Answered step by step

Verified Expert Solution

Question

1 Approved Answer

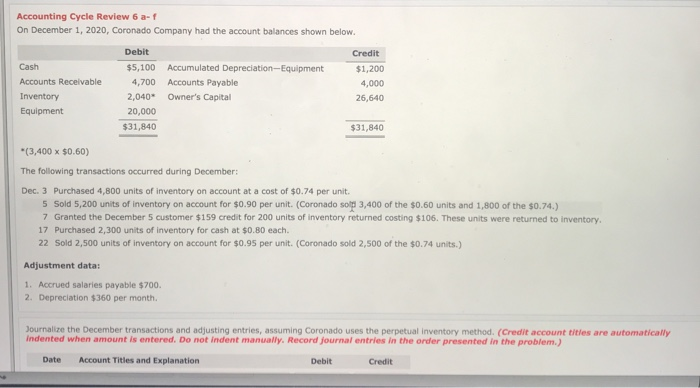

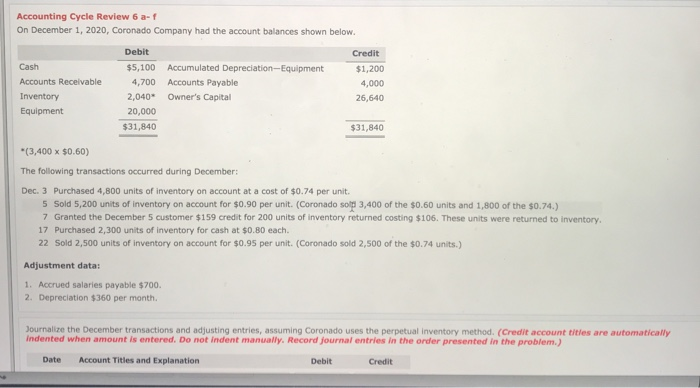

Given the information from photo number 1, need to fill out the dates, account titles and explanations and the debit/credit amount in photo 2/3 Accounting

Given the information from photo number 1, need to fill out the dates, account titles and explanations and the debit/credit amount in photo 2/3

