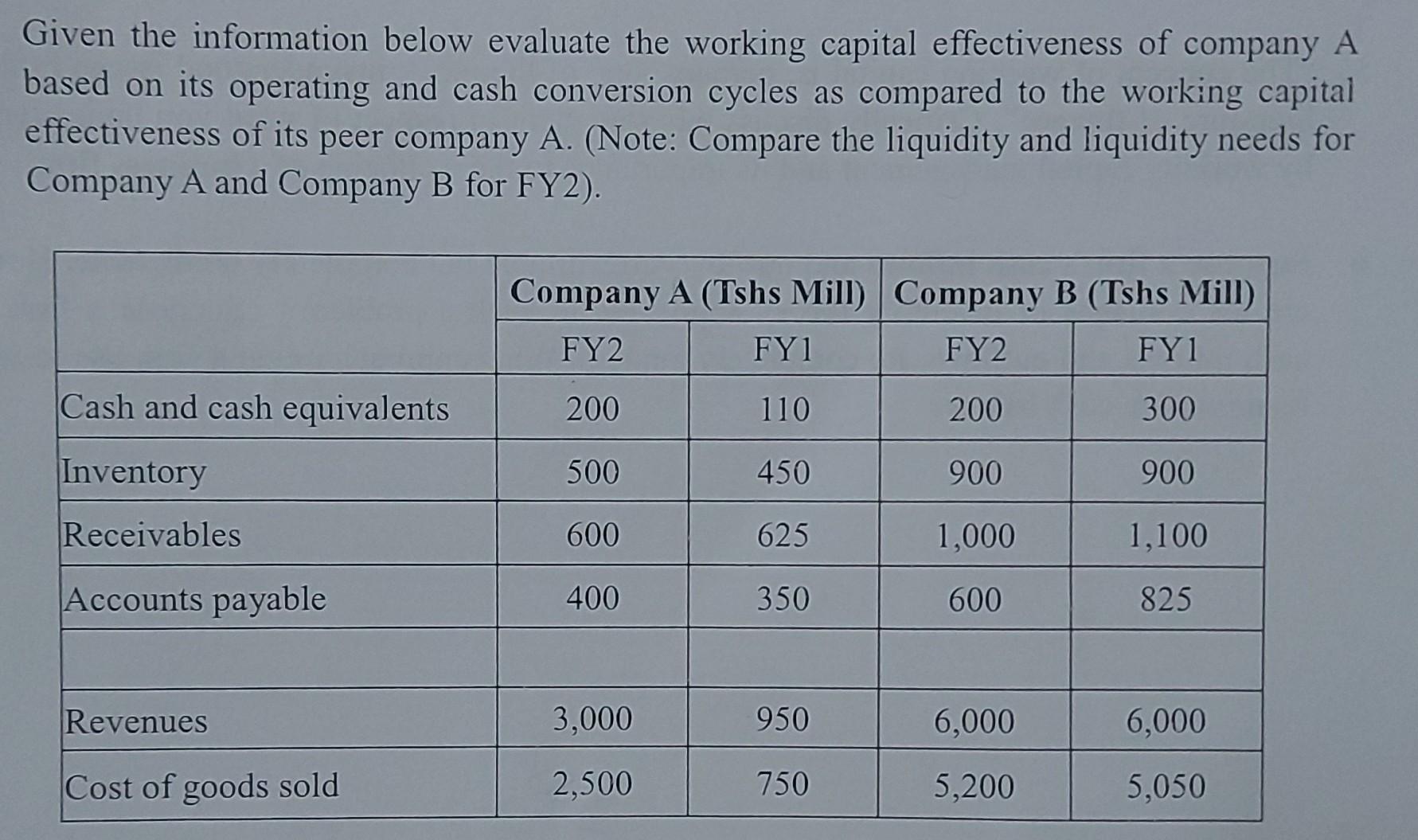

Given the information below evaluate the working capital effectiveness of company A based on its operating and cash conversion cycles as compared to the working capital effectiveness of its peer company A. (Note: Compare the liquidity and liquidity needs for Company A and Company B for FY2). Company A (Tshs Mill) Company B (Tshs Mill) FY2 FY1 FY2 FY1 Cash and cash equivalents 200 110 200 300 Inventory 500 450 900 900 Receivables 600 625 1,000 1,100 Accounts payable 400 350 600 825 Revenues 3,000 950 6,000 6,000 Cost of goods sold 2,500 750 5,200 5,050

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started