Answered step by step

Verified Expert Solution

Question

1 Approved Answer

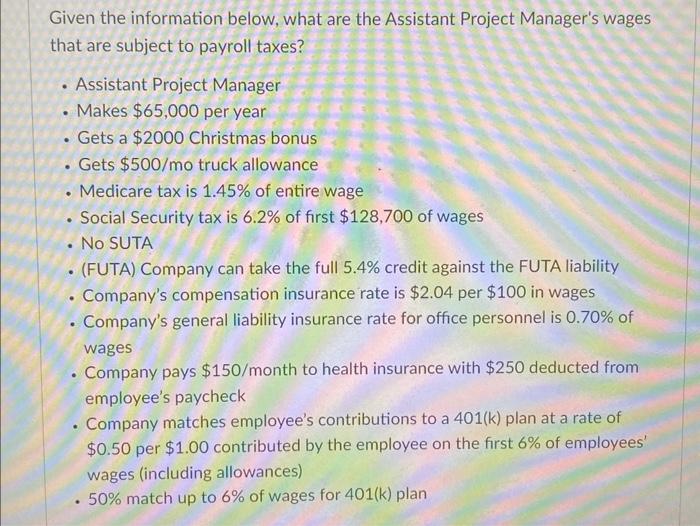

Given the information below, what are the Assistant Project Manager's wages that are subject to payroll taxes? . Assistant Project Manager Makes $65,000 per

Given the information below, what are the Assistant Project Manager's wages that are subject to payroll taxes? . Assistant Project Manager Makes $65,000 per year Gets a $2000 Christmas bonus Gets $500/mo truck allowance Medicare tax is 1.45% of entire wage Social Security tax is 6.2% of first $128,700 of wages No SUTA . . (FUTA) Company can take the full 5.4% credit against the FUTA liability . Company's compensation insurance rate is $2.04 per $100 in wages . Company's general liability insurance rate for office personnel is 0.70% of wages Company pays $150/month to health insurance with $250 deducted from employee's paycheck Company matches employee's contributions to a 401(k) plan at a rate of $0.50 per $1.00 contributed by the employee on the first 6% of employees' wages (including allowances) 50% match up to 6% of wages for 401(k) plan . .

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started