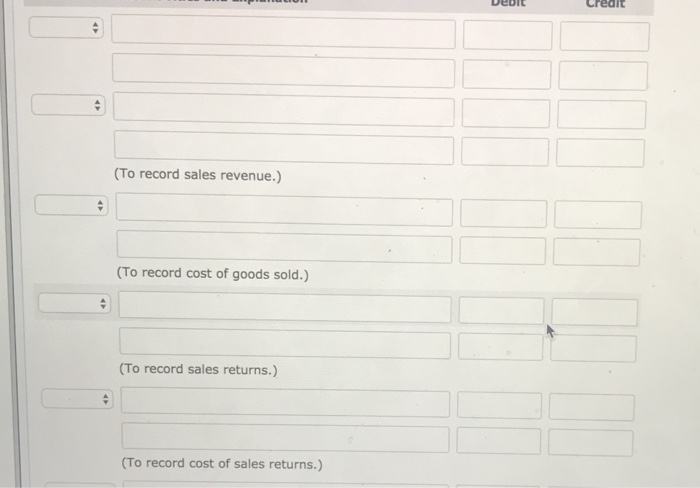

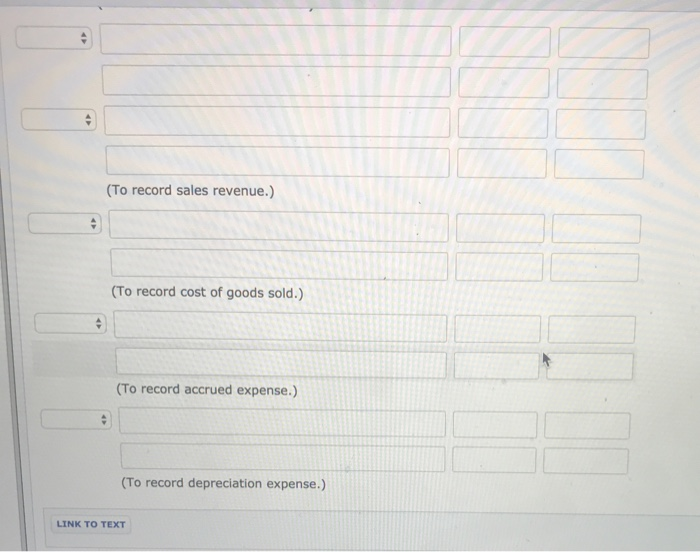

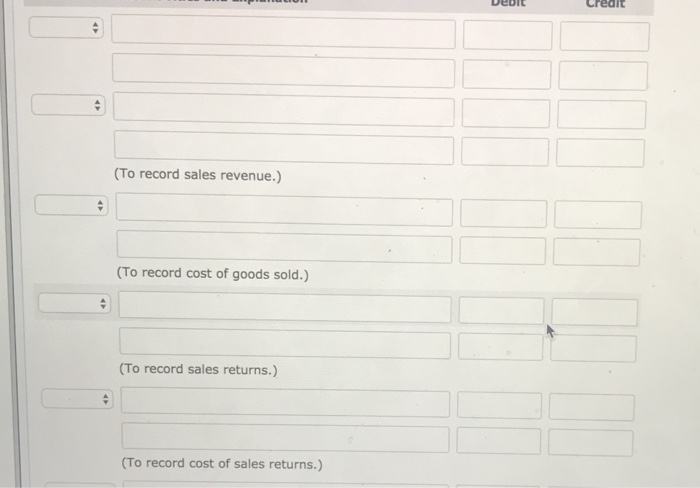

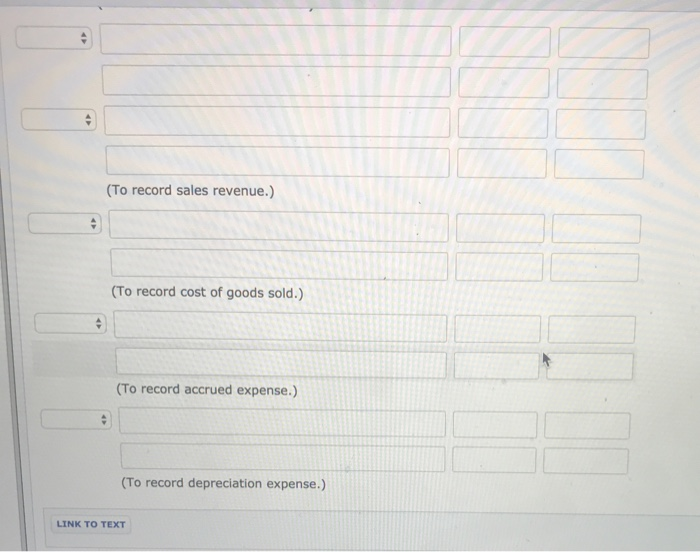

Accounting Cycle Review 6a-f On December 1, 2020, Coronado Company had the account balances shown below. Cash Accounts Receivable Inventory Equipment Debit $5,100 4,700 2,040 20,000 $31,840 Accumulated Depreciation-Equipment Accounts Payable Owner's Capital Credit $1,200 4,000 26,640 $31,840 "(3,400 x $0.60) The following transactions occurred during December: Dec. 3 Purchased 4,800 units of inventory on account at a cost of $0.74 per unit. 5 Sold 5,200 units of inventory on account for $0.90 per unit. (Coronado sold 3,400 of the $0.60 units and 1,800 of the $0.74.) 7 Granted the December 5 customer $159 credit for 200 units of Inventory returned costing $106. These units were returned to inventory. 17 Purchased 2,300 units of inventory for cash at $0.80 each. 22 Sold 2,500 units of inventory on account for $0.95 per unit. (Coronado sold 2,500 of the $0.74 units.) Adjustment data: 1. Accrued salaries payable $700. 2. Depreciation $360 per month Journalize the December transactions and adjusting entries, assuming Coronado uses the perpetual inventory method. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit -> (To record sales revenue.) (To record cost of goods sold.) (To record sales returns.) (To record cost of sales returns.) . (To record sales revenue.) (To record cost of goods sold.) (To record accrued expense.) . (To record depreciation expense.) LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started